- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: When will the 2021 8915-f form be available on Turbo Tax to efile?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will the 2021 8915-f form be available on Turbo Tax to efile?

This form is currently showing as available on the forms availability page here.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will the 2021 8915-f form be available on Turbo Tax to efile?

@Kernfveldt wrote:

It is not available. The information does not populate correctly and you still can't file your taxes if you're spreading the 2020 Coronavirus distrib from your 401k plan over 3 years for purposes of tax recognition. It still "wants" a 1099-R which is improper because if you took it in 2020, you will NOT receive a 1099-R for 2021.

You do not need a 1099-R, but it is in the 1099-R interview. The first questions is "Do you have a 1099-R to enter" say NO and then it asks if this is a disaster distribution and will lead to the 8915-F questions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will the 2021 8915-f form be available on Turbo Tax to efile?

I have tried every which way an IT DOES NOT WORK when is the next update!!

Just so anyone knows I gave up and used FREE TAX USA THEY WERE able to do it correct and efile to the IRS LAST MONTH

TURBO TAX SUCK S

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will the 2021 8915-f form be available on Turbo Tax to efile?

@Kernfveldt wrote:It is not available. The information does not populate correctly and you still can't file your taxes if you're spreading the 2020 Coronavirus distrib from your 401k plan over 3 years for purposes of tax recognition. It still "wants" a 1099-R which is improper because if you took it in 2020, you will NOT receive a 1099-R for 2021.

The question for 1099-R is for people who indeed withdrew IRA or401K funds from their account in 2021... So software is correct...You're doing it wrong...!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will the 2021 8915-f form be available on Turbo Tax to efile?

I just finished mine and I’m taking 3 years so there is something that isn’t right in your forms.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will the 2021 8915-f form be available on Turbo Tax to efile?

[to nettmann]: You're either illiterate or simply did not bother to read what I wrote. I took the distribution in 2020, as I plainly said. That is why I did not receive a 1099-R in 2021. I simply need to pay the 2nd 1/3 of the taxes on that distribution in my 2021 taxes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will the 2021 8915-f form be available on Turbo Tax to efile?

The Form 8915-F was included in the TurboTax online editions in the early evening of 03/23

The Form 8915-F was included as a software update for All the TurboTax desktop editions on 03/24

If you are using the desktop editions, update your software. Click on Online at the top of the desktop program screen. Click on Check for Updates.

You must go to the Retirement Income section of the program for a Form 1099-R to be able to enter your 2nd year of the 2020 distribution -

Click on Federal

Click on Wages & Income

Scroll down to Retirement Plans and Social Security

On IRA, 401(k), Pension Plan Withdrawals (1099-R), click on the Start or Revisit button

On the screen Did you get a 1099-R in 2021? Click on NO, if you did not receive a 2021 Form 1099-R

