- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: TurboTax saying a W-2c is on the way?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax saying a W-2c is on the way?

I did not have any tax taken out of my 2020 Social Security payments & I still get Turbo Tax Premier saying "based on your tax return info, you'll get a W-2c because you deferred payment of some of your Social Security taxes last year." I paid tax via quarterly estimated tax. Must be a Turbo Tax programming error. Is Turbo Tax aware of this error? I hope they fix it ASAP!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax saying a W-2c is on the way?

Neither have I deferred Social Security tax. I can't understand why I would not receive a W2c

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax saying a W-2c is on the way?

If you got the message "Heads up! You have a W-2C coming" .

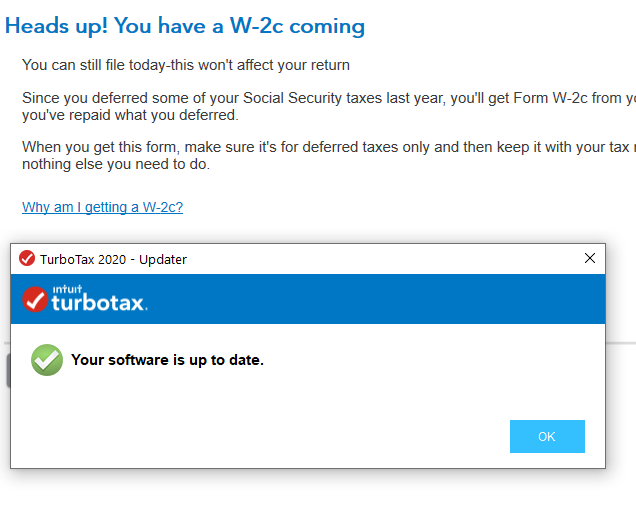

This was an issue back in February. This was fixed in the newest release on 2/19/2020. Please be sure you have all current updates. Be sure you have the most recent updates.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax saying a W-2c is on the way?

I'm being told I have deferred social security tax. But to my knowledge, I havn't.

Thanks

Bob Willenborg

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax saying a W-2c is on the way?

This was a known problem that had been resolved. Please be sure you have all current updates.

If you got the message "Heads up! You have a W-2C coming" . This was fixed in the newest release on 2/19/2020.

Only the customers who now legitimately will receive a W-2C are supposed to get the pop up.

A W-2c form is used by the United States Internal Revenue Service for tax filing and reporting services. This form is known as a Corrected Wage and Tax Statement form.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax saying a W-2c is on the way?

Im a school teacher and received the same message from the IRS/turbo tax. I made very little last year and claimed the SS amount on my W2. I have no idea what they are talking about. The school district has not heard about any of this either (no W2c has been processed.)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax saying a W-2c is on the way?

I have filed my taxes and then I received the same message. If you don't receive the W2c call your employer to see if they have heard about this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax saying a W-2c is on the way?

Do not do anything unless you actually do get a W2C.

If you got the message "Heads up! You have a W-2C coming" . These messages may be in error. Please be sure you have all current TurboTax updates.

A W-2c form is used by the United States Internal Revenue Service for tax filing and reporting services. This form is known as a Corrected Wage and Tax Statement form.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax saying a W-2c is on the way?

if you were a federal employee, the feds screwed up your SS withholding due to the "relief" they gave us... https://www.fedagent.com/news-articles/payroll-tax-deferral-program-leaves-federal-employees-seeking...

so my SS withholding is all messed up and below the 6.2%

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax saying a W-2c is on the way?

Yes, but you did receive that grace period that is outlined in the link you submitted.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax saying a W-2c is on the way?

My version is up to date but I still get the bug:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax saying a W-2c is on the way?

Some of these error messages have been randomly appearing. According to this Turbo Tax article written by DMarkM1, "You may delete and re-enter your W2(s) to see if the message clears. If the message persists, you may ignore it. It has no impact on your tax returns."

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax saying a W-2c is on the way?

Did you receive one? I got the same message and I have been retired 20 years!!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax saying a W-2c is on the way?

Since there are no wage earnings for 2020, please disregard the message. It will have no impact on your return or ability to e-file.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax saying a W-2c is on the way?

same thing is happening for 2021 taxes....whats up? What and try again?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

hollesenh

New Member

mormor

Returning Member

user26879

Level 1

CalcGuarantee

New Member

sarahpihl2013

New Member