- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: UNDETERMINED TERM TRANSACTIONS FOR NONCOVERED TAX LOTS

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

UNDETERMINED TERM TRANSACTIONS FOR NONCOVERED TAX LOTS

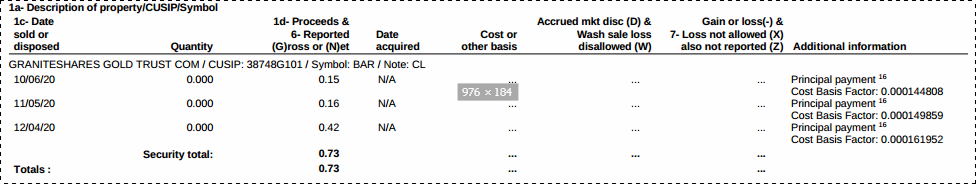

The 1099-B I received from my brokerage includes several transactions labeled as "UNDETERMINED TERM TRANSACTIONS FOR NONCOVERED TAX LOTS." They're all for a physical metal ETF. They all show quantity of 0, and the proceeds for each are less than 0.50c. If I round to whole dollars as I do for the rest of my return, this results in my listing a bunch of transactions where (d) proceeds, (e) cost or other basis, and (h) gain or loss are all $0.

Is it better to list them all like this - with all zeros - or just omit them? If I omit them, I'm concerned the IRS will flag it & ask why I didn't report the transactions. If I include them, I'm concerned the IRS will flag it & ask why I'm reporting a bunch of nonsensical transactions with both cost and sales price of $0.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

UNDETERMINED TERM TRANSACTIONS FOR NONCOVERED TAX LOTS

You have no really good option. Any one you choose could raise questions. I agree with fanfare. If they all have different sales dates and you aggregate them, there is another issue. You could choose one date, but all the others will be wrong. Omitting is the easiest option.

You can choose a purchase date, as long as if it is short term, you choose a date that will reflect that. Short term is one year or less.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

UNDETERMINED TERM TRANSACTIONS FOR NONCOVERED TAX LOTS

if you have a quantity of zero shs. and proceeds less than 0.50

I suggest your scratch those transactions from your tax return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

UNDETERMINED TERM TRANSACTIONS FOR NONCOVERED TAX LOTS

I would aggregate them and report them as a single transaction.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

UNDETERMINED TERM TRANSACTIONS FOR NONCOVERED TAX LOTS

They all have different sale dates (see below). What would I list for date sold, then...?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

UNDETERMINED TERM TRANSACTIONS FOR NONCOVERED TAX LOTS

I also have those and I can't clear the REVIEW NEEDED without a purchase date. The only option I can see is to delete them - but I have no idea what that will cause. I'm guessing a 1099-B isn't even available with the details and I also noticed that there were fees/expenses of an equal amount to the problematic entries later in the document. I'm confused.....

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

UNDETERMINED TERM TRANSACTIONS FOR NONCOVERED TAX LOTS

You have no really good option. Any one you choose could raise questions. I agree with fanfare. If they all have different sales dates and you aggregate them, there is another issue. You could choose one date, but all the others will be wrong. Omitting is the easiest option.

You can choose a purchase date, as long as if it is short term, you choose a date that will reflect that. Short term is one year or less.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

UNDETERMINED TERM TRANSACTIONS FOR NONCOVERED TAX LOTS

Thanks. I ended up listing them all as they were on the 1099, rounded to zero, since that seemed to best follow what I was doing for all the other values across my return, & also woudl match my 1099. Hopefully a human will see it & understand. What a ridiculous/unnecessary thing to even need to deal with, tho 😛

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

UNDETERMINED TERM TRANSACTIONS FOR NONCOVERED TAX LOTS

Thanks - I spoke to someone at TurboTax. Yep - I just added the numbers as they are listed in the 1099-b form also. Marked the purchase date as blank and the capital gains as not available. It still says "Needs Review" on my TurboTax page - but I was told you can just ignore it. How did you choose between long and short-term gains?? I looked at the brokerage site for my TDAmeritrade account and there were multiple purchases and sales over several years (I wonder why this wasn't an issue last year...). I sort of assumed that selecting short-term gains would pay the most tax so would be the least likely to be an issue. But still wasn't sure. All this time and effort for a $1.80 entry in my taxes.......makes me want to get rid that that particular investment.....

