- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Sold house with 3 owners. What is my gain?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold house with 3 owners. What is my gain?

Sold house with 3 owners. I know $250k for single/$500k for married is tax free. But these owners are not married together. They are Father/mother/Son. Father passed away > 2 yrs ago, so Mom is filing status is Single. Son is married

Does Mom get $250k and Son get $500k exclusion.

on each returns, do I split 50/50 cost/gain from the house? Or do I put the full amount from HUD in each return?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold house with 3 owners. What is my gain?

That's looks like the Note, not the Deed.

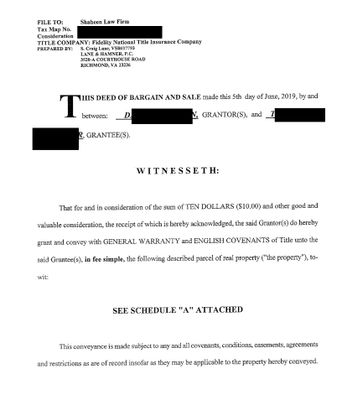

Step 1. I'm attaching page 1 of the deed to my house, it is a simple transfer of ownership. Page 2 is just the seller's signature and notary, and schedule A is the legal description of the property. Although the form in Texas may be slightly different, you would expect to find something like this from 1980 that says the seller (grantor) conveys the property to 6 named people (grantees) (parents and 4 siblings). If you don't have a copy, you should be able to get one from the county records office.

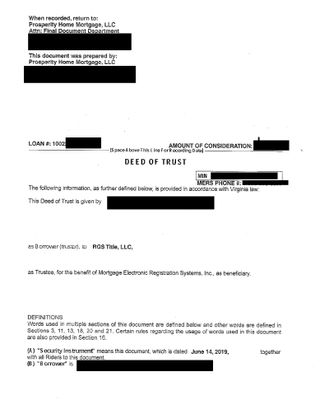

Step 2. In 2000, there was a refinance. At that time, you would expect to find a Note, which is the borrower's personal promise to repay the loan. You should also find either a Mortgage or a Deed of Trust. Both the mortgage and deed of trust are documents that go along with the Note, and give the lender the right to foreclose on the property if the Note is not repaid. You would not have both. Google thinks that the Deed of Trust is more common in Texas, but Google might be wrong.

Step 3. If there is a Deed of Trust, it may look like my second screen shot. It is a deed that conveys the property from the owners, to a title company, in trust for the lender. If the loan is defaulted, it gives the lender the right to foreclose. If the loan is repaid, the deed of trust is canceled. If there is a 2000 Deed of Trust, who are the grantors? Mother, father and son #1, or all 6 family members?

Step 4. If the deed of trust only names mother, father and son #1, then it is representing to the bank that they are the only 3 owners. If this is the case, we hope it was true (otherwise, it could be mortgage fraud. The bank should have researched the matter before accepting the refinance). But for there to be only 3 owners in 2000, then at some point, in 2000 or earlier, the other 3 siblings would have had to execute deeds that transferred their ownership to one or more of the other named owners. These transfers would also be recorded in the county records, and could significantly change the percentage of ownership. For example, all 6 family members started out as equal owners of 1/6 of the home. If son #2 gave up his share and only named his father, then father owns 2/6. If son #2 gave up his share and named all other owners, then all the owners now own 1/5 each.)

If the deed of trust only names mother, father and son #1, we could assume the other transfers were done properly, but I would prefer to have it in writing.

If the deed of trust names all 6 owners, then all 6 owners still owned the home in 2000, even though only 3 people are named on the Note and only 2 people are legally responsible for payment.

I don't feel I can go further into "what-ifs" without a definite idea of who owned what in 2019 and how they got there from 1980.

Since the property was not son #1s primary residence, he will owe capital gains tax on his share of the gain. Figuring out who owned the property and how it got there is the first step in actually figuring out what the tax bill is going to be.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold house with 3 owners. What is my gain?

The exclusion only applies if you owned the home and lived in it as your main home for at least 2 years before the sale. For example, if your mother lived in the home but you did not, then your mother can use the exclusion ($250K since she is single) but you can't use the exclusion. Your gain will be fully taxable.

To determine ownership percentages and the amount of gain, you will need to review the deed, and how the home was transferred into your name. This can be very complicated, and if your parents "gave" you share of the home, thinking they were saving you from probate, they may have also given you a big tax bill.

You probably should get this reviewed by a local tax professional. However, I can attempt to guide you a bit and let you know some of the issues.

