- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: When will form 8915-E be update and available for 2021 tax year?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will form 8915-E be update and available for 2021 tax year?

I have followed these instructions several times. I am concerned about this comment:

- “The screen Did you take a disaster distribution at any time between 2018 and 2020? you are instructed to select YES if you need to report 1/3 of the amount of your distribution from a prior year. That has already been done. Select No, I didn't.”

None of the verbiage in the question supports me answering no to this question because I need to report 1/3 of the amount. If TurboTax wanted us to answer no when we mean yes, then they need to change the wording.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will form 8915-E be update and available for 2021 tax year?

@BDLump wrote:

I have followed these instructions several times. I am concerned about this comment:

- “The screen Did you take a disaster distribution at any time between 2018 and 2020? you are instructed to select YES if you need to report 1/3 of the amount of your distribution from a prior year. That has already been done. Select No, I didn't.”

None of the verbiage in the question supports me answering no to this question because I need to report 1/3 of the amount. If TurboTax wanted us to answer no when we mean yes, then they need to change the wording.

If you followed the procedure shown you already entered the 1/3 of the distribution on the Form 8915-F in the section for reporting a Form 1099-R so there is no need to you to go back and do it over again so the answer would be NO.

If you bypassed the Form 1099-R section in the Wages & Income section selecting YES would take you back to the 1099-R section so that you could enter the 1/3 of the distribution.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will form 8915-E be update and available for 2021 tax year?

Interesting Thread!!

I contacted TurboTax Rep earlier this week regarding a question for this topic. I wanted to know if I can pay the remaining taxes. I paid 1/3 last year and wanted to pay the remaining 2/3 this year. The application itself doesn't have anything on this question. So I contacted the Rep. It took a while and she told me to enter an amount in a line that pretained to 2020. Which makes no sense, It just didn't feel right to me. She had that there was a glich in the form. I politly said Thank you and called it a day. She never told me that I needed Form 8915. I'm not reading through the web to figure out my answer and I come accross this thread.

Just Wow!! TurboTax What's going on? This is unacceptable.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will form 8915-E be update and available for 2021 tax year?

I asked this question and was given the WRONG information from a Rep at TurboTax!

She told me to enter the amount in a line that pretained to 2022.

URGGGG

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will form 8915-E be update and available for 2021 tax year?

Thank you for posting!!!

The TurboTax Rep mentioned nothing about this to me.

I'm so glad I didn't turn her BS answer, told me that the form was glitchy! This was 4 days ago!!! The form isn't even out!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will form 8915-E be update and available for 2021 tax year?

@Melissa4444 wrote:

Thank you for posting!!!

The TurboTax Rep mentioned nothing about this to me.

I'm so glad I didn't turn her BS answer, told me that the form was glitchy! This was 4 days ago!!! The form isn't even out!!

The Form 8915-F was included in the TurboTax online editions in the early evening of 03/23

The Form 8915-F was included as a software update for All the TurboTax desktop editions on 03/24

If you are using the desktop editions, update your software. Click on Online at the top of the desktop program screen. Click on Check for Updates.

You must go to the Retirement Income section of the program for a Form 1099-R to be able to enter your 2nd year of the 2020 distribution -

Click on Federal

Click on Wages & Income

Scroll down to Retirement Plans and Social Security

On IRA, 401(k), Pension Plan Withdrawals (1099-R), click on the Start or Revisit button

On the screen Did you get a 1099-R in 2021? Click on NO, if you did not receive a 2021 Form 1099-R

