- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: where do I enter the amounts from a 1099-OID?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

where do I enter the amounts from a 1099-OID?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

where do I enter the amounts from a 1099-OID?

Go to Federal Taxes > Wages & Income. On the screen "Your 2024 Income Summary," scroll down to the Interest and Dividends section. Click the Start button for "1099-OID, Foreign Accounts."

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

where do I enter the amounts from a 1099-OID?

You will enter your Form 1099-OID in the Wages & Income section in TurboTax as rjs states above.

You can get to the section in TurboTax to enter your Form 1099-OID as follows:

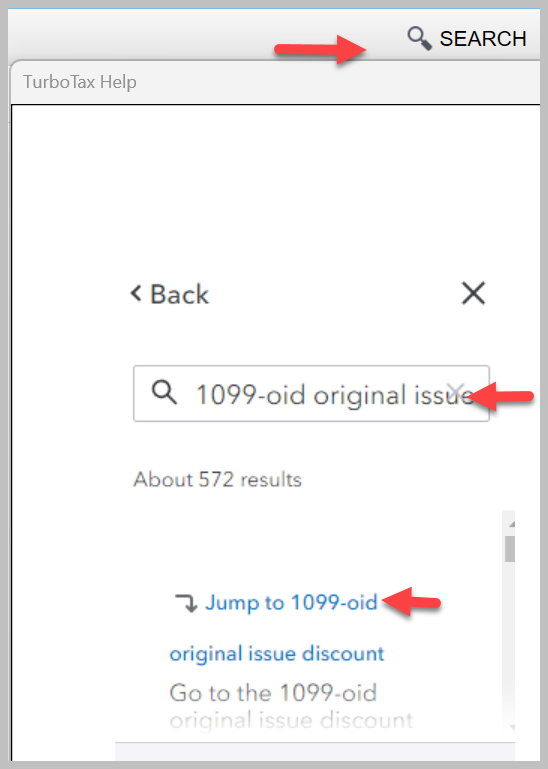

- Click on the Search Icon at the top right of your screen.

- Type the following exactly like this in the search box: "1099-oid original issue discount"

- Click the link "Jump to 1099-oid original issue discount"

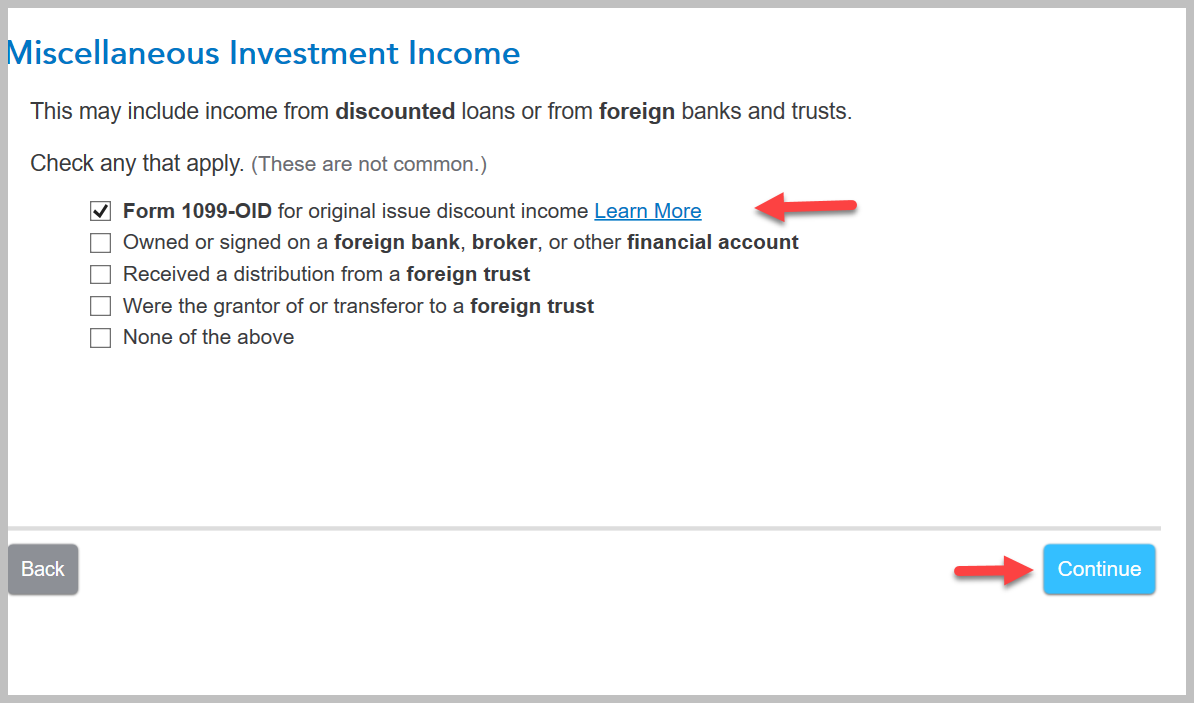

- Your screen will say "Miscellaneous Investment Income"

