- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: When will form 8915-E be update and available for 2021 tax year?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will form 8915-E be update and available for 2021 tax year?

@crfj1976 The Form 8915-E was only for tax year 2020 and not for any other tax year. Form 8915-F will be used in tax year 2021 and future tax years.

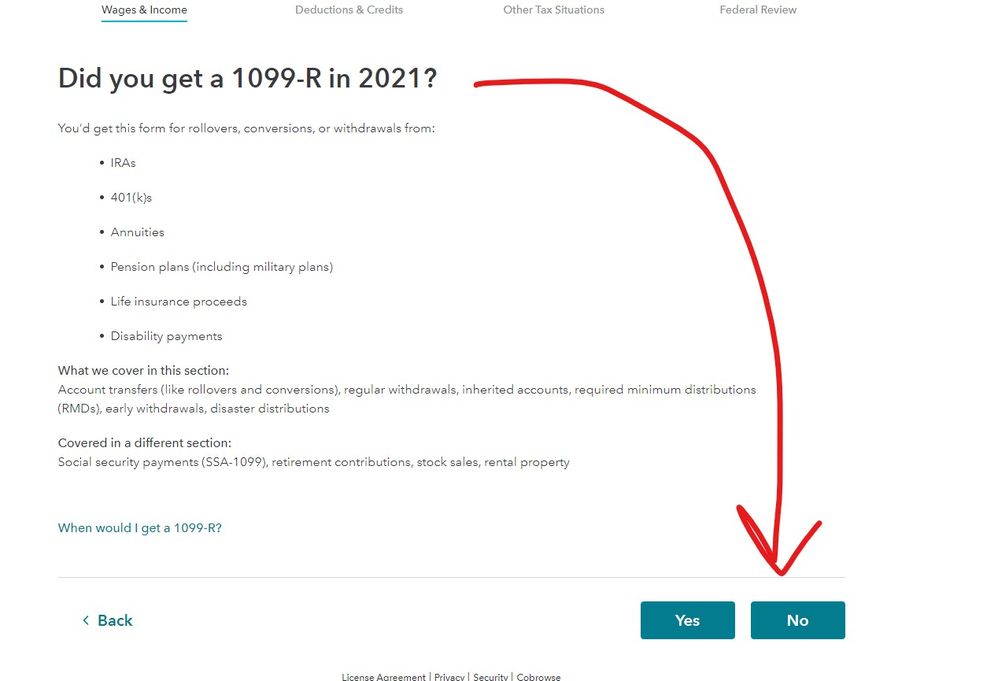

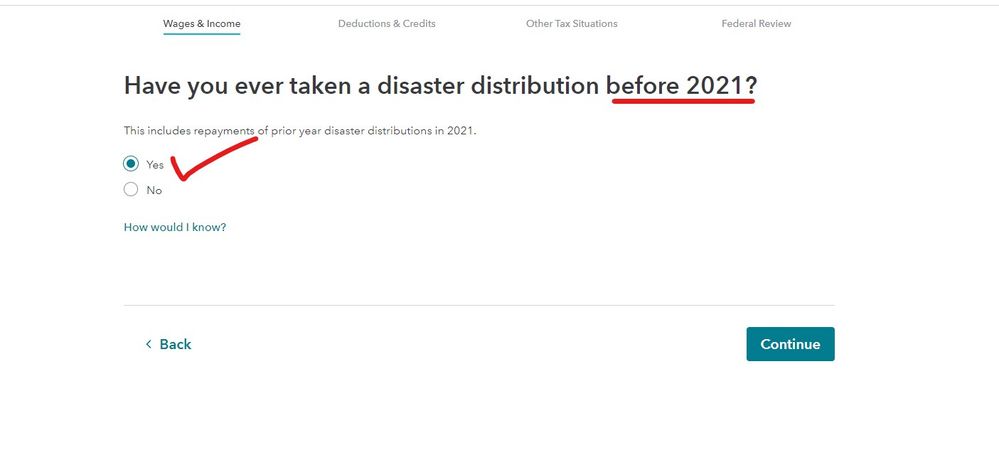

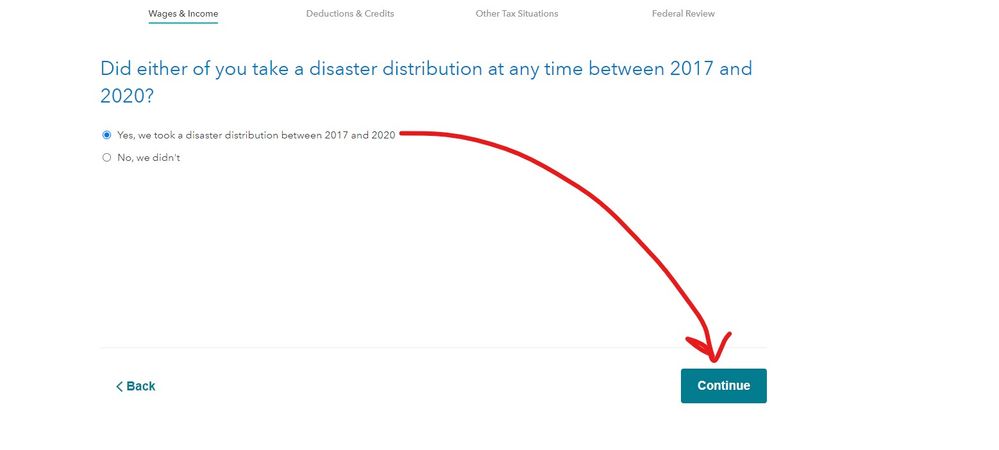

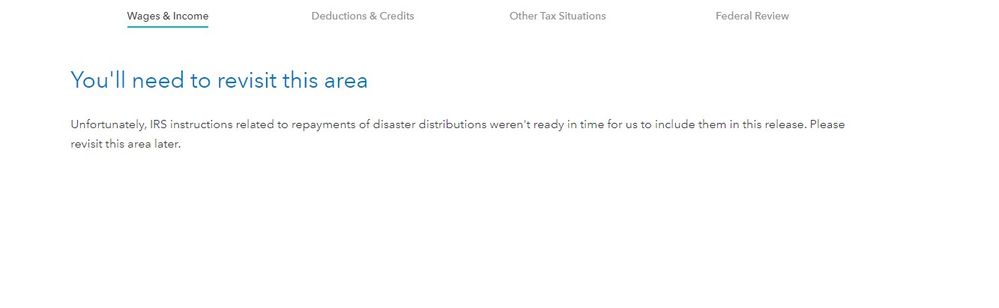

You will report this in the Retirement Plans and Social Security section under Wages & Income. However, the Form 8915-F and instructions has only just been released by the IRS on 02/03/2022. Until TurboTax receives the schema for the 8915-F from the IRS it will not be included in the TurboTax program. This process can take awhile after IRS release. So the questions are not being asked in the section for the Form 1099-R until the form is available.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will form 8915-E be update and available for 2021 tax year?

The 8915 F has now gone final on the IRS web site. When Will TurboTax have this programmed?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will form 8915-E be update and available for 2021 tax year?

The answer I got today was

first the “expert” didn’t even know that it was available yet

second that he told me that it would take them a couple days after it was released and

third once I told him it was available last week he told me to give them more time

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will form 8915-E be update and available for 2021 tax year?

I checked last years form and it was released around Feb 26, 2021. So I expect it to be released around the same time in 2022.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will form 8915-E be update and available for 2021 tax year?

My professional program just released the 8915-F yesterday so TT will be coming sometime soon.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will form 8915-E be update and available for 2021 tax year?

From the draft 8915-F instructions, with my bold/underline for emphasis. Distribution is already reported on 2020 taxes, but income from 2nd and 3rd division will be on 2021 and 2022 taxes. And yes, consensus in this thread is we have to wait, and there are two camps: wait will be short and wait will be long.

"Purpose of Form

Use Form 8915-F to report:

• Qualified 2020 disaster distributions made

in 2021 (coronavirus-related distributions

can't be made after December 30, 2020);

• Repayments of qualified 2020 disaster

distributions;

• Income in 2021 and later years from

qualified 2020 and later disaster

distributions; and

• Qualified distributions received on

January 1, 2021, for the W"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will form 8915-E be update and available for 2021 tax year?