1. If you were given a share of the house by deed transfer or quitclaim deed, but the deed says your parents have "right of survivorship" then you are not really the owner and owe no tax. Your mother would report all the gains, and qualify for the exclusion. Right of Survivorship means you have no rights in the home unless both your parents had died, so the IRS views you are not responsible for any of the taxes. If your mother gives you a share of the proceeds, that is a gift from her to you, and she must report the entire sale on her tax return.

Your mother's gain is the difference between her adjusted cost basis and the selling price. Her adjusted basis is computed as follows:

- For half the house, her basis is half the cost she originally paid, plus half the cost of any permanent improvements she made over the years.

- For the other half of the house that she inherited from her spouse when he died, her adjusted basis is half the value of the home on the day he died (called a "stepped up" basis).

So let's say the home was purchased in 1980 for $50,000, and in 2000 they renovated for another $50,000. When her spouse died in 2015, the home was worth $310,000. Your mother's basis is $50,000 (half of $100,000 costs) plus $155,000 (half the fair market value when her spouse died) for a total of $205,000. If the home sells for $400,000, her gain is $195,000. If she has lived in the home for 2 of the past 5 years, her gain is not taxable since it below the exclusion limit.

Additionally, if she moved out recently because she had to move into assisted living or a nursing home, but she retained ownership, that counts as if she still lived there, to qualify for the exclusion.

2. Suppose you were gifted a share in the home "in fee simple". Then you are an equal co-owner with the other owners and have the same rights and tax responsibilities. The IRS will assume you own equal shares (1/3 each) unless the deed says otherwise. Then when your father died, you inherited 1/6 of the home from him (half of his 1/3 share, get it?), making your total share 1/2. Your mother inherited the other 1/6, making her total share also 1/2.

Now when selling, basis gets tricky to compute. Again, let's say the home was purchased in 1980 for $50,000, and in 2000 they renovated for another $50,000. When you were gifted the home in 2010, you were also gifted your parent's cost basis. Since the total cost basis at this time was $100,000, then each of your cost bases (mom, dad, child) is now $33,333. When her spouse died in 2015, the home was worth $310,000, and the fair market value of your father's share is 1/3 of that or $103,333. Half of that gets added to your basis, and half to your mom's basis, so your adjusted cost basis becomes $85,000. If you sell for $400,000, then each of you reports a gain of $200,000 minus $85,000 equals $115,000. If your mother lived in the home, she can exclude the gain. If you did not live in the home, you can't exclude your gain and it is fully taxable.

As you can see, this requires a lot of documentation. If audited, the IRS does not award anything you can't prove, so you will need to locate any records that bear on the cost basis. The original purchase of the home, cost of improvements, fair market value when your father died. (The cost will be in the county records, and the value on the date of your father's death can be obtained from a real estate appraiser.). You need to know exactly how the deed was written making you a co-owner (there are other variations besides the 2 main ones I mentioned). A local tax professional will know what questions to ask and what to look for, and will be able to interpret the deed or will know an attorney who can check the deed for you to determine how the sale will be treated.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold house with 3 owners. What is my gain?

The rules for excluding the gain from the sale of your main home requires the the home be owned and occupied as your main home for 2 of the last 5 years from the date of the sale.

If those requirements are met, then your mother, filing as Single, will be able to exclude up to $250,000 of gain. Since you are filing as Married Filing Joint, you would only be able to exclude up to $500,000 of gain only if your spouse was also an owner of the property and met the requirements for excluding the gain. Based on your statement that the house was owned by your parents and you, you would only be eligible to exclude up to $250,000, but not up to $500,000.

As for reporting the sale, it will depend on the percent of ownership for each party. If your father's share of the house was split between you and your mother, then you would each report half of the sale proceeds and half of the cost basis. If there was a different split in the ownership after your father's death, then only report each person's share of the ownership on their own return.

To learn more, see the following TurboTax article: Is the money I made from a home sale taxable?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold house with 3 owners. What is my gain?

Thank you full detail response

House was purchased in 1980 and all three names were added at that time

Father passed away in 2016 and son moved to Texas. Does that make complication of the use test? Son did live with parents until 2016 and did visit surviving mom multiple times at that same house which was sold. It was his residence as well.

house was sold July 2019

Is Mom limit $250K or $500K. Her filing status is Single since her husband passed away > 2 yrs. what’s happens to Father share of exclusion

@AnnetteB6 Son’s spouse is not the owner. So $250K is the limit then. But he is married though.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold house with 3 owners. What is my gain?

