- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: The educator expenses is not working. How do you do this?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The educator expenses is not working. How do you do this?

It seems odd to me that the use of a 529 college savings plan for my children's college expenses would impact the deductible for the classroom expenses (up to $300) educator deduction? These aren't "education" (meaning tuition, housing, books etc.) deductions. Also, in the past TurboTax has recognized this separately and allowed the deduction for classroom expenses when using a 529 savings plan separately for children's education expenses. Can you clarify? I'm worried that past years were then incorrect?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The educator expenses is not working. How do you do this?

Agree TMAC67

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The educator expenses is not working. How do you do this?

Per the IRS:

Qualified expenses are deductible only to the extent the amount of such expenses exceed the following amounts for the tax year:

- The interest on series EE and I U.S. savings bonds that you exclude from income because you paid qualified higher education expenses,

- Any distribution from a qualified state tuition program that you exclude from income,

- Any tax-free withdrawals from your Coverdell education savings accounts,

- Any reimbursements you receive for expenses that aren't reported to you in box 1 of your Form W-2.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The educator expenses is not working. How do you do this?

I think there is a confusion (perhaps on my part??) on the use of the coverdell/529 plan to cover college expenses (I did not exceed the amount that my kids college was costing-qualified expenses) and the educator expenses deductible that is allowed for up to $300 for classroom expenses (books, supplies, etc.).

They very much seem unrelated to each other.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The educator expenses is not working. How do you do this?

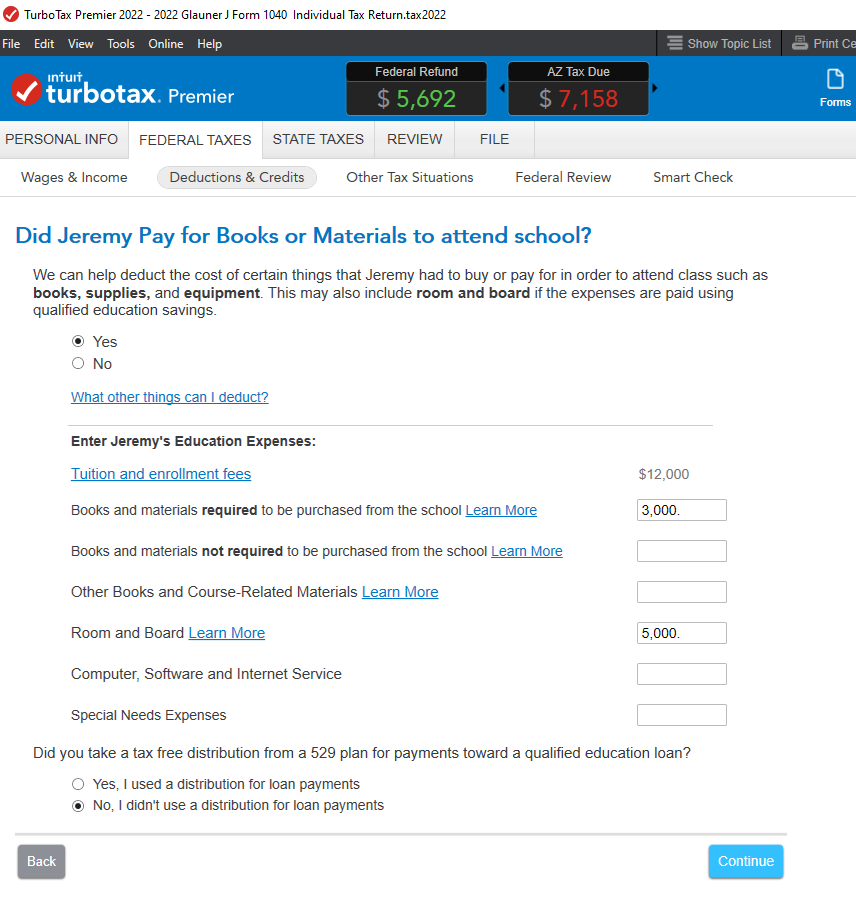

Yes, the Educator Expense Deduction is for teachers to be able to claim expenses for classroom supplies, so you are correct that it is in no way related to claiming Education Expenses for a college student.

If you received a 1099-Q for a distribution that was entirely used by Qualified Education Expenses, you can enter it by typing '1099-Q' in the Search area, then 'Jump to 1099-Q'.

Then in the Education Expenses section, you will have an entry area for Room & Board and Other Expenses, in addition to Tuition reported on Form 1098-T.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The educator expenses is not working. How do you do this?

If my spouse who is a teacher is a recipient of a 529 withdrawal since she is the “owner” of the account, then it won’t let her take this educator credit. I believe this is a bug in your system. The 529 was set up for our daughter (recipient) and the withdrawal was to cover her college expenses. It was not to cover any expenses my wife incurred. It will let me put in the credit and I am not even an educator.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The educator expenses is not working. How do you do this?

I agree with what you posted and entered in all of the expenses for my daughter which were far higher than what we took out of the 529. Unfortunately, TT has a form that places the 529 withdrawal under my wife, so she cannot claim the credit. Hence why I believe there is a bug that will cost me $300. A tax preparer would have cost me less.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The educator expenses is not working. How do you do this?

I seem to be having the same issue. Was this ever resolved?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The educator expenses is not working. How do you do this?

Please follow these steps to include your Educator Expenses on your tax return in TurboTax Online:

- Open your return

- Choose Deductions and Credits from the left panel

- Scroll down to Employment Expenses and click the arrow to expand

- Choose Teacher (Educator) Expenses

- Enter the amount of your out of pocket expenses for your classroom and click Continue

For more information, please see this TurboTax Help Article: What is the Educator Expense Deduction?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The educator expenses is not working. How do you do this?

TY for the reply RachelW33. I did all of that but it says that I am not eligible based on a previous answer. I am definitely eligible but based on a post from someone else, it appears that the system is disqualifying me since I am the owner of a 529 on my daughters behalf. This appears to be a bug in the system as 529 plans and claiming the educator credit are not related. What can I do?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The educator expenses is not working. How do you do this?

One of the stipulations for the Educator Expense Deduction is that your expenses exceed "any distribution from a qualified state tuition program that you exclude from income" (i.e. 529) on your tax return.

Please see the bulleted list at the bottom of IRS Topic 458, Educator Expense Deduction.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The educator expenses is not working. How do you do this?

TY @RachelW33 I appreciate the info

Is this the case even though the distribution was for my daughters college expenses?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The educator expenses is not working. How do you do this?

Yes. Because the 1099-Q was in your name/SSN, it disqualifies you for the Educator Expense Deduction.

I agree that it doesn't seem like a distribution from a 529 plan used for your daughter's education should have anything to do with your Educator Expense Deduction, but unfortunately that is not the case.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

kate

New Member

shimi

New Member

Rshirleyjr

New Member

sk8rzmom

New Member

horsechick48

New Member