- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: TurboTax 2022 form 8962 Premium Tax Credit

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2022 form 8962 Premium Tax Credit

@zacknaith your reply is inaccurate and misleading. form 8962 is correct for anyone with income less than 400% of the federal poverty level for their number of dependents.

i lower my income by $15k to be at 390% and everything was done correctly. TT needs to know that only over 400% doesn't calculate correctly.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2022 form 8962 Premium Tax Credit

I received the following response from TurboTax Support on Twitter:

”Thanks so much for providing that account information. There does seem to be some confusion happening with what the limits are for the 2022 filing year. To clarify, the post you shared from the forum contains incorrect information.

Due to IRS guidelines, the 2021 amounts for the poverty line are used because that is what was available when the enrollment period was open Please refer to this link for more details on this matter: http://intuit.me/3ZKaEOn

Your income has to be within a certain range to qualify for the Premium Tax Credit. That income range is between 100% - 400% of the federal poverty level. As of 2021, the federal poverty level for most of the United States was $12,880 for a single person. The 2021 amounts are the latest available during open enrollment for 2022 and are therefore used with your 2022 tax return.

If your household income is 400 percent or more of the federal poverty line for your family size, you will have to repay all of your excess advance credit payments for that tax year. See this page directly from the IRS for additional information: https://bit.ly/3Hax9Fa

Please let me know if you have any further questions or concerns,

-Benjamin”

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2022 form 8962 Premium Tax Credit

Crazy how they send you an IRS link that directly contradicts the TT expert’s answer.

2021 and 2022 Premium Tax Credit Eligibility. For tax years 2021 and 2022, the American Rescue Plan of 2021 (ARPA) temporarily expanded eligibility for the premium tax credit by eliminating the rule that a taxpayer is not allowed a premium tax credit if his or her households income is above 400% of the Federal Poverty Line.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2022 form 8962 Premium Tax Credit

We are beyond "Crazy" we are entering INSANITY

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2022 form 8962 Premium Tax Credit

@Tommy EV wow! I guess they don’t know what the operative words “other than” means. Seems TT customer service is ignoring that part. Hopefully people who can correct the error are better than customer service at understanding the IRS instructions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2022 form 8962 Premium Tax Credit

On twitter, facebook and even TT support when you call, you are most likely reaching NON tax professionals so they google search the answers to the questions they think you asked and are not aware of the technical issues that the program currently has. I know that information in the intuit system often only trickels down from customer support to the tech departments and doesn't often well up so customer support is often in the dark and are grasping at straws to come up with an answer in the time they are alloted. In the early days of the program there are always glitches and bugs to be worked out and they will eventually fix them all it is just a matter of time.

FYI ... if anyone actually files a return with this incorrect form TT will send out an email alert to those folks alerting them to the situation and instructing them on how to make the correction thru the amendment process. They usually have a specific help number to call so you can speak with someone familiar with the process and the situation. Intuit is proactive in this way when they find/fix an error that may have affected any of their customers.

This is why they verify your email address when you file and why you should pay attention to any emails TT sends you even if you will dismiss them as junk marketing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2022 form 8962 Premium Tax Credit

The IRS instructions ... complete quoted section where that answer was taken ... so they misquoted :

2021 and 2022 Premium Tax Credit Eligibility. For tax years 2021 and 2022, the American Rescue Plan of 2021 (ARPA) temporarily expanded eligibility for the premium tax credit by eliminating the rule that a taxpayer is not allowed a premium tax credit if his or her households income is above 400% of the Federal Poverty Line.

To be eligible for the premium tax credit, your household income must be at least 100 percent and, for years other than 2021 and 2022, no more than 400 percent of the federal poverty line for your family size, although there are two exceptions for individuals with household income below 100 percent of the applicable federal poverty line. Remember that simply meeting the income requirements does not mean you're eligible for the premium tax credit. You must also meet the other eligibility criteria.

For information about the two exceptions for individuals with household income below 100 percent of the federal poverty line, see the instructions to Form 8962.

Here are some things to remember about how your household income affects your premium tax credit:

- The amount of the premium tax credit is based on a sliding scale, with generally greater credit amounts available to those with lower household incomes.

- If the advance credit payments made on your behalf are more than the allowed premium tax credit, you will have to repay some or all the excess for any tax year other than 2020. If your household income is 400 percent or more of the federal poverty line for your family size, you will have to repay all of your excess advance credit payments for that tax year.

- If your projected household income is close to the 400 percent upper limit, be sure to carefully consider the amount of advance credit payments you choose to have paid on your behalf.

- For tax years other than 2021 and 2022, if your household income on your tax return is more than 400 percent of the federal poverty line for your family size, you are not allowed a premium tax credit and will have to repay all of the advance credit payments made on behalf of you and your tax family members.

See the instructions to Form 8962, Premium Tax Credit (PTC), for information about the federal poverty guidelines for purposes of claiming the premium tax credit.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2022 form 8962 Premium Tax Credit

Hey Critter, You still have confidence TT will fix this after reading what they sent me on Twitter?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2022 form 8962 Premium Tax Credit

Bottom Line:

- Turbo Tax calculates the subsidy wrong when MAGI is above 400% of poverty level.

