- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: We did NOT have an affordable care act plan in 2021 but turbotax keeps saying our returns wer...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We did NOT have an affordable care act plan in 2021 but turbotax keeps saying our returns were denied because I am not filing a 1095A form. How do I go around this?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We did NOT have an affordable care act plan in 2021 but turbotax keeps saying our returns were denied because I am not filing a 1095A form. How do I go around this?

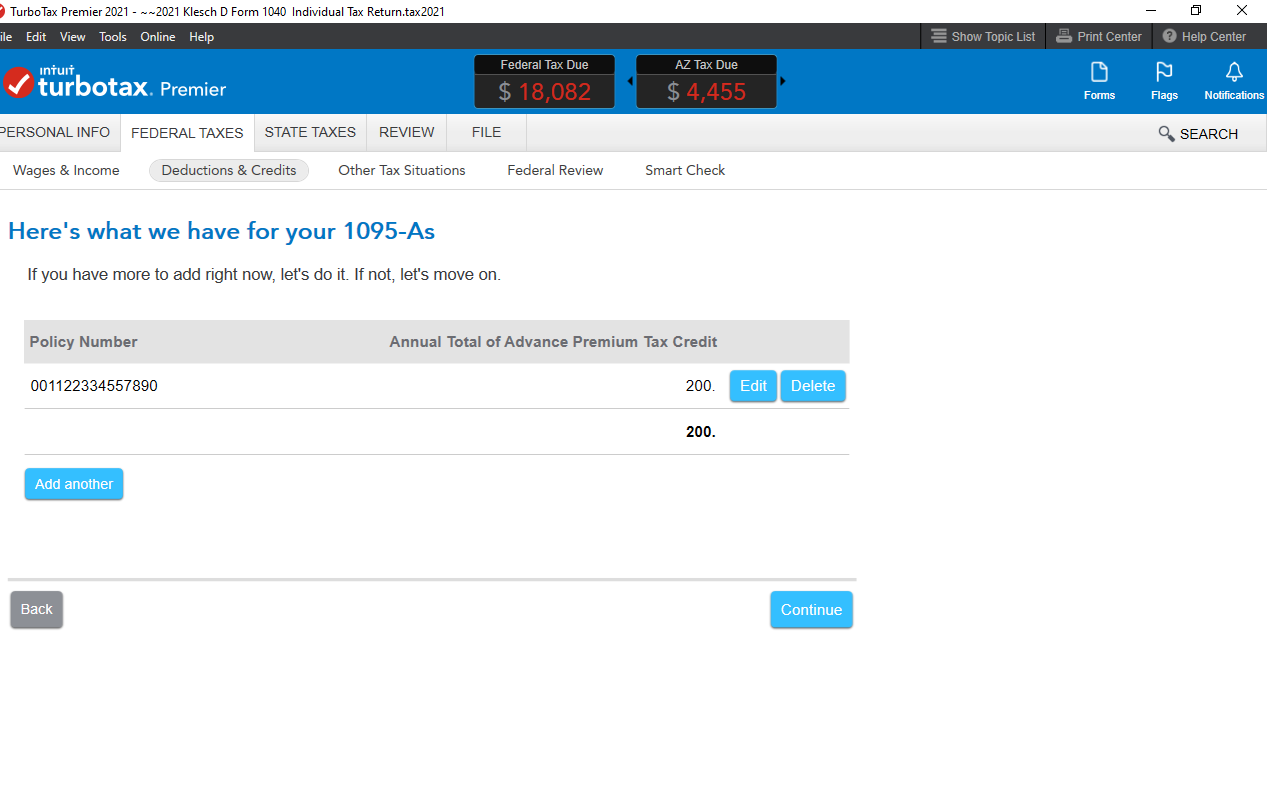

Please try these instructions below to first delete the blank 1095A/8962 forms and then select "NO" for receiving a 1095A.

- When revisiting the section the default answer is still set to "Yes," but the 8962 and 1095A are not part of the return.

- If you select "Yes" you will be prompted to enter the 1095A information and you cannot continue leaving the full form blank as an error will be presented.

- Now you will not be prompted with the "Yes/No" question to receiving the 1095A and will see your entry with options to edit/delete the entry.

- Delete the 1095A entry and both the 1095A and 8962 are removed from the return.

- If you revisit the section again default will be "Yes," but the forms are removed

- Now, select No. You should be able to e-file your return now

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We did NOT have an affordable care act plan in 2021 but turbotax keeps saying our returns were denied because I am not filing a 1095A form. How do I go around this?

