- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Schedule K-1, Section 199A, Box 20, Code Z: What do I enter in TTx

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1, Section 199A, Box 20, Code Z: What do I enter in TTx

I worked for a company and received a K-1.

Box 20, Code Z has three entries:

Ordinary Income : (negative value)

W-2 Wages: Amount much higher than my W-2 statement box 1.

Adjusted Basis of Assets: Amount slightly higher than the entry above (W-2 Wages).

The notes in the K-1 only say to consult your tax advisor on the calculation of the QBI deduction.

Any advise on what I need to enter in the turbo tax box?

thanks!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1, Section 199A, Box 20, Code Z: What do I enter in TTx

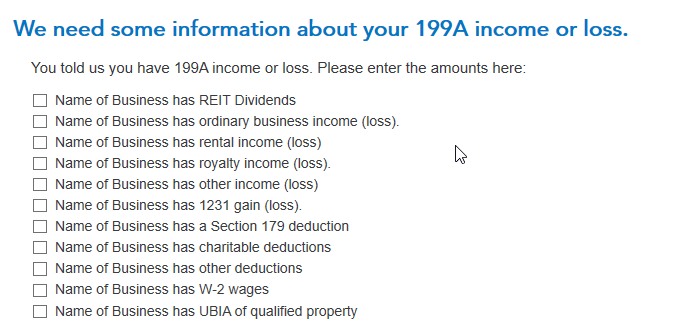

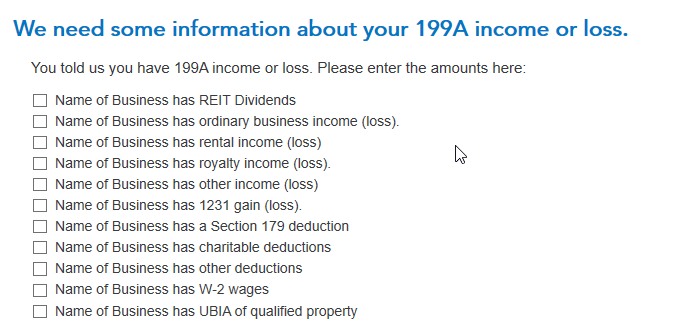

Enter the code Z when you enter the K-1 box 20 screen, but you don't need to enter an amount on that screen. Continue on, and you'll eventually find the screen "We need some more information about your 199A income or loss". When you check the box next to a category on that screen, a place will open up to enter the amounts from the Statement that came with your K-1. The applicable category (or categories) on this screen must be completed in order for your K-1 QBI information to be correctly input into TurboTax.

Note that the "Adjusted Basis of Assets" number goes on the "....has UBIA of qualified property" line.

To get back to the K-1 summary screen and find the Schedule K-1 to edit, click the "magnifying glass Search" icon on the top row, enter "k-1" in the search window and press return or enter, and then click on the "Jump to k-1" link to find the K-1 you need to edit.

Here is a screenshot of the "We need some information about your 199A income or loss" screen where you enter the information from your K-1 Section 199A Statement:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1, Section 199A, Box 20, Code Z: What do I enter in TTx

Enter the code Z when you enter the K-1 box 20 screen, but you don't need to enter an amount on that screen. Continue on, and you'll eventually find the screen "We need some more information about your 199A income or loss". When you check the box next to a category on that screen, a place will open up to enter the amounts from the Statement that came with your K-1. The applicable category (or categories) on this screen must be completed in order for your K-1 QBI information to be correctly input into TurboTax.

Note that the "Adjusted Basis of Assets" number goes on the "....has UBIA of qualified property" line.

To get back to the K-1 summary screen and find the Schedule K-1 to edit, click the "magnifying glass Search" icon on the top row, enter "k-1" in the search window and press return or enter, and then click on the "Jump to k-1" link to find the K-1 you need to edit.

Here is a screenshot of the "We need some information about your 199A income or loss" screen where you enter the information from your K-1 Section 199A Statement:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1, Section 199A, Box 20, Code Z: What do I enter in TTx

Thanks so much for the clarification of additional screens to view. That really cleared up the confusion.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1, Section 199A, Box 20, Code Z: What do I enter in TTx

This didn't work for me.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1, Section 199A, Box 20, Code Z: What do I enter in TTx

Nailed it! Thanks so much!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1, Section 199A, Box 20, Code Z: What do I enter in TTx

I have left the empty for the filed for Code Z - Section 199A Information and now it is asking for "Describe the Partnership". I have not selected any option but it is asking me to calculate at-risk amount via simplified or detailed method. I did LLC Partnership investment of 25k in Sept 2021.

Options:

I am required to pay supplemental business expense.....

I have passive activity losses......

All of my investment in this activity is at risk.

I have at-risk losses.......

I personally paid health insurance........

===================================

"Capital Contributed During 2021 $25000

Current Year Net Income (Loss) $-20913

Ending Capital Account $4087 "

I chose Simplified Method:

Enter your adjusted basis in LLC Partnership

Adjusted Basis on January 1, 2021 (what value to put in the field from K1)

I am not sure if I should put $4087 or $25000 initial investment

If put $4087 then it is saying dedutible loss may be as much as that amount for the current year and the nondeductible amount required to be carried forward to next year is $16826

Can you please help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1, Section 199A, Box 20, Code Z: What do I enter in TTx

My Statement A for Box 20, Code Z, has two numbers listed for ordinary income (loss). One is negative and, one is positive. On the "more information about 199A income" screen, the TT entry box only has room for one number. Do I add these two numbers and enter the result?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1, Section 199A, Box 20, Code Z: What do I enter in TTx

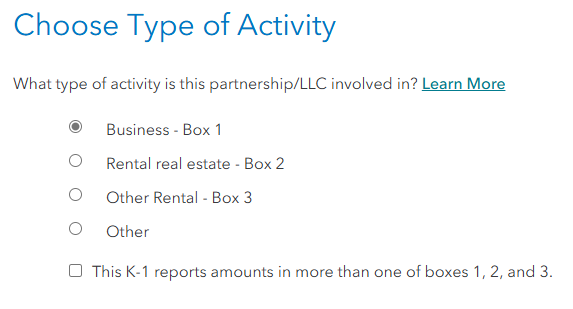

At the screen Choose Type of Activity, is there more than one income activity box reported? If so, Statement A may be reporting Statement A income (loss) for each.

If not, you may need to contact the issuer of the Statement A to clarify what income (loss) is to be reported.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

anthony3180

New Member

gma2003

New Member

univ0298

Level 2

jjmg2k

Level 2

dstautz1

Returning Member