- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Substantial Presence Test for F-1 Student: Resident or Non-Resident?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

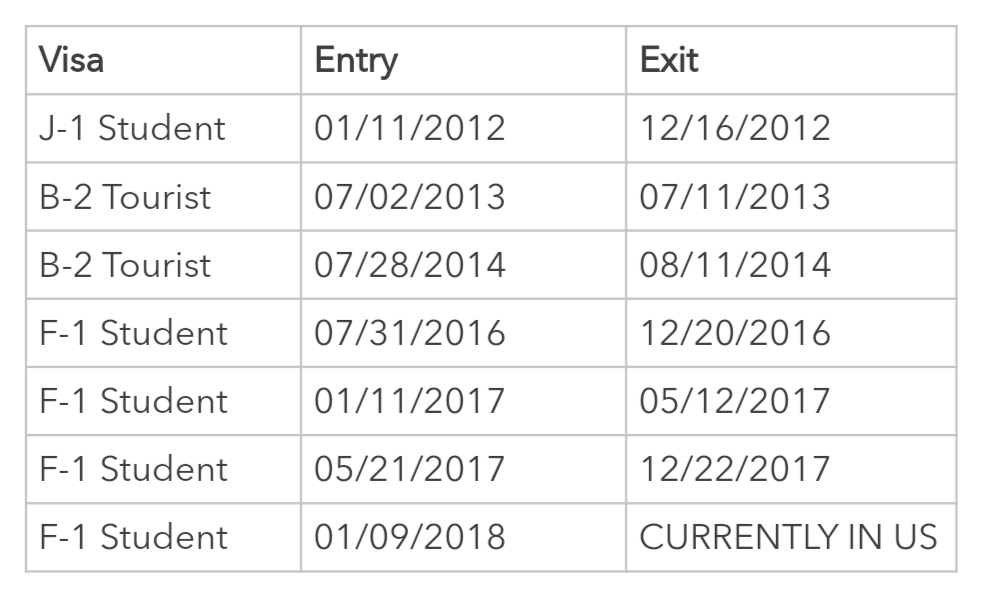

Substantial Presence Test for F-1 Student: Resident or Non-Resident?

I was pretty sure I was going to be a non-resident in 2020, but the tax service I was using deemed me as a resident. So I want to double-check that. These are all my US entry and exit dates:

| Visa | Entry | Exit |

| J-1 Student | 01/11/2012 | 12/16/2012 |

| B-2 Tourist | 07/02/2013 | 07/11/2013 |

| B-2 Tourist | 07/28/2014 | 08/11/2014 |

| F-1 Student | 07/31/2016 | 12/20/2016 |

| F-1 Student | 01/11/2017 | 05/12/2017 |

| F-1 Student | 05/21/2017 | 12/22/2017 |

| F-1 Student | 01/09/2018 | CURRENTLY IN US |

I lived in the US for the entire year in 2012, but in 2013 and 2014 I was just visiting for a short period. I did not spend any time in the US in 2015.

I moved to the US in 2016 and have been living here since then. Would anybody be able to help me understand whether or not I am a resident, and why?

Thank you for your help!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Substantial Presence Test for F-1 Student: Resident or Non-Resident?

You are not a resident for 2020 tax purposes. You may be for 2021 if you meet the substantial presence test.

Your information below follows the example in the hyperlink here from the IRS guidance on when substantial presence test

is satisfied for resident status to be met..

As a F1 Visa holder, your first 5 years in the US you are considered exempt and are a nonresident. Your time present in the

US does not count towards residency.

Date of entry into United States: 2016

Student F-1 visa

Exempt individual for 5 calendar years 2016 2017 2018 2019 2020

To determine when you meet the substantial presence test (183 days), begin counting days on 01-01-2021.

Number of nonexempt days in United States during 2021: 365 days

Count days as follows:

Current year (2021) days in United States (365) × 1 = 365 days

Prior year (2020) days in United States (0) × 1/3 = 0 days

Year before that (2019) days in United States (0) × 1/6 = 0 days

Total = 365 days

You will meet the substantial presence test on 07-01-2021(the 183rd day of 2021). Your residency starting date under IRC § 7701(b) is 01-01-2021 (the first day you were present in United States during the calendar year in which you met the substantial presence test).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Substantial Presence Test for F-1 Student: Resident or Non-Resident?

