- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

That's looks like the Note, not the Deed.

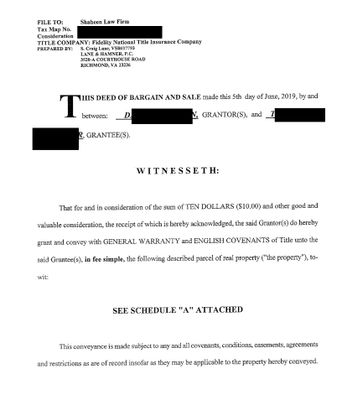

Step 1. I'm attaching page 1 of the deed to my house, it is a simple transfer of ownership. Page 2 is just the seller's signature and notary, and schedule A is the legal description of the property. Although the form in Texas may be slightly different, you would expect to find something like this from 1980 that says the seller (grantor) conveys the property to 6 named people (grantees) (parents and 4 siblings). If you don't have a copy, you should be able to get one from the county records office.

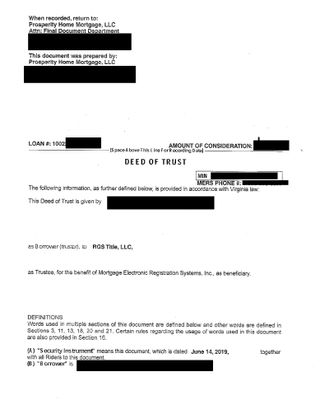

Step 2. In 2000, there was a refinance. At that time, you would expect to find a Note, which is the borrower's personal promise to repay the loan. You should also find either a Mortgage or a Deed of Trust. Both the mortgage and deed of trust are documents that go along with the Note, and give the lender the right to foreclose on the property if the Note is not repaid. You would not have both. Google thinks that the Deed of Trust is more common in Texas, but Google might be wrong.

Step 3. If there is a Deed of Trust, it may look like my second screen shot. It is a deed that conveys the property from the owners, to a title company, in trust for the lender. If the loan is defaulted, it gives the lender the right to foreclose. If the loan is repaid, the deed of trust is canceled. If there is a 2000 Deed of Trust, who are the grantors? Mother, father and son #1, or all 6 family members?

Step 4. If the deed of trust only names mother, father and son #1, then it is representing to the bank that they are the only 3 owners. If this is the case, we hope it was true (otherwise, it could be mortgage fraud. The bank should have researched the matter before accepting the refinance). But for there to be only 3 owners in 2000, then at some point, in 2000 or earlier, the other 3 siblings would have had to execute deeds that transferred their ownership to one or more of the other named owners. These transfers would also be recorded in the county records, and could significantly change the percentage of ownership. For example, all 6 family members started out as equal owners of 1/6 of the home. If son #2 gave up his share and only named his father, then father owns 2/6. If son #2 gave up his share and named all other owners, then all the owners now own 1/5 each.)

If the deed of trust only names mother, father and son #1, we could assume the other transfers were done properly, but I would prefer to have it in writing.

If the deed of trust names all 6 owners, then all 6 owners still owned the home in 2000, even though only 3 people are named on the Note and only 2 people are legally responsible for payment.

I don't feel I can go further into "what-ifs" without a definite idea of who owned what in 2019 and how they got there from 1980.

Since the property was not son #1s primary residence, he will owe capital gains tax on his share of the gain. Figuring out who owned the property and how it got there is the first step in actually figuring out what the tax bill is going to be.