- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Taxable amount on form 1099-R and Impact to Tax Due

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxable amount on form 1099-R and Impact to Tax Due

I keep getting the error message when trying to submit Fed e-filing:

"Taxable amount should not be zero if there is no prior year excess traditional IRA contribution on line 4 of the IRA information sheet. "

Where to find IRA information sheet and enter the amount in the sheet? IRA information sheet is not the same as 1099-R, right? Is it generated by Turbo Tax in the back-end? The taxable amount should be zero.

Another weird thing is that if I just put $1 instead of $0 in the taxable income, my tax due increased by a few thousand dollars. Is it supposed to be like that?

Thanks in advance!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxable amount on form 1099-R and Impact to Tax Due

What code in in box 7 on your 1099-R?

Is the IRA/SEP/SIMPLE box checked?

What is in box 2a?

Is the box 2b (not determined) checked?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxable amount on form 1099-R and Impact to Tax Due

many 1099-R's leave the taxable amount blank even though the amount may be fully or partially taxable. the reason I got speaking to one source was they leave it blank because they don't know what the taxpayer may have as their basis.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxable amount on form 1099-R and Impact to Tax Due

@Anonymous wrote:

many 1099-R's leave the taxable amount blank even though the amount may be fully or partially taxable. the reason I got speaking to one source was they leave it blank because they don't know what the taxpayer may have as their basis.

The poster said "excess traditional IRA contribution ". Any 1099-R that reports a Traditional IRA distribution cannot have a blank box 2a. Hence the reason for my questions for the actual 1099-R information that produced the error message.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxable amount on form 1099-R and Impact to Tax Due

macuser_22 - Thank you for the reply. See below.

The code in box 7 is 2, and the IRA/SEP/SIMPLE box is checked.

The amount is box 2a is the total distribution amount - it should be zero as the original IRA contribution is non tax deductible. I called the financial institution and was told that they won't be able to correct the 1099-R but they will issue the 5498 form to report the original contribution basis.

And yes, box 2b is checked.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxable amount on form 1099-R and Impact to Tax Due

A Traditional IRA distribution always has box 2a the exact same amount as box 1 and the box 2b checked. It is the box 2b being checked that will adjust the taxable amount that is calculated on a 8606 form lines 6-15. Enter the 1099-R as below:

Enter a 1099-R here:

Federal Taxes,

Wages & Income

(I'll choose what I work on - if that screen comes up)

Retirement Plans & Social Security,

IRA, 401(k), Pension Plan Withdrawals (1099-R).

OR Use the "Tools" menu (if online version left side) and then "Search Topics" for "1099-R" which will take you to the same place.

Be sure to choose which spouse the 1099-R is for if this is a joint tax return.

Be sure to pick the correct 1099-R type: Standard 1099-R, CSA-1099-R, CSF-1099-R, RRB-1099-R.

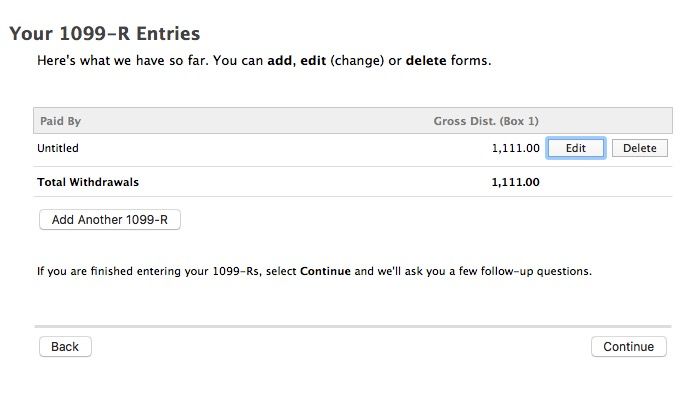

[NOTE: When you get to the "Your 1099-R Entries" screen where you can add another 1099-R, use "continue" to keep going as there are additional interview questions after that screen in most cases. You can always return as shown above.]