@stech wrote:

Thank you full detail response

House was purchased in 1980 and all three names were added at that time

Father passed away in 2016 and son moved to Texas. Does that make complication of the use test? Son did live with parents until 2016 and did visit surviving mom multiple times at that same house which was sold. It was his residence as well.

house was sold July 2019

Is Mom limit $250K or $500K. Her filing status is Single since her husband passed away > 2 yrs. what’s happens to Father share of exclusion

@AnnetteB6 Son’s spouse is not the owner. So $250K is the limit then. But he is married though.

You still need to review the deed from 1980 to determine if it was joint with rights of survivorship or not. Assuming it is not, then you were 1/3 owners at that time.

To qualify for the exclusion, you must have lived in home as your main place of residence (visits don't count) for at least 2 years (731 days) of the 5 years prior to the sale. Since the home was sold in July 2019, the testing period starts July 2014. You would qualify for the exclusion if you moved to Texas in August 2016, but not if you moved in June 2016. (You may need to get a calendar and determine the exact dates. There is also an extension available if you moved under military orders.)

Your mother is single, her exclusion is $250K. She would have been able to use the married exclusion only if she sold within 2 years (I think) of her spouse's death, its too late now. Although you are married, you can only use the $250K exclusion since your spouse is not an owner, and only if you meet the residency test.

You still need to diligently document your adjusted cost basis, the higher you can document your basis, the less taxable gain you will have.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold house with 3 owners. What is my gain?

Just found out, that house was purchased in 1980 with everyone names (4 siblings + parents) In 2000, it was refinanced with (mom,dad, one son). Son has been living there since from 2000-2010, until found a temporary job in Texas.

Every year, son made multiple trips, to check up on dad and the house. Did a lot of improvement on house as well. He wasn't there for parent, but also he was the main person managing the property. In 2016, when dad passed away, months before and months after, son spent alot of time with at the family/house.

I'm more concern about the use test. Does this mean, the son will report all the gain (assume from your example, $195K) even thought its under the $250K limit since there seem to be issue with meeting the use test?

Thanks alot!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold house with 3 owners. What is my gain?

I’m slightly curious, are you related to the story? Or are you a tax preparer looking for help?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold house with 3 owners. What is my gain?

The first thing that absolutely must be determined is who owned the home when it was sold and how was it titled? Just because it was refinanced with three people named on the mortgage does not mean that the other siblings might not still own a share of the home. (They might or might not have given up their ownership interest. You have to know this.)

Then, if you are specifically interested in the tax position of one particular son (sibling), where was the son’s primary residence over the past five years before the sale? A person can only have one primary residence at a time. Making many visits to see his parents or his mother, and making repairs to the property, does not make it his primary residence.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold house with 3 owners. What is my gain?

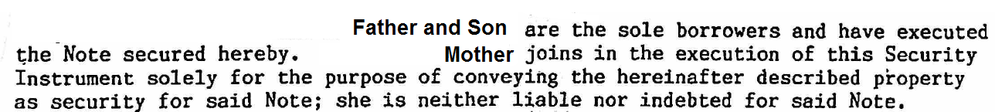

Below, please find sample text from the Deed. I removed actual names and added their relationship. Does this mean, Father/mother/son are equal owners.

When son lived in Texas, he rented a place. and filed Texas resident return.

I’m related to the story. Didn’t wanted to publish names of ppl here

Thank again for your expertise!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold house with 3 owners. What is my gain?

...,,,,

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold house with 3 owners. What is my gain?

That's looks like the Note, not the Deed.

Step 1. I'm attaching page 1 of the deed to my house, it is a simple transfer of ownership. Page 2 is just the seller's signature and notary, and schedule A is the legal description of the property. Although the form in Texas may be slightly different, you would expect to find something like this from 1980 that says the seller (grantor) conveys the property to 6 named people (grantees) (parents and 4 siblings). If you don't have a copy, you should be able to get one from the county records office.

Step 2. In 2000, there was a refinance. At that time, you would expect to find a Note, which is the borrower's personal promise to repay the loan. You should also find either a Mortgage or a Deed of Trust. Both the mortgage and deed of trust are documents that go along with the Note, and give the lender the right to foreclose on the property if the Note is not repaid. You would not have both. Google thinks that the Deed of Trust is more common in Texas, but Google might be wrong.

