- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: TurboTax Not Applying Federal Tax Overpayment to 2023 Estimated Taxes

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Not Applying Federal Tax Overpayment to 2023 Estimated Taxes

I've specified that a portion of my 2022 federal refund is to be applied to my 2023 estimated tax payments (Line 36 of Form 1040). However, TurboTax is not deducting the amount that I've entered from the first 1040-ES estimated payment voucher, nor is it deducting it from the estimated payments schedule set forth on page 2 of the Filing Instructions form. (Note that the reduction IS reflected in Federal Refund calculator box at the top of the TurboTax program header.) I'm using TurboTax Deluxe, the desktop/download version.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Not Applying Federal Tax Overpayment to 2023 Estimated Taxes

You were correct in setting up estimated payments if your expected tax liability for 2023 will be over $1,000 after credits and deductions are applied.

No penalties apply if:

- You experienced a proven hardship in 2022.

- You retired in 2022.

- You anticipate all or a portion of your 2023 income tax liability will be less than $1,000.

- You had zero tax liability in 2022.

The General Rule is that at least 90% of an individual's final income tax liability should be paid through either withholding or estimated tax payments.

The quarterly estimated payments are based on your entries in that section of TurboTax. Whenever you need or wish to update your quarterly estimated payments for 2023 because your situation has changed, you can revisit the Form W-4 and Estimated Taxes section of TurboTax under Other Tax Situations. To hold your payments to a minimum, base each installment on what you have to pay to avoid the penalty, using any exceptions that benefit you.

None of the estimated tax amounts get sent to the IRS until you include the form with your payment.

See this article for more information and suggestions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Not Applying Federal Tax Overpayment to 2023 Estimated Taxes

This isn't responsive to my issue. It appears to be a programming error.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Not Applying Federal Tax Overpayment to 2023 Estimated Taxes

Are you using the Online browser version or the Desktop CD/Download program? Maybe it first reduced the total estimates to pay before dividing into the 4 payments. You can cross out the amount on the first 1040ES and subtract the refund applied. Or just pay whatever amount you want directly online to the IRS.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Not Applying Federal Tax Overpayment to 2023 Estimated Taxes

Ok ... let us start at the beginning ...

1) you saw a refund on the meter

2) you requested part of the refund to be applied to the 2023 tax year

3) you did not see a reduction of the refund in the Refund-O-Meter ... and that is correct ... it will not show up that way.

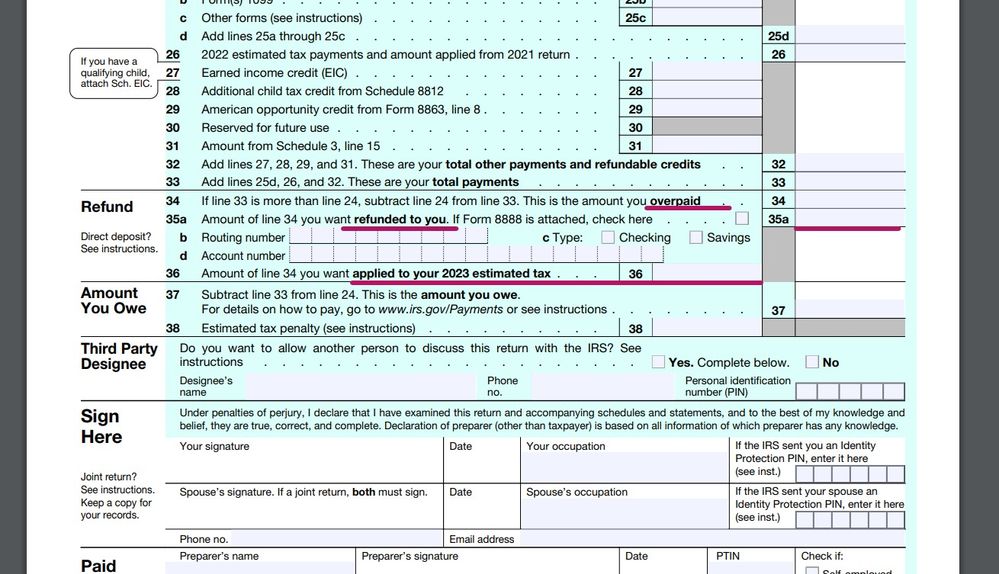

SO ... what you need to do is look at the actual form 1040 ... line 34 - line 36 = line 35a

You can peek at only the Federal form 1040 and the summary of the state info by going here:

1) lower- Left side of the screen...click to the left side of the "Tax Tools" text selection.