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

UNDETERMINED TERM TRANSACTIONS FOR NONCOVERED TAX LOTS

I did short term, but I didn't start acquiring this ETF until the last year. I think you'll definitely be fine picking short term, because as you say, that will result in the higher taxes, which they're always happy to take.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

UNDETERMINED TERM TRANSACTIONS FOR NONCOVERED TAX LOTS

Hi,

Thanks for sharing your experience!

I'm also trying to do the same, for undetermined term transactions.

Can you share, how you answered the following questions?

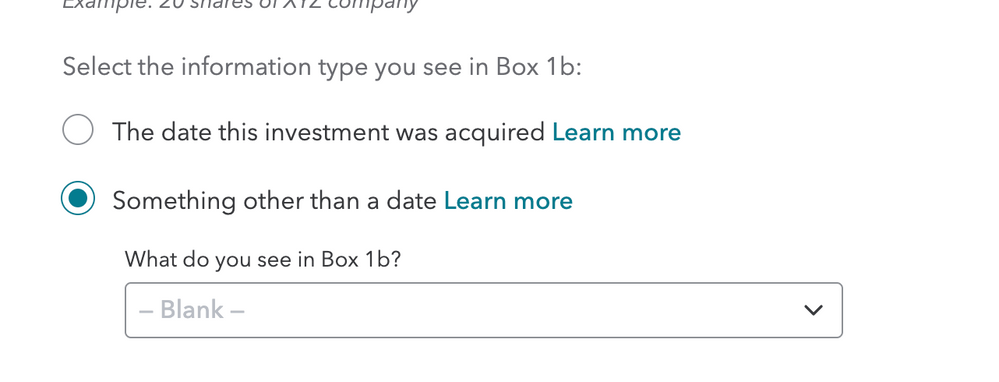

- For the question about box 1b, did you choose something other than date and chose "Blank"?

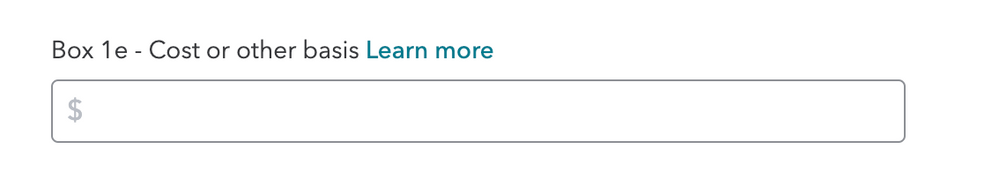

- For the question about box 1e, did you it leave blank?

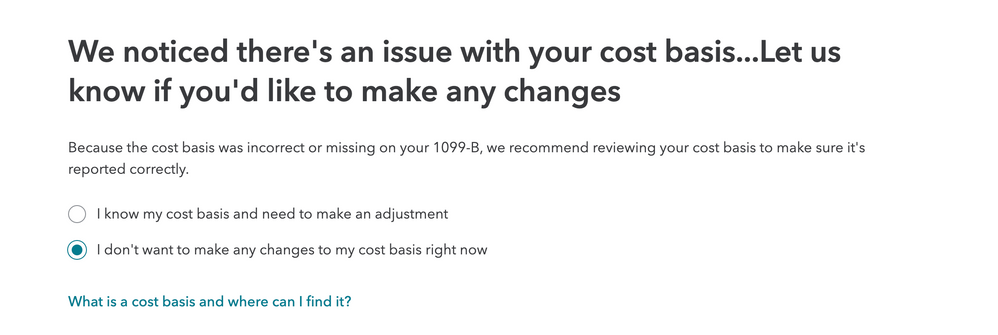

- In the later screen, if you leave cost basis blank, it was asking to confirm whether I should update my cost basis?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

UNDETERMINED TERM TRANSACTIONS FOR NONCOVERED TAX LOTS

My 1099-B is showing sales with gains and losses under this subject. How can I report these as the Tax Program does not have the option of showing Undetermined.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

UNDETERMINED TERM TRANSACTIONS FOR NONCOVERED TAX LOTS

You should try to determine when the securities were acquired and assign a code that reflects their status as short term or long term. Code B would be for short-term with basis not reported to the IRS and Code E will be for long-term with cost not being reported to the IRS. If you are unsure, you can use Code X. @chuckbloodgood

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

b_benson1

New Member

icefyre123

Returning Member

fuelnow

Level 2

DIY_HarryWhodini

Level 2

Semper0

Returning Member