- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Yes, the Educator Expense Deduction is for teachers to be able to claim expenses for classroom supplies, so you are correct that it is in no way related to claiming Education Expenses for a college student.

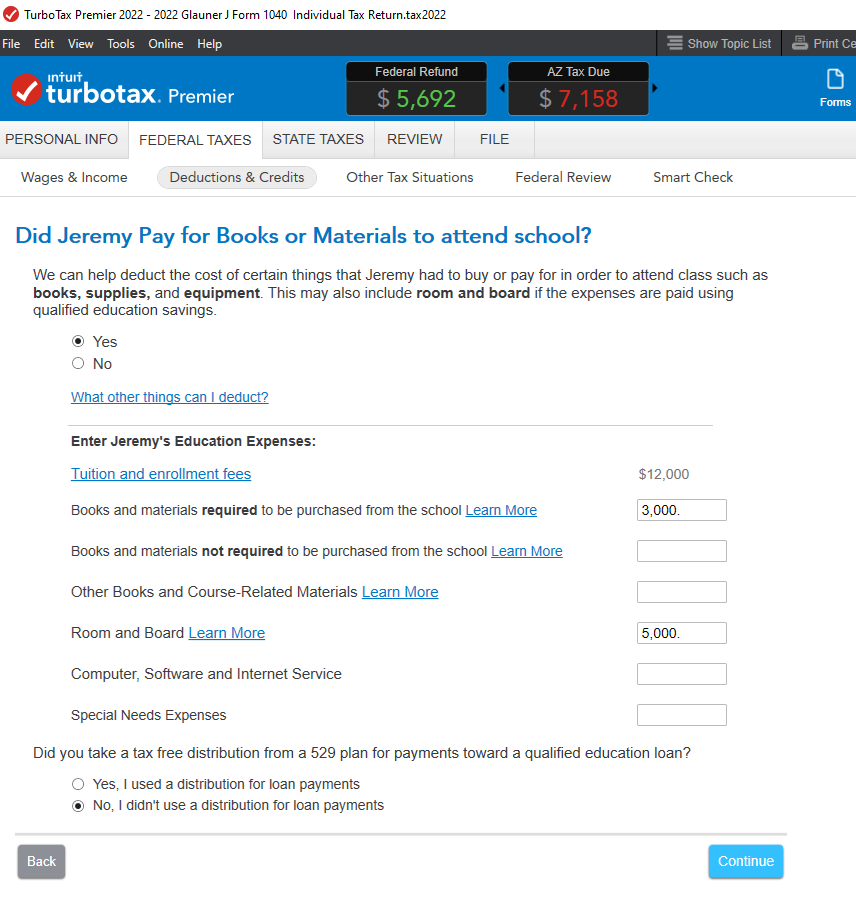

If you received a 1099-Q for a distribution that was entirely used by Qualified Education Expenses, you can enter it by typing '1099-Q' in the Search area, then 'Jump to 1099-Q'.

Then in the Education Expenses section, you will have an entry area for Room & Board and Other Expenses, in addition to Tuition reported on Form 1098-T.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

April 10, 2023

4:28 PM