- Check the box "Form 1099-OID for original issue discount income"

- Next screen will say, "Any OID 2024?" click on Yes"

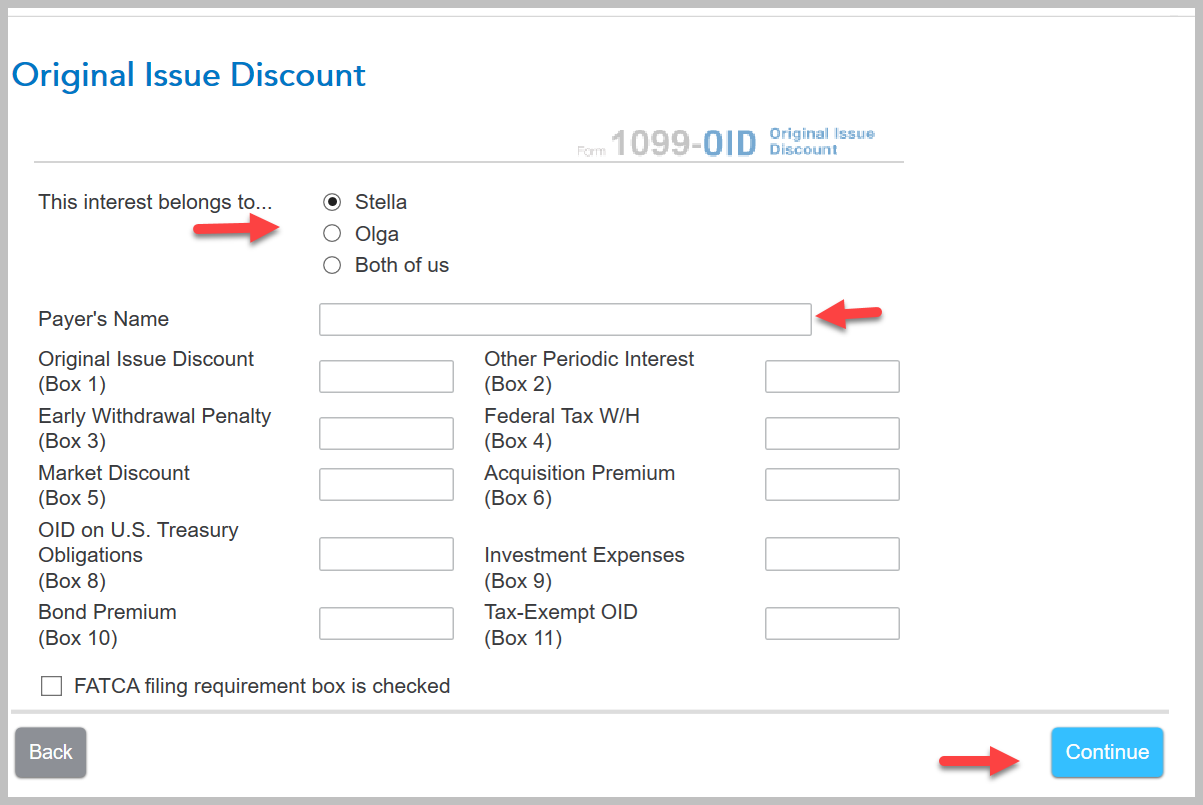

- On the next screen "Original Issue Discount"

- Here you will enter your 1099-OID information.

- Follow the screen and answer any follow-up questions pertaining to your Form 1099-OID

Your screen will look something like this:

Click on "Search" and type "1099-oid original issue discount" in the search box:

Check the box for Form 1099-OID:

Enter your Form 1099-OID information here:

Click here for "Where do I enter Form 1099-OID?"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

JustmeBG

New Member

mwchoh

New Member

user17611423359

Level 1

njp1981

New Member

wmendoza00

New Member