If it is still in draft form, then why can I print the form 8915-F from the IRS.gov website?

https://www.irs.gov/pub/irs-pdf/f8915f.pdf

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will form 8915-E be update and available for 2021 tax year?

Form 8915-F is no longer in draft status. It was approved and made available by the IRS on February 2. There is an IRS approval process for adding new forms to tax preparation software - it doesn't happen the same day a form is made available by the IRS. Form 8915-F should be available in TurboTax shortly.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will form 8915-E be update and available for 2021 tax year?

I haven't received 2021 1099-R from Fidelity. Am I supposed to use the 2020 1099-R because I spread the early withdrawal over 3 years due to COVID?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will form 8915-E be update and available for 2021 tax year?

@Vil86 wrote:

I haven't received 2021 1099-R from Fidelity. Am I supposed to use the 2020 1099-R because I spread the early withdrawal over 3 years due to COVID?

No, you do Not enter your 2020 Form 1099-R in the TurboTax section for reporting a 1099-R.

To report the three year distribution of the withdrawal made in 2020 there is a new Form 8915-F for reporting the distribution. This 8915-F is not yet available in the TurboTax program.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will form 8915-E be update and available for 2021 tax year?

Will Turbo Tax prompt you for the form?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will form 8915-E be update and available for 2021 tax year?

TT doesn't have the form in their software yet and they are saying it won't be available on the TT website until 3/31. The IRS released the final draft on 2/2/22 and many other tax companies have it available for you to get your taxes done. If you want to wait for TurboTax then you won't be able to get them done (if you need this specific form) until March 31st

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will form 8915-E be update and available for 2021 tax year?

When that section of the 1099-R input is functional you will be able to answer the appropriate questions ... this is all you get right now ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will form 8915-E be update and available for 2021 tax year?

@kmcmillan I do not want to wait until 03/31. Do you know which preparers have the form? H&R Block?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

When will form 8915-E be update and available for 2021 tax year?

@cp666 Several people have said that H&R does have it. I used FreeTaxUSA and they had it also. I was pleased with their system and it's ease and cost. Once my taxes were approved by the IRS after filing, I stopped looking for who else had this specific form available.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

hung05

Level 2

sk-anderson

New Member

aledoux2

New Member

peanutbuttertaxes

New Member

doubleO7

Level 4