- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Schedule K-1 Box 17 code N: Deferred Obligation

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 Box 17 code N: Deferred Obligation

When filling out my K-1, Box 17 Code N, Turbo Tax displays the following screen:

Follow these instructions to enter $$$$ shown as Code N Box 17 of the XXXX Schedule K-1

1. Read the instructions on K-1

2. Select Tax Tools in the toolbar. Next, select Tools, then Topic Search. Enter the specific topic included in your K-1 instructions in the search field

3. Select other taxes and enter $$$$ in the other tax field. Then select "Continue"

4. In the next screen, titled Describe the Other Tax, enter 453A(c) in the field. We'll take care of the rest.

I have a deferred obligation from the sale of a company that has not been paid yet. Topic Search does not have any topic for "deferred obligation" or "453A(c)".

The problem is that I cannot locate the screen in step #3 that has "other taxes" to enter the dollar amount. There is no screen where I can enter "453A(c)" as indicated in step #4. I'm stuck at this point and cannot go further.

How do I locate the proper screen to account for this? Following the on-screen instructions doesn't lead me to the proper screen that I need.

Thanks!!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 Box 17 code N: Deferred Obligation

Hi @bjmatusz !

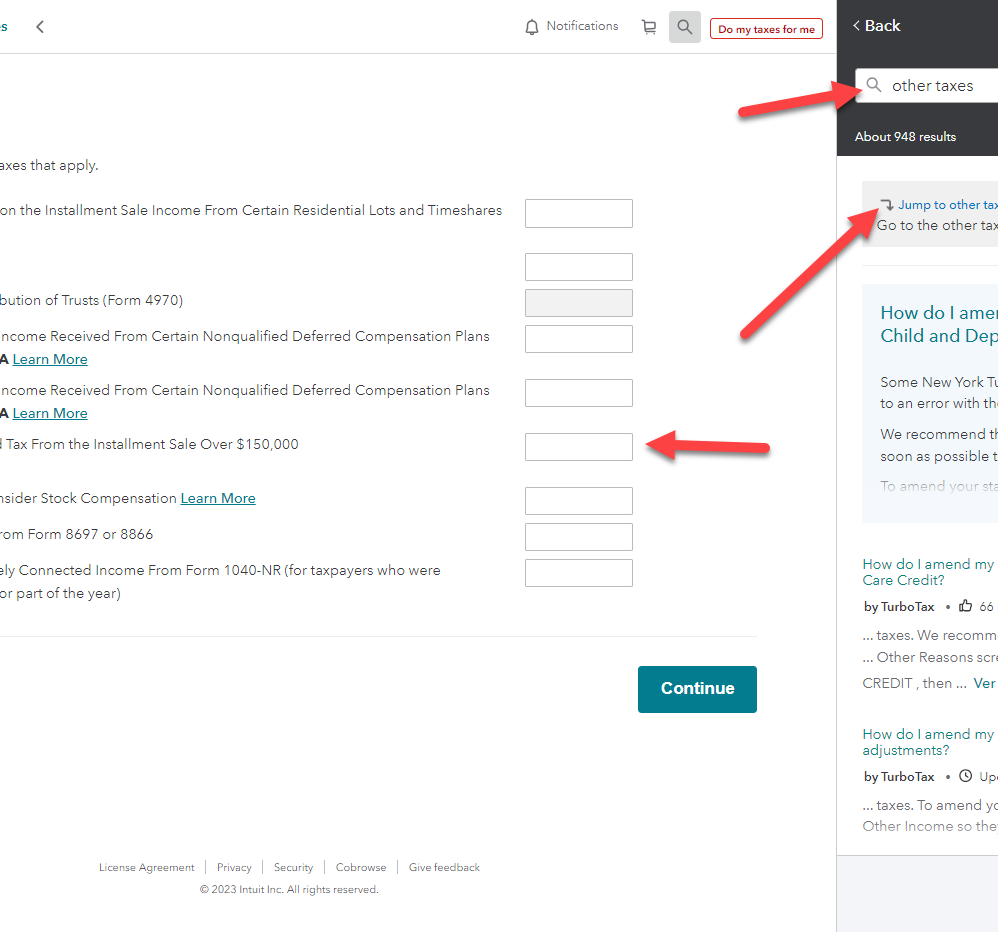

Please go to the magnifying class and search "other taxes" and select "Jump to other taxes" .

You should see the Section 453A(c) box about 3/4 of the way down.

Hope this helps!

Cindy

***Mark the post that answers your question by clicking on the "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 Box 17 code N: Deferred Obligation

***Mark the post that answers your question by clicking on the "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 Box 17 code N: Deferred Obligation

Thanks Cindy4, however, I'm not sure that applies in my case. That field seems to want the interest due from the installment sale.

Interest on Deferred Tax From the Installment Sale Over $150,000

(Section 453A(c))

What I have in Box 17 is the actual deferred obligation amount still owed to me from the sale of a company in 2021. If I add in that amount to the line item above, it seems to be treated as the total amount of interest due and not money still owed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 Box 17 code N: Deferred Obligation

According to this IRS direction, it seem you have to calculate the interest amount yourself as highlighted here when you open this link:

***Mark the post that answers your question by clicking on the "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 Box 17 code N: Deferred Obligation

Did you receive a form 6252 along with the K-1?

***Mark the post that answers your question by clicking on the "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 Box 17 code N: Deferred Obligation

Yes, I did receive Form 6252

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1 Box 17 code N: Deferred Obligation

Wonderful! You can use the form and follow the steps provided by the IRS here to determine the amount:

***Mark the post that answers your question by clicking on the "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Tina777

Returning Member

relativist42

Returning Member

mjtax20

Level 1

NanaNancy

Level 2

garys_lucyl

Level 2