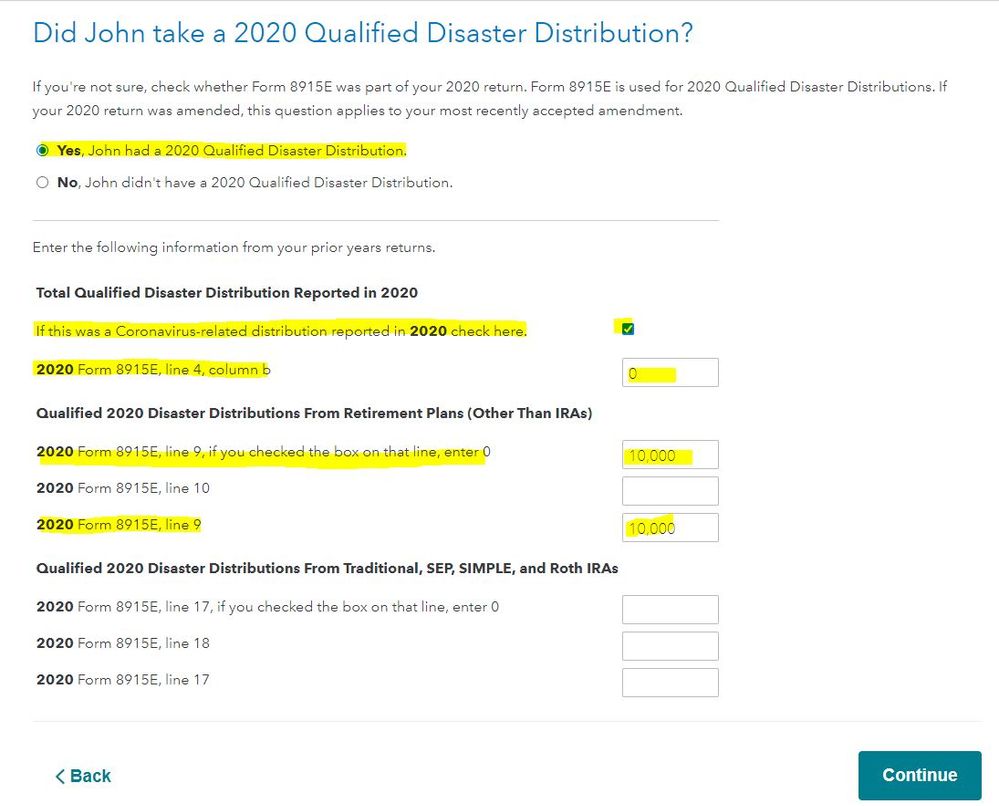

If you had a Covid-19 related distribution in 2020 and selected to spread the distribution over 3 years -

Answer Yes when asked Have you ever taken a disaster distribution before 2021?

Answer Yes when asked if you took a Qualified 2020 Disaster Distribution

Check the box that this was a Coronavirus-related distribution reported in 2020

In the box 2020 Form 8915-E, line 4, column b - Enter a 0

If the 2020 distribution was from an account that was Not an IRA

2020 Form 8915E Line 9 - Enter 1/3 of the amount from the 2020 distribution in both boxes for Line 9

If the 2020 distribution was from an IRA account

2020 Form 8915E Line 17 - Enter 1/3 of the amount from the 2020 distribution in both boxes for Line 17

Do not enter anything in the other boxes, leave them blank (empty)

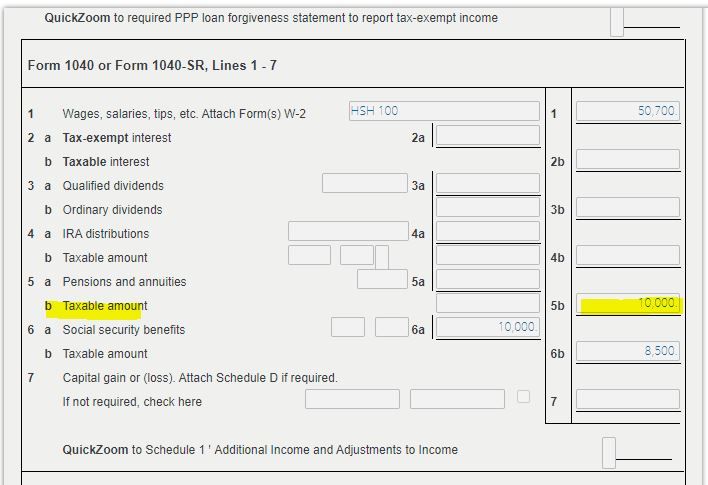

The 1/3 of the amount from the 2020 distribution will be entered on the 2021 Form 1040 Line 4b if from an IRA or on Line 5b if from a retirement plan other than an IRA

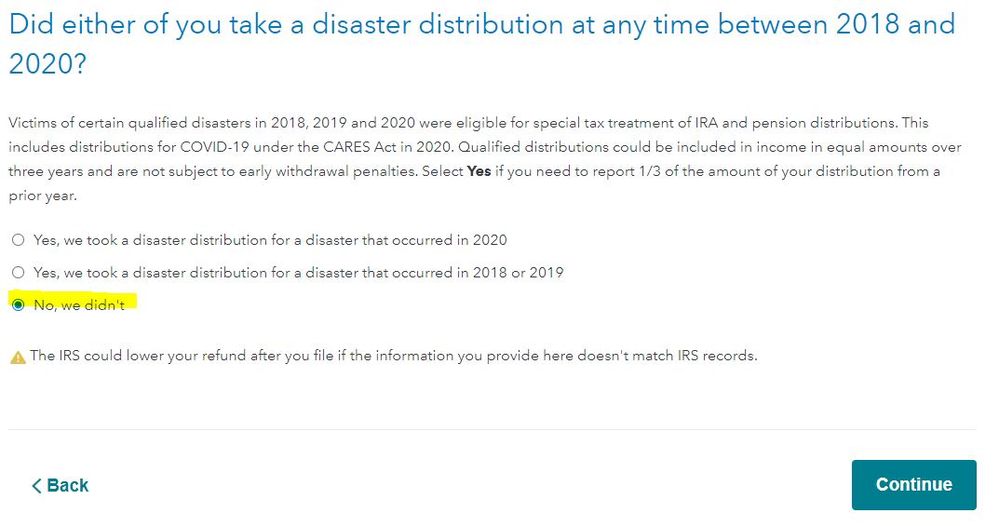

After completing the Wages & Income section you will land on a screen Did you take a disaster distribution at any time between 2018 and 2020?

