- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Why can't I input my SSN on Form 1099-NEC? It is getting pulled up at the federal review sect...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

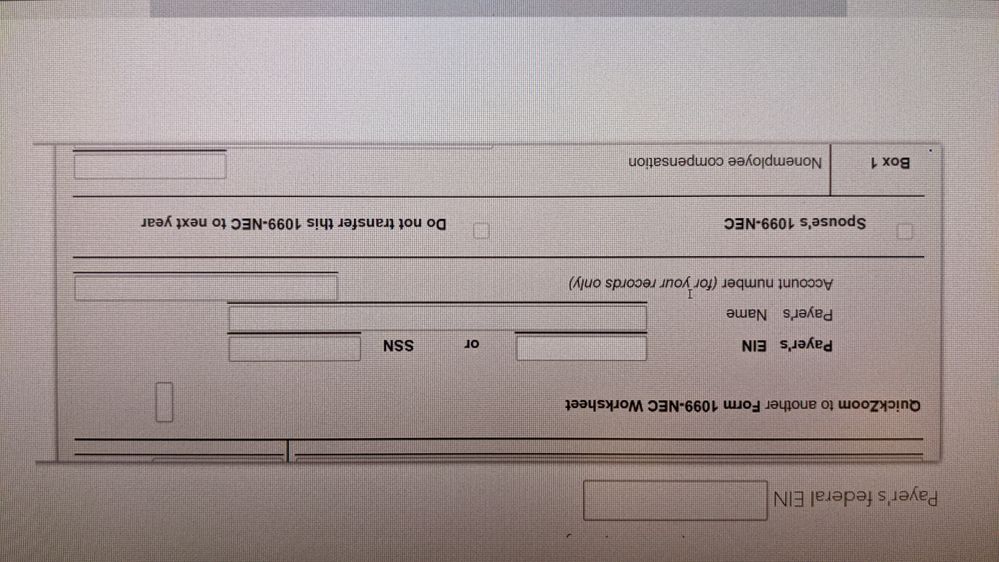

Why can't I input my SSN on Form 1099-NEC? It is getting pulled up at the federal review section. It will only allow payer's EIN and I cannot click on the SSN box.

Then it displays a mostly grayed out Form 1099-NEC with my name and social autofilled at the top. Next it has a box labeled Payer's EIN, and next to it says or SSN and an empty box. For self employment shouldn't I be putting my SSN there? Why can I not click to fill that box instead?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why can't I input my SSN on Form 1099-NEC? It is getting pulled up at the federal review section. It will only allow payer's EIN and I cannot click on the SSN box.

No, you do not enter your Social Security number on Form 1099-NEC as the payer. The payer information is for the company or entity who paid you for your services as a self-employed person. You are the recipient of Form 1099-NEC, not the payer.

You should only be entering Form 1099-NEC if you actually received the form showing your self-employed earnings from a company who paid you. If you did not receive Form 1099-NEC, then enter your self-employment income as 'cash' income on your Schedule C for your self-employed business.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why can't I input my SSN on Form 1099-NEC? It is getting pulled up at the federal review section. It will only allow payer's EIN and I cannot click on the SSN box.

I am having the same issue, but the roadblock is that the federal income check function is flagging "missing information" and demanding the payer's EIN in the pop-up window under "Check this entry". This is after I selected the SSN option and provided the payer's SSN when inputting this income in the income section. The

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why can't I input my SSN on Form 1099-NEC? It is getting pulled up at the federal review section. It will only allow payer's EIN and I cannot click on the SSN box.

If you are using TurboTax Desktop, you can go into Forms mode and enter the missing information.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why can't I input my SSN on Form 1099-NEC? It is getting pulled up at the federal review section. It will only allow payer's EIN and I cannot click on the SSN box.

