- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Turbo Tax deductions and credits review screen "state and local taxes greater than $10,000" has a negative number (-8,274)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

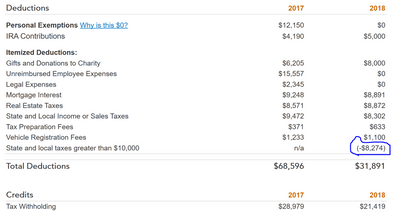

Turbo Tax deductions and credits review screen "state and local taxes greater than $10,000" has a negative number (-8,274)

And I have no idea where this comes from - it shows n/a as last years number so I assume it has something to do with the new tax reform.

Help....

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax deductions and credits review screen "state and local taxes greater than $10,000" has a negative number (-8,274)

do not worry about it; it is correct. Here is what is occuring.

for the new tax law in 2018, there is now a limit of $10,000 for state and local taxes ('SALT')

you have $8872 in real estate taxes and $8302 in state taxes, plus vehicle registration fees of $1100, which totals $18, 274 in SALT deductions.

All Turbo Tax is doing is reducing that to $10,000 by subtracting $8274.

make sense?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax deductions and credits review screen "state and local taxes greater than $10,000" has a negative number (-8,274)

do not worry about it; it is correct. Here is what is occuring.

for the new tax law in 2018, there is now a limit of $10,000 for state and local taxes ('SALT')

you have $8872 in real estate taxes and $8302 in state taxes, plus vehicle registration fees of $1100, which totals $18, 274 in SALT deductions.

All Turbo Tax is doing is reducing that to $10,000 by subtracting $8274.

make sense?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax deductions and credits review screen "state and local taxes greater than $10,000" has a negative number (-8,274)

That makes sense,

Living in California now that SALT has a limit my federal taxes are ~3,500K more than they were last year.

Thanks for the help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax deductions and credits review screen "state and local taxes greater than $10,000" has a negative number (-8,274)

I'm in a similar situation as OP. With the 2018 new tax law, my itemized deductions are drastically reduced. I will pay a lot more Federal tax from here on.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax deductions and credits review screen "state and local taxes greater than $10,000" has a negative number (-8,274)

Hello. This is confusing as the description say that it does not impact your deductions however it does dramatically which not only increases the federal cost but also increase the AGI so the State return is higher. If I have $50K in deductions and the a -$25K in state and local taxes greater than $10K, my totals deductions are reduced to $25K vs what they were n 2017 which included everything. Can this be correct and the same regardless of where you live?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax deductions and credits review screen "state and local taxes greater than $10,000" has a negative number (-8,274)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax deductions and credits review screen "state and local taxes greater than $10,000" has a negative number (-8,274)

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

georgiesboy

New Member

MaxRLC

Level 3

MaxRLC

Level 3

cordovasoftball

New Member

rjandbj

New Member