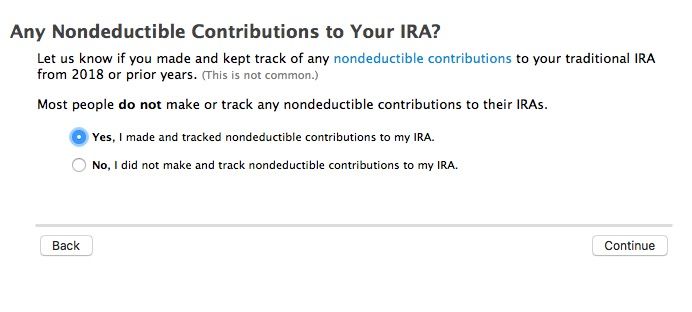

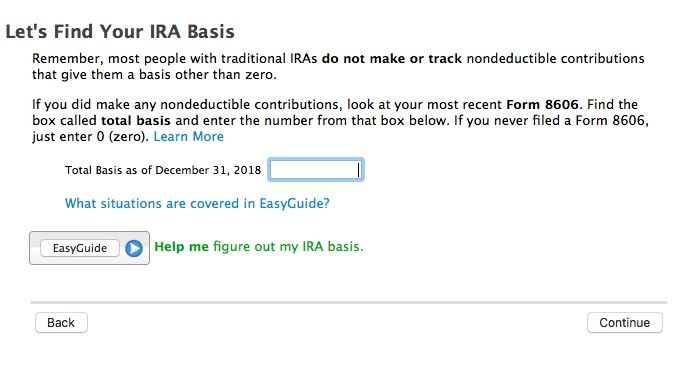

You will be asked of you had and tracked non-deductible contributions - say yes. The enter the amount from the last filed 8606 form line 14 if it did not transfer. Then enter the total value of any Traditional, SEP and SIMPLE IRA accounts that existed on December 31, 2019.

That will produce a new 8606 form with the taxable amount calculated on lines 6-15 and the remaining carry-forward basis on line 14.

NOTE: If there is an * next to line 15 then 6-15 will be blank and the calculations will be on the "Taxable IRA Distributions worksheet instead.

The taxable amount will never be zero, however, if there was any 2019 Dec, 31, value in ANY Traditional IRA account of if the IRA contained any earnings.

You can NEVER withdraw ONLY the nondeductible part - it must be prorated over the entire value of ALL Traditional IRA accounts which include SEP and SIMPLE IRA's. (For tax purposes you only have ONE Traditional IRA which can be split between as many different accounts as you want, but for tax purposes they are all added together).

For example using rough figures: if you had $60K of nondeductible contributions in an IRA with a total value of $600K (10:1 ratio), then when you take a $60K distribution from any IRA account $6,000 would be nontaxable and $54,000 would be taxable (same 10:1 ratio) , with the remaining $54K of basis staying in the IRA for future distributions. As long as there is any money in the IRA, there will be some basis.

TurboTax will ask for your non-deductible "basis" and then the *Total Value* of *all* Traditional IRA, SEP and SIMPLE accounts as of Dec 31, of the tax year. That is so the prorating of the basis can be properly proportioned between the current years distribution and the remaining IRA value. That is done on the 8606 form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxable amount on form 1099-R and Impact to Tax Due

Macuser_22, thanks again for your detailed reply!

I can find the 1099-R form by going through:

Wags & Income

Retirement Plans & Social Security,

IRA, 401(k), Pension Plan Withdrawals (1099-R)

And picked the correct 1099-R type.

However, I didn't get asked about the question about if "you had and tracked non-deductible contributions".

I understand that I can NEVER withdraw ONLY the nondeductible part - it must be prorated over the entire value of ALL Traditional IRA accounts. Actually I only have non deductible amount in my IRA account, with $1 interest received that is also part of the total distribution. I tried to report the $1 taxable amount in box 2a, but then my tax due jumped by a few thousand dollars comparing to if I just put $0 in 2a.

Not sure if the Turbo Tax version has anything to do with form 8606. I am using Deluxe and was not prompted the question and I don't see form 8606.