I am using the online version. Is there a similar option? I have put them in during the input of income info, but TT Online is not carrying it forward and during the federal check the info is not there and it won't let me input it. Help please!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why can't I input my SSN on Form 1099-NEC? It is getting pulled up at the federal review section. It will only allow payer's EIN and I cannot click on the SSN box.

My recommendation for TurboTax Online is to go to the dark border area on the left of your screen and select Tools, Tax Tools, Delete a Form and delete the Form 1099-NEC. Then go back into the Income & Expense, Self-Employment to re-add the 1099-NEC. Do Not add the Form 1099-NEC under Other Common Income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why can't I input my SSN on Form 1099-NEC? It is getting pulled up at the federal review section. It will only allow payer's EIN and I cannot click on the SSN box.

This didn't work for me.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why can't I input my SSN on Form 1099-NEC? It is getting pulled up at the federal review section. It will only allow payer's EIN and I cannot click on the SSN box.

Did you ever get an update? I’m experiencing the same thing, it’s not moving forward with just the social

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why can't I input my SSN on Form 1099-NEC? It is getting pulled up at the federal review section. It will only allow payer's EIN and I cannot click on the SSN box.

Your best option is to remove Form 1099-NEC from your return and re-enter.

Go to the 1099-NEC topic and click Delete beside the form you need to remove.

Or go to the left column and choose Tools >> Delete a form. Choose the form you need to remove and then click Delete.

Additional information: How do I view and delete forms in TurboTax Online?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why can't I input my SSN on Form 1099-NEC? It is getting pulled up at the federal review section. It will only allow payer's EIN and I cannot click on the SSN box.

I'm having the same issue right now, kept asking for EIN on my 1099 NEC, when it's only has SSN.

I'm getting frustrating now, never has this issue last year. Turbo Tax has glitch or something isn't right.

Has to file by mail, can't e-filing without it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why can't I input my SSN on Form 1099-NEC? It is getting pulled up at the federal review section. It will only allow payer's EIN and I cannot click on the SSN box.

I am having the same issue.

A 1099 has a SSN on it, not an EIN.

Last year I filed online using the same method, from the same 1099 issuer and had no issues filing electronically.

This year, I cannot file as I am being told this particular 1099 requires an EIN. That's never the way its been issued and never been a problem.

Please Advise.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why can't I input my SSN on Form 1099-NEC? It is getting pulled up at the federal review section. It will only allow payer's EIN and I cannot click on the SSN box.

Since you said the 1099-NEC has a Social Security number instead of an EIN, try changing the format of that field to accept an SSN instead.

In that same general area on the input screen there should be a question asking how the payer's Federal ID number is formatted. Choose the option that shows xxx-xx-xxxx to enter the SSN.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why can't I input my SSN on Form 1099-NEC? It is getting pulled up at the federal review section. It will only allow payer's EIN and I cannot click on the SSN box.

Turbotax had no problem accepting an SSN for the 1099-NEC in the EasyStep mode. It is only when I attempt to electronically file for California that it complains about the missing EIN. There is no EIN in the paper form itself, of course. And both EIN and SSN should be valid entries. It seems like a bug in Turbotax final validation algorithm before filing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why can't I input my SSN on Form 1099-NEC? It is getting pulled up at the federal review section. It will only allow payer's EIN and I cannot click on the SSN box.

@AnnetteB6

That solution does not work.

I have SSN selected, but the online form will not let me go beyond that and it REQUIRES me to put in an EIN, even thought the form shows the proper SSN.

It says I cannot e-file without the EIN.

I've done this plenty of times before with 1099s from this same place.

I have obfuscated the SSN but they are there and correct.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why can't I input my SSN on Form 1099-NEC? It is getting pulled up at the federal review section. It will only allow payer's EIN and I cannot click on the SSN box.

It depends. Is your business a single-member LLC? If so, this is why it won't accept a Social Security number.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

danielle

New Member

eschmidt1224

Returning Member

slhen

New Member

MamaC1

Level 3

horsetroff

New Member