Step 3. If there is a Deed of Trust, it may look like my second screen shot. It is a deed that conveys the property from the owners, to a title company, in trust for the lender. If the loan is defaulted, it gives the lender the right to foreclose. If the loan is repaid, the deed of trust is canceled. If there is a 2000 Deed of Trust, who are the grantors? Mother, father and son #1, or all 6 family members?

Step 4. If the deed of trust only names mother, father and son #1, then it is representing to the bank that they are the only 3 owners. If this is the case, we hope it was true (otherwise, it could be mortgage fraud. The bank should have researched the matter before accepting the refinance). But for there to be only 3 owners in 2000, then at some point, in 2000 or earlier, the other 3 siblings would have had to execute deeds that transferred their ownership to one or more of the other named owners. These transfers would also be recorded in the county records, and could significantly change the percentage of ownership. For example, all 6 family members started out as equal owners of 1/6 of the home. If son #2 gave up his share and only named his father, then father owns 2/6. If son #2 gave up his share and named all other owners, then all the owners now own 1/5 each.)

If the deed of trust only names mother, father and son #1, we could assume the other transfers were done properly, but I would prefer to have it in writing.

If the deed of trust names all 6 owners, then all 6 owners still owned the home in 2000, even though only 3 people are named on the Note and only 2 people are legally responsible for payment.

I don't feel I can go further into "what-ifs" without a definite idea of who owned what in 2019 and how they got there from 1980.

Since the property was not son #1s primary residence, he will owe capital gains tax on his share of the gain. Figuring out who owned the property and how it got there is the first step in actually figuring out what the tax bill is going to be.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold house with 3 owners. What is my gain?

I went to HR Block today and got different reply and I wanted to share with others

Tax pro said, I could use any 2 years, for my use test of 2 years.

not sure who is correct

Here is IRS website rules (bold text)

In general, to qualify for the Section 121 exclusion, you must meet both the ownership test and the use test. You're eligible for the exclusion if you have owned and used your home as your main home for a period aggregating at least two years out of the five years prior to its date of sale. You can meet the ownership and use tests during different 2-year periods. However, you must meet both tests during the 5-year period ending on the date of the sale. Generally, you're not eligible for the exclusion if you excluded the gain from the sale of another home during the two-year period prior to the sale of your home. Refer to Publication 523 for the complete eligibility requirements, limitations on the exclusion amount, and exceptions to the two-year rule.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold house with 3 owners. What is my gain?

Obviously the IRS regulations (laws) are correct. The requirement is that one must live in the home as one’s primary residence for two years (731 days) out of a 5 year period ending on the day of the sale. The two years (731 days) do not have to be consecutive but must occur within 5 years of the sale date.

There is an exception or extension for military and certain others who moved as a result of foreign service orders, but you have never mentioned that before.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold house with 3 owners. What is my gain?

I am not in military or moved because of foreign service orders. Its an IT consultant job.

I had another meeting with HR Block today & they insured me I am still eligible. They said that the 5 yr rule applies to selling of the house. If I have not sold any house in 5 yrs I meet to exclude my gain. Also, since my mom lived there, our gain is excluded. Since I have lived in the for 18+ yrs, I meet the use test

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold house with 3 owners. What is my gain?

As long as HRB guarantees to support you in any audit and to pay any penalties and late fees if they are wrong, then use them. They are flat wrong on the law, as you know from the source you quoted yourself.

There are three provisions of the exclusion rule that they are getting mixed up.

1. The taxpayer must have owned the home for at least two years.

2. The taxpayer must have lived in the home as their primary residence for at least two years of the five years previous to the sell date.

3. The taxpayer can not have used the same exclusion rule on a different home within the two years before the sell date.

Because the mother lived in the home as her primary residence, she can use the exclusion on her share of the gain. Because the son did not live in the home as his primary home for at least two of the past five years, he cannot use the exclusion rule on his share of the gain.

The exclusion rule is particular to each owner. Even in the case of a married couple, when one newlywed moves into the other spouse’s home, if they sell the home and the new spouse has lived in the home less than two years, the maximum exclusion is only $250,000 for the spouse who lived there longer, and not $500,000 for both spouses.

If you care about filing a correct tax return, you need to see a different tax preparer. If you only care about not paying penalties if you are caught, then go ahead and file an incorrect tax return with HRB, as long as they guarantee that they will pay your late fees and penalties if you are audited. (No tax preparer will pay the tax you owe if you are caught. You will always owe the tax. A legitimate preparer will pay the penalties if you follow their advice and then get audited.)

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

trock69

New Member

keithl1

Level 2

Lburns31

New Member

meade18

New Member

LJMS

New Member