- Some at TT acknowledge there MAY be an issue, other front line people say it is working correctly. I was told TT is investigating the issue, but did not say it was an error. The Investigation number is INV-21840.

- Other Tax software (I have checked Tax Act and H&R) works correctly.

- You can move to a different vendor or wait for TT to fix it.

- For me, I am moving on. Hope it is fixed sooner than later.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2022 form 8962 Premium Tax Credit

I will give TT until the first week of February to fix this issue. If not resolved I will move to HR Block

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2022 form 8962 Premium Tax Credit

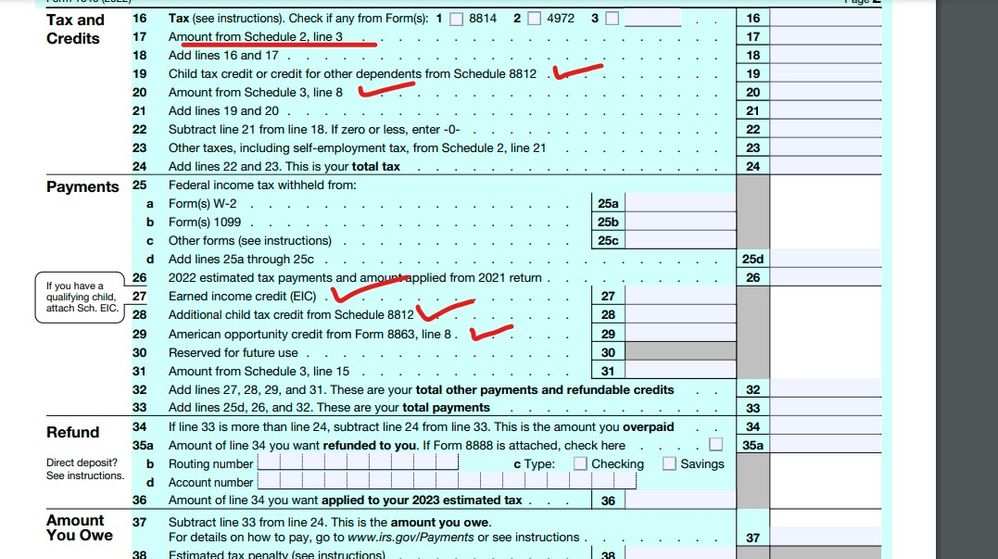

YES ... again you were talking to customer service and NOT the program writing/fixing department (who doens't have time to answer questions on any forum). The moderators of this forum have been alerted and they have responded back that they are aware of the issue and are working on it. As already stated, this is not just one simple data entry box to fix. All the forms interact with each other so many forms have to be adjusted... the form 1040 is like a long river and what you do up stream can affect the flow down stream. For instance, when you do NOT have to repay the credit on line 2 of Sch 2 which then goes to the 1040 line 17 that amount now affects all the rest of the lines on the 1040 after that line. That line change can now affect at least 5 more lines on the form 1040 and all the underlying forms/schedules they entail (even if you don't use those lines they must be addressed). Fixing the program code for this ONE "simple" item needs to be adjusted all accross the board for everything "downstream" from it. Do you now see why this could be taking so long to correct? Can you all please be patient and be content that they will probably fix this before the IRS starts processing returns next monday ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2022 form 8962 Premium Tax Credit

@Critter-3 After seeing all the replies from Customer Service, do you still have confidence that this will be fixed? If they aren’t relaying the problem, how do we know the ‘powers that be’ are looking into it?

Also, this thread is labeled as “Solved”, which is troubling. Usually TT/Intuit ‘experts’ monitor community posts, especially one like this with so much activity. I haven’t seen any ‘experts’ on this thread. No one from Intuit has jumped in to reassure us that they are looking into the problem.

What is your relationship with Intuit/Turbo Tax? Why do you feel confident about the fix for this? More importantly, how is the word “Solved” removed from the title of this thread?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2022 form 8962 Premium Tax Credit

Do you realize the tax code did not change from last year? The issue with premium tax credit over 400% of poverty level was in place for 2021 return. This is not new.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2022 form 8962 Premium Tax Credit

I worked for them so I know their systems. And you cannot remove the "solved" from anything ... it doesn't mean the program error has been resolved simply that the questions posed were answered and don't need to be rehashed until the cows come home.

So everyone has the option to wait for the fix or use a different program. This is a free country and you have free will to do what you want.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax 2022 form 8962 Premium Tax Credit

To add to @mindiw latest, if TT knew this was an issue and they're working on it, then why is the form still marked as done and one is able to file with it? Seems to me if they knew the form had an error and they're working on it the first thing they would do would be to mark it as not done and make sure folks didn't file with the error.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Edge913

New Member

RickyFl

Level 1

Taxes_Are_Fun

New Member

sailwag

Level 1

brennad0130

New Member