- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: See the instructions below to report and excluded your Se...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report exclusion of interest from series EE savings bonds?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report exclusion of interest from series EE savings bonds?

See the instructions below to report and excluded your Series EE interest.

You report Savings Bond interest from 1099-INT as interest income.

- Select Federal Taxes tab

- Select Wages & Income

- Choose I'll choose what to work on

- Select Interest and Dividends

- Locate the option Interest on 1099INT and click the Start /Update button

- Select "Yes" Did you receive any interest income?

- On the "Let Us Enter Your 1099-INT" screen, scroll down and press "I'll type it in myself"

- On the "Let's get the details from your 1099-INT or brokerage statement" screen, be sure to check the checkbox for "My form has info in more than just box 1 (this is uncommon)"

- Enter in the Savings Bond interest into Box 3

- You can now add Box 3 interest from your savings bonds.

- Continue along with answering the questions in the following screens and pressing "Continue"

- If you reach the "Did you cash any Series EE or I U.S. savings bonds?" screen, press "Yes" if you did

- On the "Did you use your U.S. savings bonds to pay for higher education expenses?" screen, press "Yes" if you used your savings bonds for educational costs

- If you qualify, TurboTax will help you to record your exclusion of savings bond interest for Form 8815 on a series of screens.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report exclusion of interest from series EE savings bonds?

I followed the above but am not getting the promptDid you cash any Series EE or I U.S. savings bonds?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report exclusion of interest from series EE savings bonds?

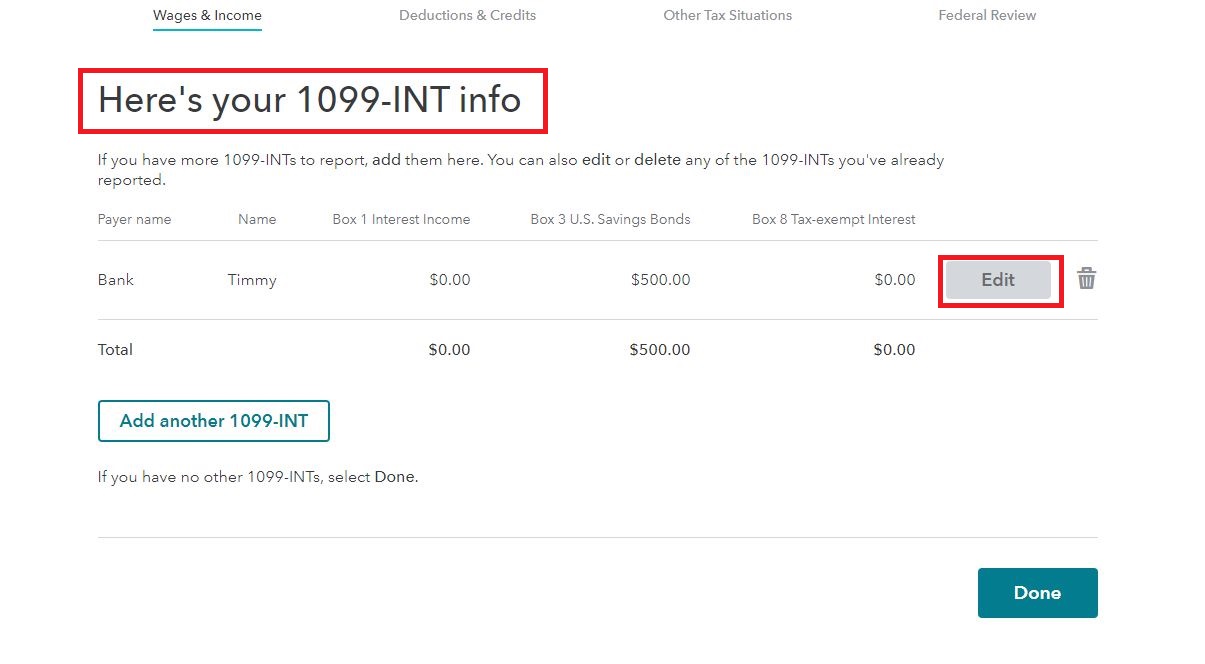

The question "Did you cash any Series EE or I U.S. savings bonds?" Should appear on the page after the "Here's your 1099-INT Info" summary page (see below).

If you are not seeing the question, please double-check your entries by selecting Edit next to the Savings Bond Interest entry. Be sure you entered an amount in Box 3 for Interest on U.S. Savings Bonds. If you did enter an amount in Box 3 and the question is not triggered, please delete the savings bond entry (using the trash can next to 'Edit') and re-enter the info.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report exclusion of interest from series EE savings bonds?

my exclusion from my income for interest for my I-bonds used fully for higher education is less than the actual interest that was used. eg. Turbo tax said my exclusion was 1,188 but the interest from the bond was 1519 and I used all from tuition for my son. So why the discrepancy?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I report exclusion of interest from series EE savings bonds?

Starting in 2021, there is a phase out of this exclusion based on income.

If your modified adjusted gross income is more than $83,200 if single, or $124,800 if married filing jointly, your exclusion will be limited.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

HollyP

Employee Tax Expert

smear

Level 2

Illia

Level 2

BME

Level 3

neutron450

Level 3