- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

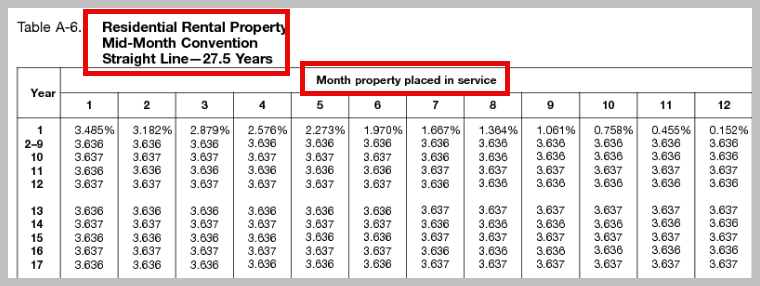

Yes, you can use the square feet of the rooms against the whole house to arrive at the correct percentage of depreciation. This can get complicated for tax software so my suggestion is to enter the information yourself and keep track of any depreciation you use on your tax return. See the chart below used for 27.5 year depreciation.

Once the whole house is converted to rental you will enter it as an asset with a date placed in service. TurboTax will handle the math for depreciation on this asset. Be sure to separate the land cost and enter it when asked. You can use the tax assessment to arrive at the percentage of cost that applies to the land.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

April 9, 2025

8:56 AM