- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Sign into your TurboTax account: Be sure to put zero in for the amount if you do NOT want to defer.

- Go back into Deductions and Credits and deductions section

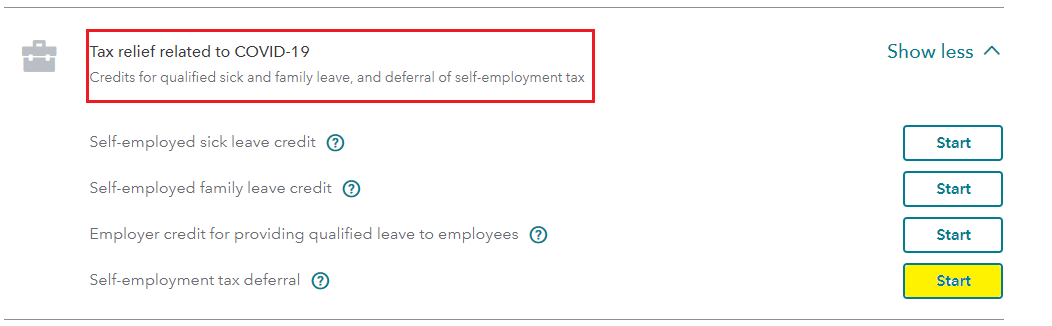

- Scroll down to Tax relief related to COVID-19

- Click edit/update for Self-employment tax deferral

- Select no to deferral. (see image below)

The self-employment tax on that portion can be postponed for payment in the following year. You can postpone that portion of your taxes due with no penalties or interest, if you qualify. If the program is saying you do not qualify, you must be getting a refund.

You might also have a piece of data stuck, you may want to clear cookies and cache or change browsers.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 4, 2021

1:56 PM