- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: What do you enter for the EIN number for the US TREASURY/IRS, if you did not receive the 1099...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What do you enter for the EIN number for the US TREASURY/IRS, if you did not receive the 1099-INT they were suppose to mail for interest earned on your 2019 tax refund?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What do you enter for the EIN number for the US TREASURY/IRS, if you did not receive the 1099-INT they were suppose to mail for interest earned on your 2019 tax refund?

You do not need the EIN. Please follow these steps to enter the interest income:

- Login to your TurboTax Account

- Click on "Search" on the top right and type “1099-INT”

- Click on “Jump to 1099-INT”

- Answer "Yes" to "Did you receive any interest income?"

- Click "continue" on the "Get ready to be impressed" screen

- On the "Let’s import your tax info" screen click "Change how I enter my form"

- Select "Type it in myself"

- Enter the interest

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What do you enter for the EIN number for the US TREASURY/IRS, if you did not receive the 1099-INT they were suppose to mail for interest earned on your 2019 tax refund?

I followed your directions and just left the FEIN # field blank. But the Federal Tax Review flagged the transaction and said it needed the FEIN # for the payer. I put all 0's into the field in a FEIN # format but the Federal Tax Review still flagged the item as needing a review and entry of a VALID FEIN #.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What do you enter for the EIN number for the US TREASURY/IRS, if you did not receive the 1099-INT they were suppose to mail for interest earned on your 2019 tax refund?

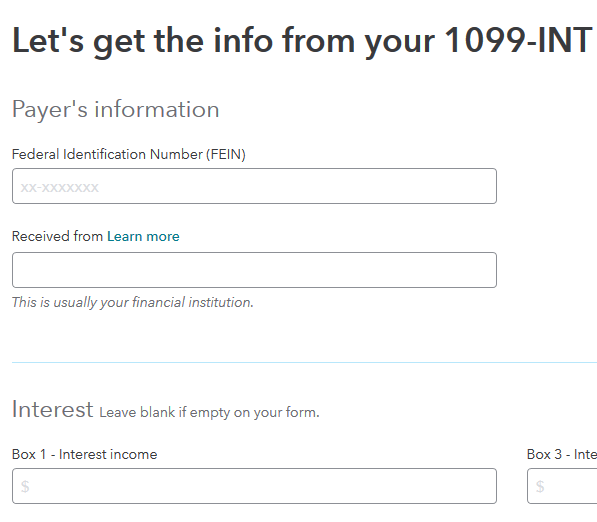

There is no EIN field for the 1099-INT entry:

You will enter the interest amount in box 1. Please verify that you are on the correct screen.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What do you enter for the EIN number for the US TREASURY/IRS, if you did not receive the 1099-INT they were suppose to mail for interest earned on your 2019 tax refund?

The screen that comes up for me when I follow your instruction goes along just fine till I select "Type it myself". The screen I that comes up for me starts with a box that says"Federal Identification Number (FEIN). Then right below it is a box that says "Received From". Below these 2 lines is box 1-Interset Income. So what ever I am seeing is not what you are seeing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What do you enter for the EIN number for the US TREASURY/IRS, if you did not receive the 1099-INT they were suppose to mail for interest earned on your 2019 tax refund?

I am using Turbo Tax self-employed does this make a difference???

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What do you enter for the EIN number for the US TREASURY/IRS, if you did not receive the 1099-INT they were suppose to mail for interest earned on your 2019 tax refund?

Lets try deleting through tools and starting over. While in your return in TurboTax:

- In the left hand column select "Tax Tools"

- Select "Tools"

- Select "Delete a form"

- Review for the 1099-INT under "Schedule B"

- Delete selected form(s) then "Continue with my Return".

If this does not work, you may need to delete the entire Schedule B information and re-add all 1099-Div and 1099-Int forms.

After you have logged in and are in your return in TurboTax Online:

- Go to Search at the top of the screen.

- Enter Form 1099-INT in the search box.

- You will see a Jump To function that will take you to the 1099-INT input screens.

- Then add a new 1099-INT and manually enter your 1099-INT.

At the financial services screens, click "Change how I enter my form" then "Type it myself"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What do you enter for the EIN number for the US TREASURY/IRS, if you did not receive the 1099-INT they were suppose to mail for interest earned on your 2019 tax refund?

I did not work. I used the TOOLS and deleted the interest entry for payment from IRS and went back to Use jump start 1099-DIV and chose self enter the information and the same screen for entry comes up as shown I my previous reply. It requests the FEIN number of the payer and their name in Box #1 and Box # 2 on the screen. Below that I can enter the amount of interest paid to me. So I still get an item that needs review from the Federal Return Review in the software. The item in question in the review is the FEIN number field ( empty or filed in with 0s in a FEIN # format, I tried both ways) on the 1099-INT that I self entered for the US Treasury/IRS payment.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What do you enter for the EIN number for the US TREASURY/IRS, if you did not receive the 1099-INT they were suppose to mail for interest earned on your 2019 tax refund?

When I sign into TurboTax Online Self-Employed I also do not get the screen that you seem to see. I show only the screen posted earlier by @DanaB27.

I'm wondering if you are using a MAC which sometimes does show slightly differently. Either way there is no requirement for you to have to use an EIN for this entry.

Just in case this may help while I see if I can find an EIN that works for you try clearing your cache and cookies. Sometimes that's all it takes.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What do you enter for the EIN number for the US TREASURY/IRS, if you did not receive the 1099-INT they were suppose to mail for interest earned on your 2019 tax refund?

I am not on a Mac. I tried to just leave the 1099-INT form entered "as is" (0s in a FEIN format)and when I paid for the software and went to try to file electronically it would not let be because of the FEIN on the IRS 1099-INT form. It wanted to print out my return, so I could mail it to the IRS. I went in and deleted the IRS 1099-INT form out the interest income section and added to to my return as OTHER INCOME (on Schedule !) with an explanation next to the amount. At least it is figured into my adjusted gross income and I am paying taxes on the amount. And I could then e-file my return. Hope it works out OK with the IRS.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What do you enter for the EIN number for the US TREASURY/IRS, if you did not receive the 1099-INT they were suppose to mail for interest earned on your 2019 tax refund?

That should work fine.

In the unlikely event the IRS contacts you about a "missing 1099-INT", just respond that you reported it as "Other Income" on Line 8 of Form 1040 (also Line 8, Schedule 1).

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

nestog33

New Member

regena767lott

New Member

Tamlea222

New Member

gjgogol

Level 5

Mike9241

Level 15