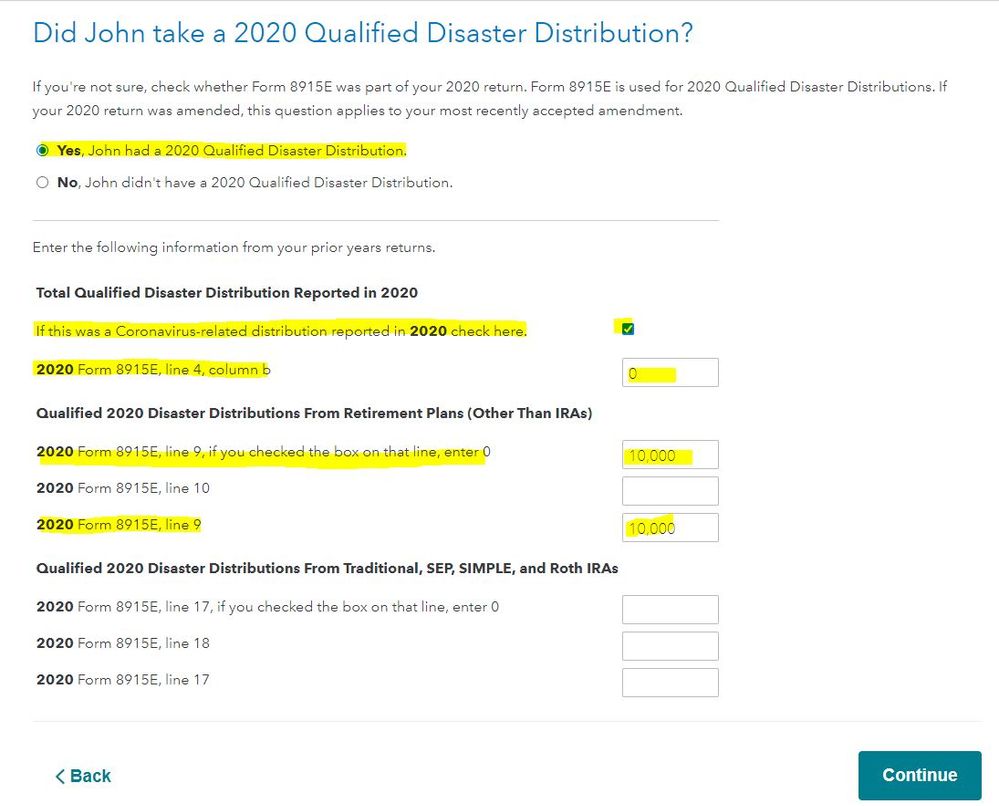

If you had a Covid-19 related distribution in 2020 and selected to spread the distribution over 3 years -

Answer Yes when asked Have you ever taken a disaster distribution before 2021?

Answer Yes when asked if you took a Qualified 2020 Disaster Distribution

Check the box that this was a Coronavirus-related distribution reported in 2020

In the box 2020 Form 8915-E, line 4, column b - Leave blank or enter a 0

This is not required on a Form 8915-F for a Coronavirus-related distribution

If the 2020 distribution was from an account that was Not an IRA

Enter 1/3 of the amount from the 2020 distribution in both boxes for Line 9

2020 Form 8915E, line 9, if you checked the box on that line, enter 0

2020 Form 8915E Line 9

If the 2020 distribution was from an IRA account

Enter 1/3 of the amount from the 2020 distribution in both boxes for Line 17

2020 Form 8915E, line 17, if you checked the box on that line, enter 0

2020 Form 8915E Line 17

Do not enter anything in the other boxes, leave them blank (empty)

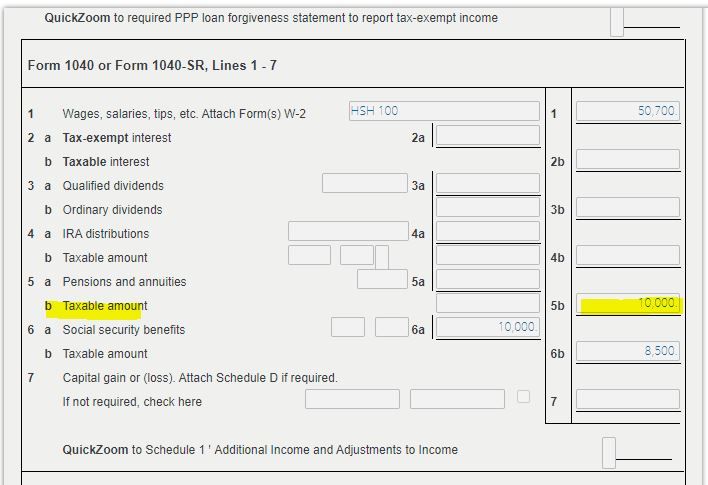

The 1/3 of the amount from the 2020 distribution will be entered on the 2021 Form 1040 Line 4b if from an IRA or on Line 5b if from a retirement plan other than an IRA

