- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Why did I get an initial 1099?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why did I get an initial 1099?

I see the question asked by numerous other people but I see no answers. Help!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why did I get an initial 1099?

To clarify, what type of 1099? What is it reporting? (tax refund, miscellaneous income? )

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why did I get an initial 1099?

I’m referring to an SSA1099

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why did I get an initial 1099?

Is this SSA-1099 reporting the Social Security Payments you received in 2024?

If YES, enter under

Wages & Income

Retirement Plans and Social Security

Social Security (SSA-1099, RRB-1099) START or UPDATE

The program will perform the calculations to determine how much, if any, of that income is taxable.

The amount received will be on your 1040 line 6a

If any is taxable, that amount will be on line 6b

Is this reporting something different, such as a one-time death benefit or lump sum payment?

If yes, please continue.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why did I get an initial 1099?

I think so? I received a lump sum distribution from the sale of my late mother’s estate, but haven’t received tax documents associated with that.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why did I get an initial 1099?

Also, I have never received an initial SSA-1099, so I’m stumped. Can I count on its data for filing?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why did I get an initial 1099?

You should contact the Social Security Administration if you are unsure about your Form SSA-1099.

The Social Security Administration sends Form SSA1099 to you every January if you receive Social Security benefits. It shows the total amount of benefits you received in the previous year, so you will know how much Social Security income to report to the IRS on your tax return.

If this is what is disclosed on your Form SSA-1099 and the total matches the total of all your deposits from Social Security, than it is correct.

If you confirm your Form SSA-1099 matches what you received from Social Security or Social Security confirms that this is your correct Form SSA-1099, you should report it on your tax return as per KrisD15 states above.

To call Social Security: 1-800-772-1213 (TTY 1-800-325-0778), Monday through Friday, 8:00 am - 7:00 pm.

Contact your local Social Security office.

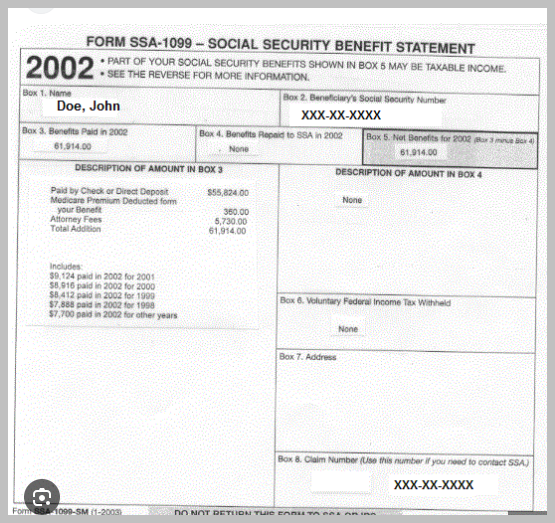

This is a generic copy of what your Social Security Form SSA-1099 should look like.

Click here for "A Guide to Social Security Tax.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why did I get an initial 1099?

Thanks. I have been on hold with the SSA for more than two hours. I was hopeful you would be a quicker resource.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Frenchy714

New Member

user17705805865

New Member

cool_kiwi

Level 2

bobmcleod21

New Member

nastewart_126

Level 1