Please try these instructions below to first delete the blank 1095A/8962 forms and then select "NO" for receiving a 1095A.

- When revisiting the section the default answer is still set to "Yes," but the 8962 and 1095A are not part of the return.

- If you select "Yes" you will be prompted to enter the 1095A information and you cannot continue leaving the full form blank as an error will be presented.

- Now you will not be prompted with the "Yes/No" question to receiving the 1095A and will see your entry with options to edit/delete the entry.

- Delete the 1095A entry and both the 1095A and 8962 are removed from the return.

- If you revisit the section again default will be "Yes," but the forms are removed

- Now, select No. You should be able to e-file your return now

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We did NOT have an affordable care act plan in 2021 but turbotax keeps saying our returns were denied because I am not filing a 1095A form. How do I go around this?

Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We did NOT have an affordable care act plan in 2021 but turbotax keeps saying our returns were denied because I am not filing a 1095A form. How do I go around this?

Hello,

I am following your helpful post but still having a problem. When I select yes to the question as directed in bullet 2 it populates the 1095-A form but since there is no affordable care plan for 2021 what do I put on the form to get passed continue? I have tried to click off and save at this point then return to the forms and delete them but it never gets me to bullet 3 to edit/delete the entry so it stays yes and is rejected upon efile.

Thank you for your help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We did NOT have an affordable care act plan in 2021 but turbotax keeps saying our returns were denied because I am not filing a 1095A form. How do I go around this?

Try entering $1 in each of the columns on the blank 1095-A for January so you can Continue.

Then type '1095-a' in the Search area, and click on 'Jump to 1095-a'.

Then at the 1095-A Summary page, you can DELETE your dummy 1095-A.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We did NOT have an affordable care act plan in 2021 but turbotax keeps saying our returns were denied because I am not filing a 1095A form. How do I go around this?

I'm having the exact issue still, I've followed the steps listed along with filling out a dummy 1095 to delete. After deleting the dummy 1095 form I don't know the correct way to go back and select 'No' when it asks did you receive Form 1095-A for your health insurance plan. It keeps auto selecting to yes no matter what I do to stop it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We did NOT have an affordable care act plan in 2021 but turbotax keeps saying our returns were denied because I am not filing a 1095A form. How do I go around this?

You are correct forms 1095-B and 1095-C do not need to be filed and should be kept with your tax records. Please check the interview section and also manually delete any Form 1095-A and/or Form 8962 forms in the return.

When our interview section Affordable Care Act (Form 1095-A) for the Marketplace insurance reaches the screen Did you receive Form 1095-A for your health insurance plan? it will default to "Yes". If you select "No" and Continue, it will not generate any Form 8962 information into your return. If you come back, it will default to "Yes" again, but it remained the "No" you selected until the time you came back into the area. This is as it should be.

In TurboTax Online, to be sure there is not a partially completed form in TurboTax, please check here to delete the form from your return. This will delete both the form and the entries. Please check for any Form 1095-A and also Form 8962.

- To Delete a Form go black menu bar on the left

- Click on Tax Tools

- Click on Tools

- Under Other helpful links, click on Delete a Form

- Scroll down and check for 1095-A or 8962 and if there is one, click on Delete

- Click on the blue Delete Selected Form

- At the bottom Continue

- At the bottom Continue with my Return

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We did NOT have an affordable care act plan in 2021 but turbotax keeps saying our returns were denied because I am not filing a 1095A form. How do I go around this?

I HAVE FOLLOWED ALL OF THE STEPS LISTED & I AM STILL GETTING A REJECTION FOR THE SAME ERROR! PLEASE HELP

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We did NOT have an affordable care act plan in 2021 but turbotax keeps saying our returns were denied because I am not filing a 1095A form. How do I go around this?

Please feel free to contact Customer Support so you can speak with someone who can assist you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We did NOT have an affordable care act plan in 2021 but turbotax keeps saying our returns were denied because I am not filing a 1095A form. How do I go around this?

I am also having this issue. I tried the dummy information and deleting the form. And using the tools. Both have been rejected.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We did NOT have an affordable care act plan in 2021 but turbotax keeps saying our returns were denied because I am not filing a 1095A form. How do I go around this?

We apologize for the inconvenience, please contact us at customer support so we can further assist you.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

sonia-yu

New Member

kruthika

Level 3

alphonzograham

New Member

driverxxv

New Member

bobby_chris30

New Member