Answer NO since you have already completed the entering the 1/3 of the 2020 distribution.

You can view your Form 1040 at any time using the online editions. Click on Tax Tools on the left side of the online program screen. Click on Tools. Click on View Tax Summary. Click on Preview my 1040 on the left side of the screen.

Using the desktop editions click on Forms. Open the Form 1040

Screenshots from the online editions, the desktop editions are similar -

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will the 2021 8915-f form be available on Turbo Tax to efile?

Online version here - it's not adding anything to my income and shows that I've overpaid by thousands of dollars. Absolutely nothing changed after I filled this out and ran a review. Nothing about retirement is being shown on the income summary..

Qualified 2020 Disaster Distribution Y

Coronavirus-related distribution reported in 2020 Y

2020 Form 8915E, line 4, column b 33000

-boxes skipped b/c it was from an IRA-

Qualified 2020 Disaster Distributions From Traditional, SEP, SIMPLE, and Roth IRAs

2020 Form 8915E, line 17, if you checked the box on that line, enter 0

2020 Form 8915E, line 18 0

2020 Form 8915E, line 17 11000

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will the 2021 8915-f form be available on Turbo Tax to efile?

Go back to the 1099-R section for entering the 2nd year distribution and also enter the amount in the box for - 2020 Form 8915E, line 17, if you checked the box on that line, enter 0

That will enter the 2nd year distribution amount on your Form 1040 Line 4b as taxable income.

And after completing the Wages & Income section you will land on a screen Did you take a disaster distribution at any time between 2018 and 2020?

Answer NO since you have already completed the entering the 1/3 of the 2020 distribution.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will the 2021 8915-f form be available on Turbo Tax to efile?

You have to enter your 11,000 in both the first box and the last for line 17. I made the same mistake leaving it blank. Once you enter it, it will show on your 1040 in line 4 and the 8915-F will be there.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will the 2021 8915-f form be available on Turbo Tax to efile?

Turbo Tax is not recognizing that I have paid back money to the IRA this year. It taxed me 1/3 whether I put zero or the amount I paid back this year's amount. Can anyone help figure out what to do here?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will the 2021 8915-f form be available on Turbo Tax to efile?

Can someone help me out. So iam in the section of income that talks about 1099r. The status next to it says needs review but no matter what I do it stays as need review. I said no to do I have a 1099r in 2021. I said yes to have u ever taken a disaster distribution before 2021. I filled out the did u take a 2020 qualified disaster distribution. I didnt repay anything. I said no to the question asking if I took a qualified disaster distribution for 2019, 2018 and 2017. And the final question did u take a disaster distribution at any time between 2018 and 2020 I said yes(not sure why they are asking me again). But still it tells me to go back to 1099r and the status still says needs review. I go back to answer and the same exact results.........just by chance I went to delete forms and I do see a 8915F-T in there but I dont know why the section in income 1099r will not move of needs review. Also iam getting charged a underpayment penalties is that correct?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will the 2021 8915-f form be available on Turbo Tax to efile?

After completing the Wages & Income section you will land on a screen Did you take a disaster distribution at any time between 2018 and 2020?

Answer NO since you have already completed the entering the 1/3 of the 2020 distribution.

If you did not have a 2021 distribution from a retirement account then you cannot have a 10% early withdrawal penalty reported as a liability on your 2021 tax return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will the 2021 8915-f form be available on Turbo Tax to efile?

Please help me.

We took a Qualified Disaster Distribution from my husband's 401k in 2020.

When I enter values shown in snippet below, nothing happens.

The 1/3 amount is not being added to our income.

Please help

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will the 2021 8915-f form be available on Turbo Tax to efile?

On the screen Did (Name) repay any 2020 Qualified Disaster Distribution in 2021? did you enter the same amount of the 2nd year distribution?

If you did NOT make a repayment in 2021 you should NOT enter an amount on this screen.

You entered your 2nd year distribution correctly as shown on your screenshot. You should have the 2nd year distribution amount of $33,333 on your Form 1040 Line 5b.

You can view your Form 1040 at any time using the online editions. Click on Tax Tools on the left side of the online program screen. Click on Tools. Click on View Tax Summary. Click on Preview my 1040 on the left side of the screen.

Using the desktop editions click on Forms. Open the Form 1040

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Joanne9rose

New Member

Jefro99

New Member

emberrbiss

New Member

MaxRLC

Level 3

Once a year Accountant

Level 3