- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Why is TT telling me I cant e-file because of a value in 1040 18d, which is my estimated paym...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is TT telling me I cant e-file because of a value in 1040 18d, which is my estimated payments?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is TT telling me I cant e-file because of a value in 1040 18d, which is my estimated payments?

Without seeing your actual return, it's hard to say what might be causing the error message.

If you are using the CD/Download version of TurboTax you can run a Final Review, which should pick up the error and explain it. To do this, click Tools (in the black bar at the top of the page and select Final Review.

You can also go into Forms Mode and check for errors:

- Go into Forms Mode by clicking on the Forms icon in the top right of the blue bar.

- In the Forms in My Return list on the left, double-click on Form 1040 to open it.

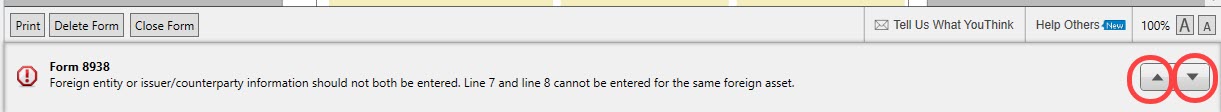

- At the top of the Forms in My Return list, click the Errors icon (see screenshot).

4. Errors will appear in a window below the form. You can navigate through by clicking the up or down arrows on the right.

5. To return to the interview, click on the Step-By-Step icon in the top right of the blue bar.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is TT telling me I cant e-file because of a value in 1040 18d, which is my estimated payments?

Been there, done that. With forms open. when I click the error icon I get "Congratulations, your form has no errors", a contradiction since it tells me in the review that the amount in line 18d is not supported for e-filing. I have reinstalled the program, updated...still the same problem. Help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is TT telling me I cant e-file because of a value in 1040 18d, which is my estimated payments?

It appears you cannot e-file your return because you made estimated tax payments. If so, then that would be a requirement set by the IRS, not TurboTax.

If the IRS will not allow tax returns with estimated payments to be e-filed, then your return is error free, but needs to be mailed in per IRS regulations.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

dkatz71

New Member

Omar80

Level 3

vetz76

Level 2

organdan

Level 1

black1761

Level 1