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxable amount on form 1099-R and Impact to Tax Due

You will not see form 8606 since that is in the background. You should get the question if the IRA/SEP/SIMPLE box is checked and you continued the interview after the 1099-R summary screen.

About the only them that you would not would be if if you are over 70 1/2 and the entire distribution was a QCD since the basis is not applied to a QCD.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxable amount on form 1099-R and Impact to Tax Due

Hi Macuser_22,

I tried multiple times and still couldn't get the question. Wondering if you have any additional tips what I could change or do differently.

By the way, during the final review prior to submission, I got a message reporting the exception for Form 1099-R that "Full Roth conversion should not be checked unless there is an amount on line B4, the amount that potentially could be converted to a Roth IRA." I hope that I can upload the screenshot here, but do you happen to know the form the message is referring to? I don't see line B4 in Form 1099-R.

Thanks again!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxable amount on form 1099-R and Impact to Tax Due

Are you doing a Roth conversion?

I suggest that you delete the 1099-R and re-enter. That question comes up is the 2nd part of the interview after the 1099-R summary screen where you can add another 1099-R - press continue and keep going after the questions that ask about a disaster.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxable amount on form 1099-R and Impact to Tax Due

Yes, that helped. I deleted the 1099-R and re-entered it and now the question came up. Thanks!

However, it still doesn't solve the problem even after I enter my total basis as of December 31 2018. Below is my scenario - please let me know how I should enter the information differently and avoid the issue.

I made a nondeductible contribution of $4000 in 2018, so my tax basis for 2018 is $4000. In 2019, I made $5000 nondeductible contribution, and converted the total amount $9000 ($4000 + $5000) to Roth-IRA. The total distribution amount in 1099-R is $9000, but I still got an error message when I tried to eFile: "Taxable amount should not be zero if there is no prior year excess traditional IRA contribution on line 4 of the IRA Information Worksheet."

Is it possible that TurboTax just had a bug in the validation rule that it doesn't properly take into account of the tax basis?

Thanks again for your help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxable amount on form 1099-R and Impact to Tax Due

There is no bug.

Line 4 on the information worksheet says that there was a carry-over 2018 excess contribution that was not removed in 2018 and carried to 2019. Was there? Apparent you entered a 2018 contribution that was in excess and did not remove it.

Go to the IRA contribution interview and check the Traditional IRA box, do not enter any new contribution but click through the interview until you get to the excess and see what it says.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxable amount on form 1099-R and Impact to Tax Due

In the page during IRA contribution questionnaire:

Enter Excess Amount

This amount should be the total excess contributions My NAME made to a traditional IRA as of the date your 2018 tax return was filed. Find This

My NAME's Prior Year Excess IRA Contribution: [ ]

In the box next to it, the amount entered is 0.

Did I miss anything here?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxable amount on form 1099-R and Impact to Tax Due

I replied to your message but somehow didn't see it. Apologize if I am replying twice. In the page to enter excess amount, the amount is zero.

Enter Excess Amount

This amount should be the total excess contributions My Name made to a traditional IRA as of the date your 2018 tax return was filed.

I am wondering why it doesn't ask my 2019 contribution, deductible or nondeductible. Does the Deluxe version always treat the current year contribution as deductible?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Taxable amount on form 1099-R and Impact to Tax Due

@madben wrote:

I am wondering why it doesn't ask my 2019 contribution, deductible or nondeductible. Does the Deluxe version always treat the current year contribution as deductible?

Because that section of the interview is asking of a 5329 imposing a 2019 6% penalty on a *prior* years excess needs to be added. Any 2019 excess for a 2019 contribution that you enter will be alerted that it is excess and needs to be removed. You have until July 15, (or Oct 15 if you file and extension) 2020 to have the financial institution that holds the IRA, return that excess and if removed you simply don't enter it at all, since removing it before those dates is the same as never contributing it.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17549435158

New Member

tianwaifeixian

Level 4

nirbhee

Level 3

mhenry550

Level 1

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

timulltim

Level 1

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill