- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Why do I have to use Deluxe version? Last year, I had nearly $2000 in capital gains. This yea...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why do I have to use Deluxe version? Last year, I had nearly $2000 in capital gains. This year is only $230 and not allowed to have free e-file like I had last year.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why do I have to use Deluxe version? Last year, I had nearly $2000 in capital gains. This year is only $230 and not allowed to have free e-file like I had last year.

https://turbotax.intuit.com/modals/simple-tax-return/

Tax laws change, tax forms change as do preparation fees and procedures.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why do I have to use Deluxe version? Last year, I had nearly $2000 in capital gains. This year is only $230 and not allowed to have free e-file like I had last year.

you must have forgot to file your gains.

You can't use the TurboTax free version with capital gains.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why do I have to use Deluxe version? Last year, I had nearly $2000 in capital gains. This year is only $230 and not allowed to have free e-file like I had last year.

@fan & @ee-ea -- The capital gains were in a form of annual distribution from mutual funds and reinvested back into the funds. FYI, I am not required to file Schedule D for those capital gains (the tiny box next to the line 7 item is checked to indicate that Schedule D is not required). It has been reported every year. Expected to have same process this year but was not allowed. Is it possible that software overlooked the checked box? Maybe TurboTax had to change the process this year? I have no idea but is now exploring on different options to file Federal and State tax forms.

BTW. I am here for the first time because I have encountered an issue unexpectedly. Been a TurboTax user (Both Deluxe and Free) for long time since sometime in 1990s.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why do I have to use Deluxe version? Last year, I had nearly $2000 in capital gains. This year is only $230 and not allowed to have free e-file like I had last year.

I am having the same issue and can't get help b/c of it's requiring me to upgrade. Did you get any further assistance?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why do I have to use Deluxe version? Last year, I had nearly $2000 in capital gains. This year is only $230 and not allowed to have free e-file like I had last year.

TurboTax Free Edition is free as long as it is a simple return that files a 1040 with no additional schedules or upgrades. Please see Why am I being charged for TurboTax Free Edition? for more information.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why do I have to use Deluxe version? Last year, I had nearly $2000 in capital gains. This year is only $230 and not allowed to have free e-file like I had last year.

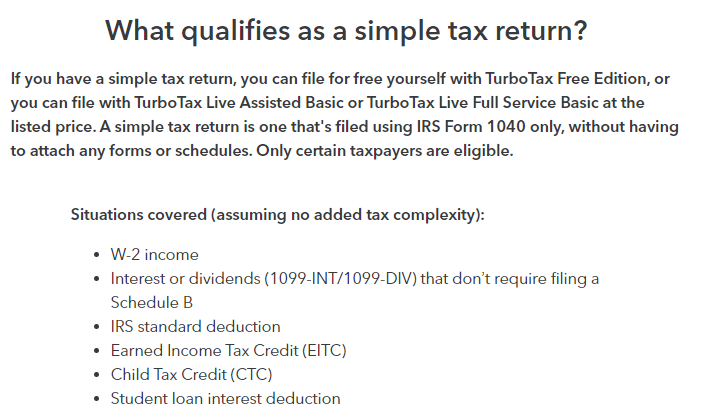

What qualifies as a simple tax return?

If you have a simple tax return, you can file for free yourself with TurboTax Free Edition, or you can file with TurboTax Live Assisted Basic or TurboTax Live Full Service Basic at the listed price. A simple tax return is one that's filed using IRS Form 1040 only, without having to attach any forms or schedules. Only certain taxpayers are eligible.Situations covered (assuming no added tax complexity):

- Interest or dividends (1099-INT/1099-DIV) that don’t require filing a Schedule B

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why do I have to use Deluxe version? Last year, I had nearly $2000 in capital gains. This year is only $230 and not allowed to have free e-file like I had last year.

I don't understand; last year I had a higher capital gains. It has a check that no additional schedule required. What changed? There should be a check as well filing this year that no additional schedule is required. What about Turbo Tax changed?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why do I have to use Deluxe version? Last year, I had nearly $2000 in capital gains. This year is only $230 and not allowed to have free e-file like I had last year.

I am looking at my form, there is a check mark on Line 7 Capital gain or (loss). Attach Schedule D if required. If not required, check here. THERE IS A CHECK!!! Is this an error in the software b/c I should be able to file in the free edition b/c there is no Schedule D required. I am confused on how to proceed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why do I have to use Deluxe version? Last year, I had nearly $2000 in capital gains. This year is only $230 and not allowed to have free e-file like I had last year.

I am looking at my form, there is a check mark on Line 7 Capital gain or (loss). Attach Schedule D if required. If not required, check here. THERE IS A CHECK!!! Is this an error in the software b/c I should be able to file in the free edition b/c there is no Schedule D required. I am confused on how to proceed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why do I have to use Deluxe version? Last year, I had nearly $2000 in capital gains. This year is only $230 and not allowed to have free e-file like I had last year.