2) then select "Tools"

3) then select "View Tax Summary" from the pop-up

4) then back to the left-side and "Preview 1040"

Then hit the "Back" on the left side to get back to your tax entries.

To view your entire return using the online editions (including the state) before you file, you will need to pay for your online account.

To pay the TurboTax online account fees by credit card, without completing the 2019 return at this time, click on Tax Tools >>> Tools and then Print Center. Then click on Print, save or preview this year's return. On the next page, to pay by credit card, click Continue. On the next screen it will ask if you want Audit Defense, if you do not want this option just click on the Continue button. The next screen will ask for all your credit card information so you can pay for the account.

Now to the issue of the estimated payments ... revisit that section of the interview so that the program can recompute the estimates. You may need to close the program and clear your cookies first before revisiting that section again.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Not Applying Federal Tax Overpayment to 2023 Estimated Taxes

I've got the same problem with the 1040-ES not taking into account the 2022 overpayment that was applied. I followed the suggested steps of checking lines 34-36. Closed the program, restarted, did the interview, etc. Same problem. I'm using the CD desktop version of Turbotax Home & Business.

Besides fixing the program bug, I'm open to suggestions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Not Applying Federal Tax Overpayment to 2023 Estimated Taxes

Since you are using TurboTax for Desktop, you can review the calculations for Forms 1040-ES.

- Open your return and click the Forms icon in the TurboTax header.

- Look for Est Tax Options in the left column. Click the form name to open it in the large window.

- In the box "Amount of Estimated Taxes to Pay in 2023," the fifth line should display "Last year's overpayment you applied to this year."

- If you need to change any of the assumptions for this worksheet, open "ES & W4 Wks," where you can edit any numbers in a blue font. This is a TurboTax worksheet, not an IRS form, so anything you change here won't affect your tax return (other than the amount you apply from this year's refund).

Note that you can always manually change the amounts printed on Form 1040-ES and/or pay a different amount by the due date. You don't need a 1040-ES if you pay on the IRS website.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Not Applying Federal Tax Overpayment to 2023 Estimated Taxes

Perfect!! Thank you very much for the assistance.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Not Applying Federal Tax Overpayment to 2023 Estimated Taxes

Please let us know if you need further assistance.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Not Applying Federal Tax Overpayment to 2023 Estimated Taxes

I have the same problem. Not applying the refund to 2023.

And besides I want to enter my own estimated amounts per qtr and it will not let me.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Not Applying Federal Tax Overpayment to 2023 Estimated Taxes

The change is done in a Turbotax worksheet, not on a 1040 form.

Open your return, click "View" and select "Forms"

Scroll down on the left side and select "ES and W4 Wks". It's about 8 lines above the state tax section. There's a box "Choose the Method You Will Use to pay your 2023 Federal Income Taxes". Select the second box. The next line is Overpayment from my 2022 payment. Enter the value. And then I think you just enter it again on the amount to apply. This carries over to the Form "Est Tax Options".

I'm not sure how to create my own estimates for the quarters using Turbotax. I'm planning on printing the forms and then using a pen to write in the amount when I mail in the voucher.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax Not Applying Federal Tax Overpayment to 2023 Estimated Taxes

I just printed out the slips for my friend. I printed them with everything except an amount. There is a checkbox on that worksheet to print without amounts. Oh that was for the California estimates. If you paid federal estimates last year, it's nice the IRS mails you preprinted estimates that fit in the window envelopes so all you have to do is write in the amount. I just got the IRS package 2 days ago.

But you can play around with the estimates worksheet and tweak them or even type in your own amounts on them.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

davegoldfarb

New Member

tf35sc

Level 1

stephendpa

Returning Member

planetm69

Level 2

4826tagliacozzo

New Member