Hi @JeffreyR77,

So, the time I spent here in 2012 as a J-1 student should not be counted for the purposes of the test?

I believe that's how the other test from Sprintax classified me as a resident.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Substantial Presence Test for F-1 Student: Resident or Non-Resident?

No, you count the number of days in the current year, plus 1/3 of the days present in the immediate prior year, plus 1/6 of the days present in the immediate year before that. 2012 is out of bounds.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Substantial Presence Test for F-1 Student: Resident or Non-Resident?

Sounds good. Thanks, @JeffreyR77. I am going to get in touch with Sprintax, this might just be something they need to fix on their software.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Substantial Presence Test for F-1 Student: Resident or Non-Resident?

Hey @JeffreyR77,

In 2020 Form 8843, there's the following question:

"Were you present in the United States as a teacher, trainee, or student for any part of more than 5 calendar years? "

Could it be that they are referring to non-consecutive years?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Substantial Presence Test for F-1 Student: Resident or Non-Resident?

Also found this link that says that the 5 calendar year rule doesn't only apply to consecutive years:

I have a feeling I met the substantial presence test last year because in this case 2012 will count towards my 5 year credit.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Substantial Presence Test for F-1 Student: Resident or Non-Resident?

You would be a nonresident alien if I understand your visa information correctly. The spacing did not show up correctly.

If your F-1 Visa began in 2016, you would be an exempt individual for five calendar years. Parts of a year count as a year.

Therefore, if you were "exempt" for any part of one calendar year, that year is calculated as a whole year. Your exempt years will be 2016, 2017, 2018, 2019 and 2020. You would not be able use years prior to 2016 because you were not on an F-1 visa before 2016.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Substantial Presence Test for F-1 Student: Resident or Non-Resident?

@ErnieS0 so 2012 does not count towards this 5-year rule? Did you see the link I previously posted?

Form 8843 also makes me think that my J-1 from 2012 would count towards this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Substantial Presence Test for F-1 Student: Resident or Non-Resident?

I had a real problem understanding your visa entry exit which is jumbled together on my screen. It's hard to read. It might help everyone if you could repost that.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Substantial Presence Test for F-1 Student: Resident or Non-Resident?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Substantial Presence Test for F-1 Student: Resident or Non-Resident?

Your source does not override the IRS. IRS guidance is current year, prior year and prior to that.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Substantial Presence Test for F-1 Student: Resident or Non-Resident?

@JeffreyR77 I understand that. The IRS says this though:

"You will not be an exempt individual as a student if you have been exempt as a teacher, trainee, student, Exchange Visitor, or Cultural Exchange Visitor on an "F, " "J, " "M, " or "Q " visa for any part of more than 5 calendar years, unless you establish to the satisfaction of the IRS that you do not intend to reside permanently in the United States, and you have substantially complied with the requirements of your nonimmigrant status."

https://www.irs.gov/individuals/international-taxpayers/exempt-individual-who-is-a-student

It doesn't specify that the years need to be consecutive.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Substantial Presence Test for F-1 Student: Resident or Non-Resident?

Your citation is in reference to what allows F1 visa holder to be considered for residency status after 5 years. "You will not be an exempt individual as a student...for any part of more than 5 calendar years, ..."

The substantial presence test as described in IRS Publication 519 U.S. Tax Guide for Aliens is a test of 3 consecutive years, beginning with the first year of consideration and counting back as in this example:

Substantial Presence Test

You are a resident for tax purposes if you meet the substantial presence test for calendar year 2020. To meet this test, you must be physically present in the United States on at least:

-

31 days during 2020; and

-

183 days during the 3-year period that includes 2020, 2019, and 2018, counting:

-

All the days you were present in 2020, and

-

1/3 of the days you were present in 2019, and

-

1/6 of the days you were present in 2018.

-

2020 in your case doesn't apply as your five year of exempt status are 2016 2017 2018 2019 and 2020.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Substantial Presence Test for F-1 Student: Resident or Non-Resident?

@JeffreyR77 what if my exempt years were 2012 (J-1), 2016, 2017, 2018, 2019?

Doesn't "any part of more than 5 calendar years" sound to you more like any year, as opposed to 5 consecutive years? In which case, my 2012 student status would count?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

balld386

New Member

ajm2281

Level 1

shil3971

New Member

bongon

New Member

Waylon182

New Member