- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: State tax refunds

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax refunds

I got a $50.00 refund from NJ on my 2019 return. After listing this refund on my 2010 return, I was asked for the total state taxes paid in 2020. I had to refile my NJ returns for 2017 and 2018. I paid 40.00 for 2017 and 50.00 for 2018 when refiled in 2010. Do I include these amounts in the total requested?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax refunds

If the program is asking for the amount of state tax you paid in 2020, and those additional payments were made in 2020, those additional payments would be included, HOWEVER are you sure that is what the TurboTax program is asking? I suspect it might be asking for your state payments made in 2019.

If you made those additional payments in 2019, and TurboTax is asking for the state tax paid in 2019, Yes, add those additional payments.

When you receive your 2019 tax year State refund, the refund is usually received in 2020. The amount of the refund may or may not be considered as taxable income on your 2020 tax year federal return.

IS IT TAXABLE INCOME? that depends.

IF you claimed the Standard Deduction on your 2019 tax year, no, it is NOT taxable. It won't be reported on your 2020 tax year return.

IF you Itemized Deductions on your 2019 tax year return, it COULD be taxable income on your 2020 tax return.

Did you use the State Income tax paid as a deduction? Then no, it isn't.

Did you use the State Sales tax paid as a deduction? Then yes, at least part may be taxable.

TurboTax is asking about your numbers from your 2019 tax return so it can determine if the 1099-G is taxable on your 2020 tax year return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax refunds

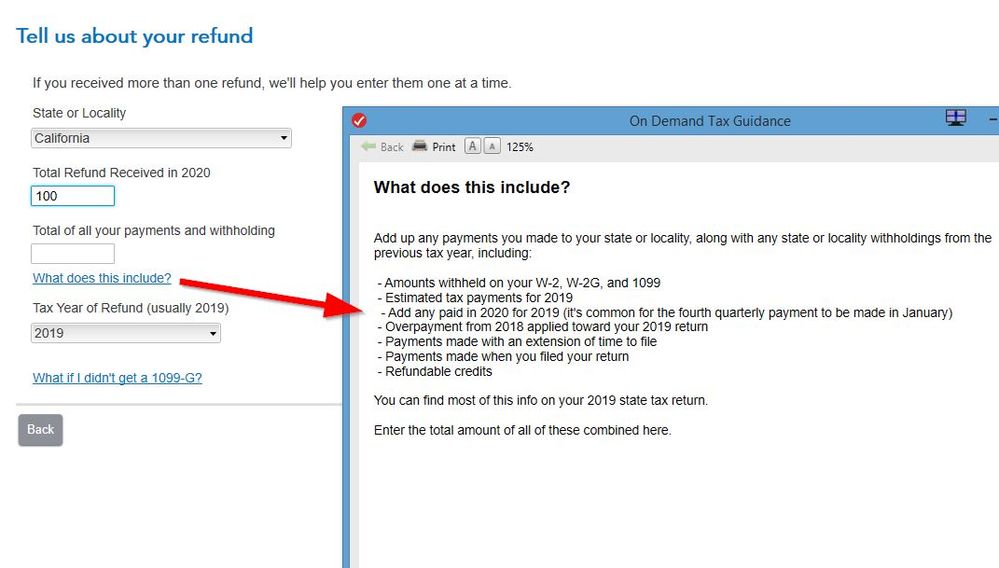

If you are on this screen it doesn't actually say the year. But it wants the payments from the previous year, so 2019. See What does this include........

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax refunds

VolvoGirl,

Thanks for the reply. After I managed to locate my original question, I realized that I had mad a couple of errors that might have caused some confusion. I decided to try and clarify my issue so here goes.

1. I am working on my federal tax for 2020.

2. On 04/16/2020 I received a $50 refund from New Jersey for my 2019 state taxes.

3. I entered this on the State Refund screen of the 2020 federal income.

4. On that screen it asked for the amount of the refund (entered $50) and "Total of all your payments and withholding". This latter amount is what I am asking about, but see item 5 below for relevant info.

5. In April, 2020 I had to refile my 2017 and 2018 New Jersey tax returns because of an IRS mandated reclasification of 2 items of income. This reclassification resulted in having to pay $40 in NJ tax for 2017 and $50 for NJ tax for 2018. These payments were made on 04/06/2020.

So my question is "should the 2 payment made in item 5 be included as the total requested in item 4"? I had no other NJ tax payment made or withheld in 2020.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax refunds

Yes. Include those payments. The Total of all your payments and withholding should include any payments you made to your state or locality the $40 and $50 paid to NJ), along with any state or locality withholdings from the previous tax year, including:

- Amounts withheld on your W-2, W-2G, and 1099

- Estimated tax payments for 2019

- Add any paid in 2020 for 2019 (it's common for the fourth quarterly payment to be made in January)

- Overpayment from 2018 applied toward your 2019 return

- Payments made with an extension of time to file

- Payments made when you filed your return

- Refundable credits

You can find most of this info on your 2019 state tax return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Jessie123

New Member

finance

New Member

cassi-faulkner

New Member

kvhpkh

New Member

madmanc20

Level 3