- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Why do I keep getting me to enter my sch SE T deferral amt? Thought it was automatically put ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why do I keep getting me to enter my sch SE T deferral amt? Thought it was automatically put in for social security self employment?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why do I keep getting me to enter my sch SE T deferral amt? Thought it was automatically put in for social security self employment?

Re: Why do I keep getting me to enter my sch SE T deferral amt? Thought it was automatically put in for social security self employment?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why do I keep getting me to enter my sch SE T deferral amt? Thought it was automatically put in for social security self employment?

I am getting the same thing. It is annoying because that's why I'm paying to use the TurboTax service. Hopefully it's just a temporary glitch.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why do I keep getting me to enter my sch SE T deferral amt? Thought it was automatically put in for social security self employment?

You must first make sure that you did not accidently choose the option to defer part of your self-employment tax.

In order to delete/change your election to defer your self-employment taxes from your tax return, please follow these steps in TurboTax:

- Open your return.

- Click Federal on the left hand side.

- Click Deductions and Credits on the top of the page.

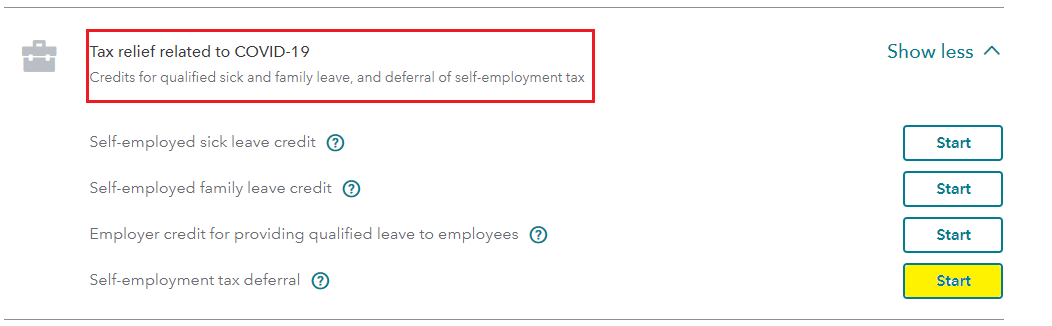

- On the page Tax Breaks, scroll down until you see Tax relief related to Covid-19.

- Click Revisit next to Self-employment tax deferral.

- Answer no to the question Do you want more time to pay self-employment taxes?

Now that you have elected to opt-out of referring your self-employment taxes, you should not be prompted to enter a referral amount on other TurboTax screens.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why do I keep getting me to enter my sch SE T deferral amt? Thought it was automatically put in for social security self employment?

I don't remember saying yes to that the first time, but Turbo Tax apparently thought I did. And now when I go back to try to change it, it won't let me. It actually says that since I'm getting a refund (only generated since it calculated the deferral), that I don't qualify for the deferral, so it's locked me out of the question. It's like it made a bad, unchangeable, circular progression. Help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why do I keep getting me to enter my sch SE T deferral amt? Thought it was automatically put in for social security self employment?

I'm having the same issue, despite NOT selecting yes at any point. I've tried going back and selecting NO several times and it's still throw up the error.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why do I keep getting me to enter my sch SE T deferral amt? Thought it was automatically put in for social security self employment?

Sign into your TurboTax account: Be sure to put zero in for the amount if you do NOT want to defer.

- Go back into Deductions and Credits and deductions section

- Scroll down to Tax relief related to COVID-19

- Click edit/update for Self-employment tax deferral

- Select no to deferral. (see image below)

The self-employment tax on that portion can be postponed for payment in the following year. You can postpone that portion of your taxes due with no penalties or interest, if you qualify. If the program is saying you do not qualify, you must be getting a refund.

You might also have a piece of data stuck, you may want to clear cookies and cache or change browsers.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

tianwaifeixian

Level 4

dlz887

Returning Member

dlz887

Returning Member

tbduvall

Level 4

benzaquenbills

New Member