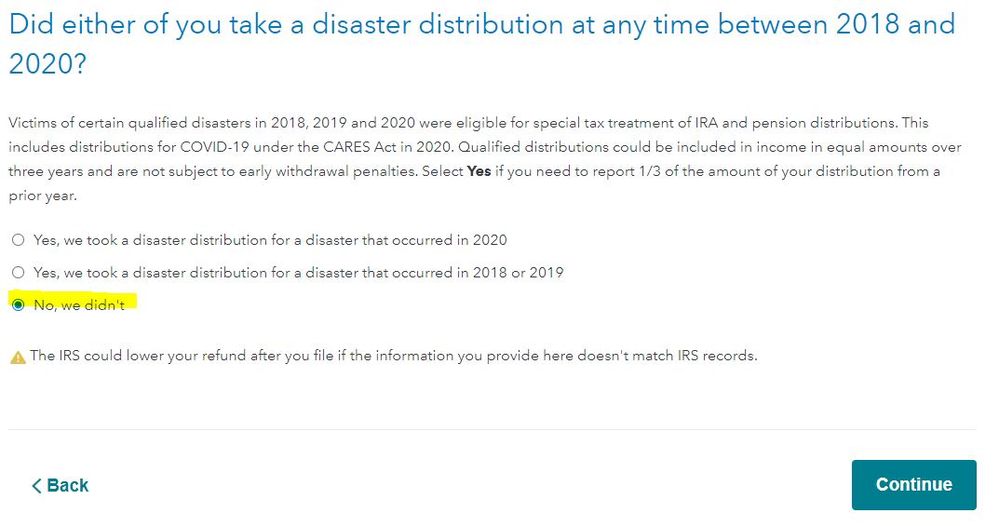

After completing the Wages & Income section you will land on a screen Did you take a disaster distribution at any time between 2018 and 2020?

Answer NO since you have already completed the entering the 1/3 of the 2020 distribution.

You can view your Form 1040 at any time using the online editions. Click on Tax Tools on the left side of the online program screen. Click on Tools. Click on View Tax Summary. Click on Preview my 1040 on the left side of the screen.

Using the desktop editions click on Forms. Open the Form 1040

NOTE - During Federal Review you may get a notice to check an entry. Clicking Check Entries takes you to the Check This Entry screen showing a box for entering a FEMA Disaster name. Put your cursor in the box (click in the box) and then click on the spacebar. Click on Continue On the following screen Run Smart Check Again click on Done.

The Form 8915-F you completed already has the box for the Coronavirus checked on Item D of the form.

As stated on the Form 8915-F -

If your disaster is the coronavirus, check this box ▶ Don’t list the coronavirus in item C.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will form 8915-E be update and available for 2021 tax year?

I entered the fema name as coronavirus before I found your answer. Now I can’t go back and take it. For some reason, It keeps saying that it needs review, but when I looked at the tax preview it has the 1/3 amount added in my total. When I do the complete check review it says I’m ready to file. Should I move forward on filing even though it says it needs review?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will form 8915-E be update and available for 2021 tax year?

You can delete the form. If yo uto into Tax form and then delete form, look for 8915 and delete it and go back and revisit the section.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will form 8915-E be update and available for 2021 tax year?

Thank you for posting this!!!

Strange Behavior - Section still says "Review Needed", even when I have reviewed it. But when I to a final check there are no issues.

Question Regarding repayment - The form allows for you to enter 2nd year 1/3 of the amount borrowed. Does the form allow for someone to pay the 3rd 1/3 amount. In essencse could I finish paying off all of the taxes this year or do I have to wait until next year?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will form 8915-E be update and available for 2021 tax year?

There is certainly something off with this. I split my cares act 401k withdrawal in 3. TurboTax is trying to tax me for the 3rd I input this year. This is not supposed to be taxable income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will form 8915-E be update and available for 2021 tax year?

@Realninja24 wrote:

There is certainly something off with this. I split my cares act 401k withdrawal in 3. TurboTax is trying to tax me for the 3rd I input this year. This is not supposed to be taxable income.

Why would you think it is not taxable income?

When you decided to have the 2020 distribution spread over three years, 1/3 of the taxable amount of the distribution was entered on your 2020 tax return. On the 2021 tax return 1/3 of the taxable amount of the 2020 distribution is entered on your tax return as ordinary income and taxed at your current tax rate.

All of the federal taxes withheld from the 2020 distribution were entered on the 2020 tax return as a tax payment. The taxes withheld were included in the 2020 federal tax return you received.

The federal taxes withheld from the 2020 distribution cannot be spread over 3 years, only the distribution.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will form 8915-E be update and available for 2021 tax year?

I think my friend followed @DoninGA's latest guidance to the teeth, but still couldn't have the 2nd year 1/3 amt shown up on their 1040 line 5b. Software is the latest desktop version with the 3/31 updates.

Instead, what did show up on their 1040 line 5b was their true 2021 early withdrawal of their 401(k) that was subject to penalty. They tried to delete that early withdrawal amount; or delete the 8915F-T/S shown up in the forms view. None worked. By the way, what's the diff between 8915F-T vs 8915F-S? 8915F-T shows Item D checked, but -S doesn't.

