- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Splitting a single K-1 into multiple TurboTax K-1 entries, how to answer combined business qu...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Splitting a single K-1 into multiple TurboTax K-1 entries, how to answer combined business question

Hi

I need to split my K-1 into 8 Turbotax K-1 entries. Note, I was told I need to split my single received K-1 into 8 turbax entered K-1s because Box 20 code Z data is split into a main entity and 7 pass through entities, and also I have Box 1 and Box 2 information.

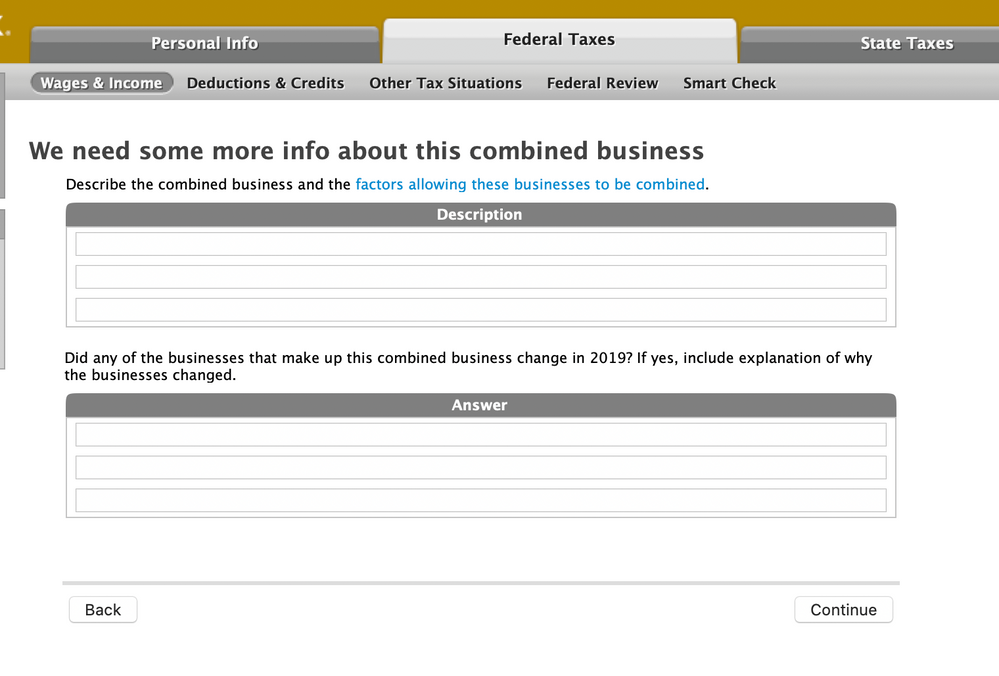

A question during the data entry comes up (each time for each of the K-1s entered) (see below screenshot):

For the "Description" do I need to enter ALL 8 Combined Businesses every time (for all 8 Turbotax K-1s) or only enter the single sub-business that I am entering?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Splitting a single K-1 into multiple TurboTax K-1 entries, how to answer combined business question

More information may help resolve your issue. For example, are you answering "yes" to a question about combining ("aggregate") this business with other QBI businesses?

Even though you are entering separate K-1s, this is still "one business" for QBI purposes, even though it receives QBI from several passthrough entities, so all these K-1s are not being "combined" or "aggregated" in the IRS QBI "sense" of the word.

Also, note that during the first part of the K-1 entry, all the separate K-1s use the name, address, and EIN of the "main" partnership shown in Part I and Part II of the K-1 you actually received. For Part II, I recommend that the information through Line I (India) be entered, and the appropriate at-risk answer under Line K. Don't put the partner percentages or the partner capital account amounts on the additional K-1s.

When you enter each K-1, you'll encounter the question "Is the business that generated the Section 199-A income a separate business owned by the partnership?" screen, TurboTax is asking if the Section 199-A income was passed through to the partnership sending you the K-1 by another partnership, S-Corp, or trust; versus being generated by the business operations of the partnership that sent you the K-1. So, on one of the K-1s you enter you will answer that it is from the "main" partnership, and on the others you will enter that it is from the pass-through entity. TurboTax will ask for the name and EIN of each pass-through entity.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Splitting a single K-1 into multiple TurboTax K-1 entries, how to answer combined business question

This was helpful, but I still have a question and a problem related to splitting my k1 into multiple k1's.

The received k1 has all of the income combined. I assume I should only report the income from the main company and not the pass-through income for the main k1 entry in Turbotax, since we are reporting the pass-through incomes in separate k1 entries. And the same with all the other boxes (e.g. 4 - 20). Correct?

When it asks me the combined question, only 4 of my k1's show up in the list and not the one that it should be combined with. Is this a bug in TurboTax 2020? Is there a way I can make the "main" k1 of the split show up or manually work around this?

Thanks (hoping to finish up my taxes before my extension expires)!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Kell7

Level 2

kater832

Level 1

Kenn

Level 3

gborn

Level 2

savadhamid

New Member