- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: W-4S Sick leave - wants to make me leave feeling sick

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

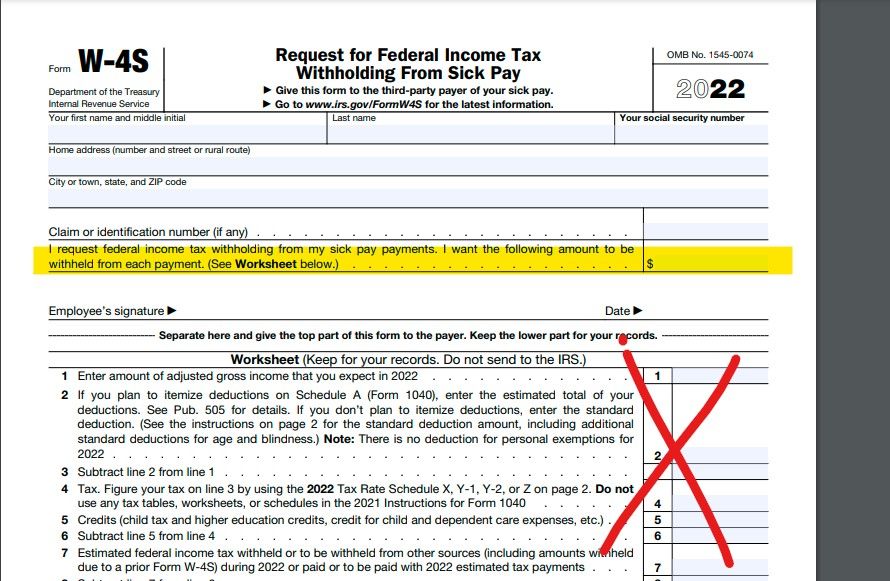

W-4S Sick leave - wants to make me leave feeling sick

Hello!

so I am super stumped on filing a W-4S for sick leave tax withholding. I have my gross income of 83,907 and I’m filing single. I have a tax of 11,227. I’m stuck on the part about the amount of sick leave payments. I expect to be out for a month, so to me, I get paid every other week meaning 2 payments for my sick leave. However, I feel like withholding close to 6k in taxes seems like it’s too much. My current tax withholding is about $400. Should I just write down my current tax withholding for the form or did I do something wrong with the math?

thank you!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

W-4S Sick leave - wants to make me leave feeling sick

If

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

W-4S Sick leave - wants to make me leave feeling sick

All you have to do is enter an amount on line highlighted in yellow for the payer and skip the worksheet if you wish (it is not required to be filled in hense the term "worksheet". If the sick pay is about the same as your usual wages then just enter the same federal withholding if you wish.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Solar Eclipse

Level 3

grgmalone

New Member

Sachaaa

Level 1

sam992116

Level 4

Katie1996

Level 2