- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

You should contact the Social Security Administration if you are unsure about your Form SSA-1099.

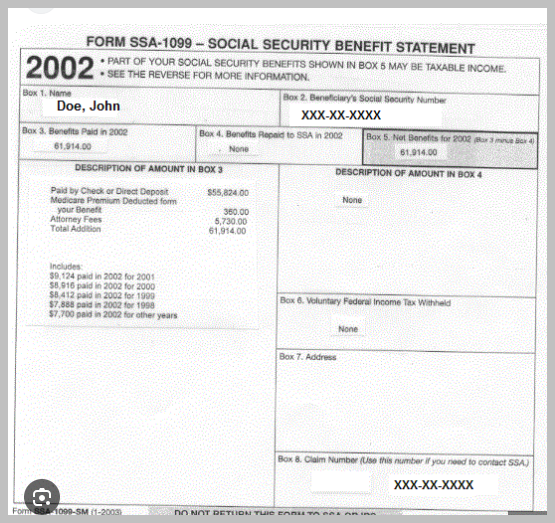

The Social Security Administration sends Form SSA1099 to you every January if you receive Social Security benefits. It shows the total amount of benefits you received in the previous year, so you will know how much Social Security income to report to the IRS on your tax return.

If this is what is disclosed on your Form SSA-1099 and the total matches the total of all your deposits from Social Security, than it is correct.

If you confirm your Form SSA-1099 matches what you received from Social Security or Social Security confirms that this is your correct Form SSA-1099, you should report it on your tax return as per KrisD15 states above.

To call Social Security: 1-800-772-1213 (TTY 1-800-325-0778), Monday through Friday, 8:00 am - 7:00 pm.

Contact your local Social Security office.

This is a generic copy of what your Social Security Form SSA-1099 should look like.

Click here for "A Guide to Social Security Tax.

**Mark the post that answers your question by clicking on "Mark as Best Answer"