Capital gain and loss on line 7 of the 1040 Federal tax return is not supported in the Free Edition.

See TurboTax Free Edition at this website, Scroll down to See if you qualify. It states:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why do I have to use Deluxe version? Last year, I had nearly $2000 in capital gains. This year is only $230 and not allowed to have free e-file like I had last year.

Thank you for sharing. I am well aware of what you sent to me; I read it and reread it multiple times, thanks. However, it does NOT apply in my case. That is what I am trying to explain. I think you are missing my point. I cannot use a simple return ONLY, in my case, if a schedule B is required. TurboTax would create one and then I can accept being charged. In my situation, as I have explained, Line 7 indicates "if not required, check in box". My return, just like last year, had a check in the box, I completed it in the FREE version. TurboTax didn't prepare a schedule B. This year TurboTax is FREE b/c I was NOT required to have a schedule B (in my case), but it created one which it should NOT have done. This is my issue. This is what needs to be addressed. I am not paying for something that should NOT have been created by error of TurboTax. I don't understand why it's NOT being understood! I even talked to someone (even though she couldn't help with the refund b/c that's not her department). She understood what I was saying, she could see the Schedule B, which should NOT have been created! She had tried with another customer calling with the same issue and they tried to delete the Schedule D but it didn't make a difference. What is wrong with the software? I tried to get assistance before completing but getting through to anyone is difficult. And I see why, b/c what I am saying is not being understood. And I will continue to complain and file a refund. If I need to go to corporate to explain this I can do as well. NOwhere in the FINE print does it say TurboTax will create a Schedule B (when it clearly states a schedule B is NOT required!!!) resulting in being charged. Please tell me you now see what I am saying. And I am not the ONLY one seeing this issue. The woman I spoke to said most of her calls have been about Schedule B. SO either fix the software or the screenprint you shared with me need to be updated to say "REGARDLESS IF THE SCHEDULE IS NOT REQUIRED IS CHECKED, THIS YEAR , IT WILL CREATE IT AND YOU WILL NO LONGER BE ABLE TO FILE IN THE FREE VERSION LIKE YOU COULD DO LAST YEAR". Last year, I had MORE capital gains than this year. Last year I had a 1099-DIV. Last year, the box was checked that the schedule was NOT required. Last year it did NOT create a schedule B. Last year, I used the FREE version. There is nothing showing me that this changed when I do a side by side of what I did last year to this year. Regardless of what you screenshot me, the fact is the fact. The schedule B was NOT required. Therefore it SHOULD NOT have been created!!!!! This is my point. And if it wasn't erroneously created, I would have been able to file FREE, just like last year. This is why I am trying to get in touch with someone that can talk to me, instead of sending messages and screenshot that are in relation to the issue at hand but not the issue at all. Do you understand what I am saying? I don't know how else to explain Schedule B was NOT required, I got charged b/c TurboTax is being either sneaky or an error occurred. I am asking for assistance in fixing the issue. We tried to Delete the Schedule B but it wouldn't go away. Why? Where is the bug in the system that created the Schedule B in the first place. It's really frustrating. I knew something on my side changed. I expected nothing to change. I understood the vague 1099-DIV blurb. What I did NOT expect and what was not addressed in the screenshot is that unlike last year even if the Schedule B is NOT required one gets created. That's the issue and the screenshot does not address that point. And you are not as well. I will keep typing this and keep posting the issue. And keep requesting a refund until someone acknowledges the mistake and understands the situation. Plus the kind woman I spoke to even helped me go to the IRS to see if some requirement for this had changed. So I, and the help with the woman I spoke to, did our due diligence. It's time for a responsible party, management, senior management to hear their customer in this case. I work for a large bank for 28 years...we are very good about Customer/Client Experience and Satisfaction. I am utterly disappointment in my long use of TurboTax how this has been handled and continues to be handled. I will remain hopeful that someone will respond who truly understands, raises this and takes the proper action. This doesn't take a Master's Degree like I have to see what I am trying to explain. Thanks for your attention and look forward to a resolution instead of continued run around.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why do I have to use Deluxe version? Last year, I had nearly $2000 in capital gains. This year is only $230 and not allowed to have free e-file like I had last year.

Btw, what you sent proves my point....the schedule B was NOT required. I can use the FREE version if the Schedule be is not required. It says it right there. The schedule B not required box was checked. It created one, why? lol. I am going to take the screenshot and use that as leverage in my refund request if possible b/c this is getting silly.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

bill Pohl

Returning Member

jeffry-jackson

New Member

SB2013

Level 2

fellynbal

Level 3

ilenearg

Level 2