They scrolled down 8915F-T and followed the chart 1 and was told to complete lines 12 thru 15 and 23 thru 26 as applicable, but those blanks were not fillable. This worksheet 2/4 seems to refer to the step-by-step view that had pulled the right amount from the 2020 8915-E line 4b/9/17. Thanks.m

oops. I think IRS confirmed per https://www.irs.gov/pub/irs-schema/ty[product key removed]s-and-solutions.xlsx that 8915-F wasn’t developed in XML, so how does TurboTax actually gonna handle this 1/3 not showing up on 1040/8915-F issue?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will form 8915-E be update and available for 2021 tax year?

Ugh… spoke with so called TT customer service earlier today. Told 8915-F not supported and that have to file paper copy. I informed that info for 1/3 for 2021 not populated at all. Not implemented in tax return. Was again told not supported. Why am I paying for turbo tax if not implementing all forms?!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will form 8915-E be update and available for 2021 tax year?

@Kryptonian The only way the 2nd year distribution amount would not be entered on Form 1040 Line 5b is if the user did not enter the amount in both boxes as shown in the procedure -

If the 2020 distribution was from an account that was Not an IRA

Enter 1/3 of the amount from the 2020 distribution in both boxes for Line 9

2020 Form 8915E, line 9, if you checked the box on that line, enter 0

2020 Form 8915E Line 9

The T indicates Taxpayer (First name on the tax return). The S indicates Spouse

If the user had also had a distribution from a retirement account that was not from an IRA in 2021 then they would have received a Form 1099-R and they had to enter that form on the 2021 tax return. Any taxable amount on the Form 1099-R in box 2a of the form is required to be entered on the Form 1040 Line 5b.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will form 8915-E be update and available for 2021 tax year?

@Maryann809 wrote:

Ugh… spoke with so called TT customer service earlier today. Told 8915-F not supported and that have to file paper copy. I informed that info for 1/3 for 2021 not populated at all. Not implemented in tax return. Was again told not supported. Why am I paying for turbo tax if not implementing all forms?!

Apparently the TurboTax agents you spoke with do not have correct information.

The Form 8915-F was included in the TurboTax online editions in the early evening of 03/23

The Form 8915-F was included as a software update for All the TurboTax desktop editions on 03/24

If you are using the desktop editions, update your software. Click on Online at the top of the desktop program screen. Click on Check for Updates.

You must go to the Retirement Income section of the program for a Form 1099-R to be able to enter your 2nd year of the 2020 distribution -

Click on Federal

Click on Wages & Income

Scroll down to Retirement Plans and Social Security

On IRA, 401(k), Pension Plan Withdrawals (1099-R), click on the Start or Revisit button

On the screen Did you get a 1099-R in 2021? Click on NO, if you did not receive a 2021 Form 1099-R in 2022

Answer Yes when asked Have you ever taken a disaster distribution before 2021?

Answer Yes when asked if you took a Qualified 2020 Disaster Distribution

Check the box that this was a Coronavirus-related distribution reported in 2020

In the box 2020 Form 8915-E, line 4, column b - Leave blank or enter a 0

This is not required on a Form 8915-F for a Coronavirus-related distribution

If the 2020 distribution was from an account that was Not an IRA

Enter 1/3 of the amount from the 2020 distribution in both boxes for Line 9

2020 Form 8915E, line 9, if you checked the box on that line, enter 0

2020 Form 8915E Line 9

If the 2020 distribution was from an IRA account

Enter 1/3 of the amount from the 2020 distribution in both boxes for Line 17

2020 Form 8915E, line 17, if you checked the box on that line, enter 0

2020 Form 8915E Line 17

Do not enter anything in the other boxes, leave them blank (empty)

The 1/3 of the amount from the 2020 distribution will be entered on the 2021 Form 1040 Line 4b if from an IRA or on Line 5b if from a retirement plan other than an IRA

After completing the Wages & Income section you will land on a screen Did you take a disaster distribution at any time between 2018 and 2020?

Answer NO since you have already completed the entering the 1/3 of the 2020 distribution.

You can view your Form 1040 at any time using the online editions. Click on Tax Tools on the left side of the online program screen. Click on Tools. Click on View Tax Summary. Click on Preview my 1040 on the left side of the screen.

Using the desktop editions click on Forms. Open the Form 1040

NOTE - During Federal Review you may get a notice to check an entry. Clicking Check Entries takes you to the Check This Entry screen showing a box for entering a FEMA Disaster name. Put your cursor in the box (click in the box) and then click on the spacebar. Click on Continue On the following screen Run Smart Check Again click on Done.

The Form 8915-F you completed already has the box for the Coronavirus checked on Item D of the form.

As stated on the Form 8915-F -

If your disaster is the coronavirus, check this box ▶ Don’t list the coronavirus in item C.

Screenshots from the online editions -

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

aledoux2

New Member

peanutbuttertaxes

New Member

doubleO7

Level 4

wcrisler

New Member

stays

New Member