- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: This year turbo tax didn’t ask about my healthcare insurance any idea why?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

This year turbo tax didn’t ask about my healthcare insurance any idea why?

That work's! But I already sent 1095-A and 8962 forms to IRS as they requested. Due I still need to correct with TurboTax online?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

This year turbo tax didn’t ask about my healthcare insurance any idea why?

Didn't ask me neither and I have Market Place. If it's a requirement to file it T. T should have made sure that question stood out. It always did in the past. No it's not a requirement to show proof unless it's Market Place and it should have it's place for making sure if you did have it you filed it. Want use them again. When I called the IRS they say it will be another 4to6 weeks. I will not use T. T again.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

This year turbo tax didn’t ask about my healthcare insurance any idea why?

Messed me up also. T. T got my last W2. I will not use them again.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

This year turbo tax didn’t ask about my healthcare insurance any idea why?

I called them and they gave me a fax number to send it in.Now I have to get a form and fill it out and fax it. Maybe another 4to6 weeks before I get my refund. They messed me up. Never use them again.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

This year turbo tax didn’t ask about my healthcare insurance any idea why?

Won't use them again neither

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

This year turbo tax didn’t ask about my healthcare insurance any idea why?

Did you fill out the form and fax to them. I never got a letter so I called and it's B.S

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

This year turbo tax didn’t ask about my healthcare insurance any idea why?

Yeah same same! They didn't prompt me to enter health insurance as they have every year...so here I am, googling what to do about it. Ugh! This is so frustrating!

I hope it doesn't cost additional to get this form entered...or slow things down drastically. So upset that I could have enteted it to begin with and would have no issue. Big FAIL on your part turbo tax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

This year turbo tax didn’t ask about my healthcare insurance any idea why?

So you have a1095-A form that was not entered on TurboTax and submitted to the IRS ? You may also be getting a letter from the IRS.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

This year turbo tax didn’t ask about my healthcare insurance any idea why?

I also got majorly screwed over this year by this issue. I feel like it is a 2020 program flaw. I literally had the insurance document ready with my other tax documents and since their crappy program didn't ask any questions this year about my insurance, I thought I maybe didn't need it. I am not a tax pro and cannot afford to have them prepared professionally, so I relied on TurboCrapz to walk me through correctly. I emailed them about this and was given no help, so I have complained to the BBB. TT refuses to admit that there was any wrongdoing on their behalf! I needed that refund check and now I have to wait an additional 8 WEEKS! I don't know how I will scrape by until then. Don't bother calling because TT will skim over the issue and will put the blame on you as the consumer. Literally the most unempathetic customer service that I have ever encountered.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

This year turbo tax didn’t ask about my healthcare insurance any idea why?

It seems like TT is pretending like we should have known to seek out the "Did you receive a 1095-A" link rather than admitting they made a mistake by omitting it from the process. 75% of the questions I'm asked while using their service to do my taxes are things that don't pertain to me... yet they ask about EVERYTHING! They screwed up on this. They totally dropped the ball. But they aren't even taking responsibility for their mistake. It seems to me that a report to the Better Business Bureau might be a good next step.

For those who are going to fill out the 8962 by hand, look back at last years'. That's what I did and seeing how TT did it last year helped me a lot in doing it manually this year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

This year turbo tax didn’t ask about my healthcare insurance any idea why?

I’m waiting for my letter to arrive as well. Nothing like having to wait two months for something TurboTax should have asked in the first place. What a joke. A glaring oversight and failure on their part. Feels like we should be entitled to a refund.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

This year turbo tax didn’t ask about my healthcare insurance any idea why?

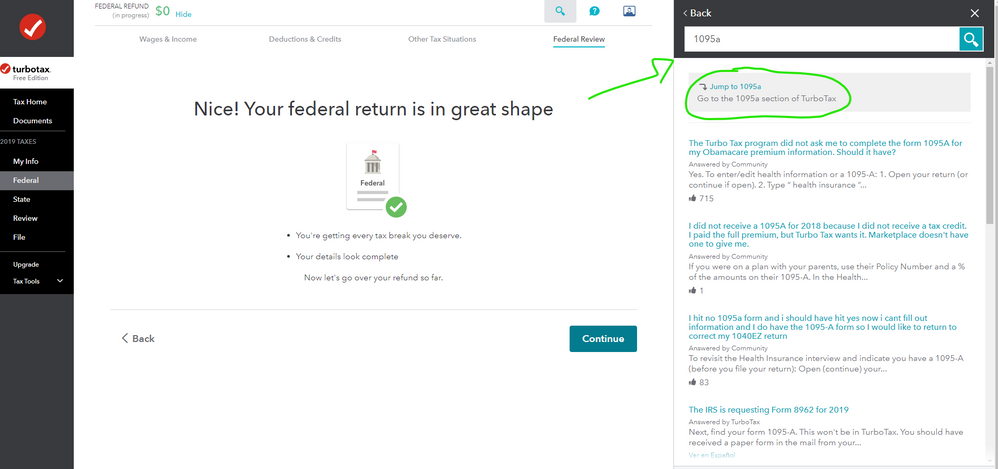

NO ONE needs to complete the 8962 by hand ... use the program ... log in and scroll down and click on ADD A STATE to open the account ...

For 2019 it is now listed under Deductions instead of a separate tab.

To enter your Form 1095-A -

Federal Taxes (Personal using Home and Business)

Deductions and Credits

Scroll down to Medical

On Affordable Care Act (Form 1095-A), click the start or update button

Where to enter 1095A

https://ttlc.intuit.com/community/credits-and-deductions/help/where-do-i-enter-my-1095-a/00/26456

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

This year turbo tax didn’t ask about my healthcare insurance any idea why?

And although I agree that the abrupt removal of the Health Insurance tab was not a wise choice by TT the individual taxpayer must ultimately take responsibility for failing to enter the form they received in the program or even ask where to put it ... I have answer that question many times in this forum to the folks who took a moment to ask.

Also for future reference ... there has always been a search box function in the program which would have taken you directly to that place ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

This year turbo tax didn’t ask about my healthcare insurance any idea why?

So when you PAY for guaranteed correct tax returns they hold no liability???? That's the most ridiculous thing I have ever heard. Dozens of actually FREE programs prompt the form, so why couldn't TT when they're being paid to file correct returns???? When you're paying for a service you shouldn't have to go to forums to get them done correctly

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

This year turbo tax didn’t ask about my healthcare insurance any idea why?

Knowing these kinds of things is why I pay a professional company $80.00. And, for the record, when I came to the website to fix the problem I received a message stating that I'd have to come back later in February in order to have TT do it. So I opted to do it myself -- and to share a tip here that made it a little easier.

What TT did was more than simply unwise. You can try and justify it all day long, but there is no justification. They've screwed up a lot of people who paid good money for their expertise and they messed up. Yet, they won't admit it, let alone apologize for it.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

kac42

Level 2

KellyD6

New Member

cmatchett18

New Member

zwillhidejames

New Member

andy9963

New Member