- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: schedule D posted on the taxform $5000 says it can post no more than $1500 It's on line 7

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

schedule D posted on the tax form $5000 says it can post no more than $1500 It's on line 7

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

schedule D posted on the tax form $5000 says it can post no more than $1500 It's on line 7

I'm using Turbo Tax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

schedule D posted on the tax form $5000 says it can post no more than $1500 It's on line 7

Any ideas?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

schedule D posted on the tax form $5000 says it can post no more than $1500 It's on line 7

your filing status is MFS.

This limits your deduction this year to $1,500.

the rest is carried forward to next year

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

schedule D posted on the tax form $5000 says it can post no more than $1500 It's on line 7

Are you filing married filing separately?

Instructions for Schedule D (page D-4) states:

Capital Losses

You can deduct capital losses up to the amount of your capital gains plus $3,000 ($1,500 if married filing separately). You may be able to use capital losses that exceed this limit in future years.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

schedule D posted on the tax form $5000 says it can post no more than $1500 It's on line 7

Yes yes but what in saying it won't let me manually change it to $1500

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

schedule D posted on the tax form $5000 says it can post no more than $1500 It's on line 7

Please clarify what you are talking about.

1. Are you referring to line 7 on the 1040?

2. Are you saying that Schedule D has $5,000 on line 7 or 15?

3. Are you saying that the $1,500 is actually a -$1,500?

4. What are you trying to change to $1,500? the 1040 or Schedule D or something else altogether?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

schedule D posted on the tax form $5000 says it can post no more than $1500 It's on line 7

Line 7 on schedule D has $5000 entered on it. Turbo Tax did it. Turbo tax then tells me that I can not have more than $1500 on that line. I can not figure out how to change it to that amount. Highlighting and backspacing does not work so that I can not manually rectify the problem they caused.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

schedule D posted on the tax form $5000 says it can post no more than $1500 It's on line 7

I looked at my D line 7. That is the total of all losses and gains for short term. No $ sign shows with my numbers. So, does yours show 5,000 or -5,000.

The 1,500 limit does not come into play until line 21 on schedule D.

Is your line 7 not really on schedule D but a different form. i.e. Sched D worksheet, etc.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

schedule D posted on the tax form $5000 says it can post no more than $1500 It's on line 7

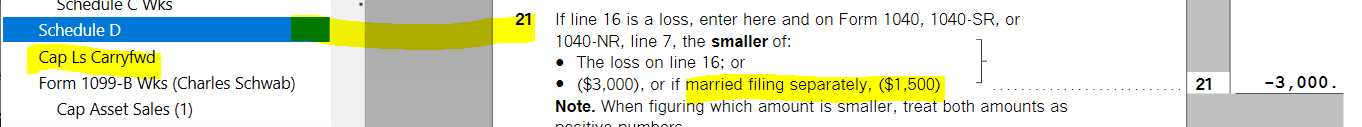

The program uses far fewer words to convey the message. The program is actually telling you: the amount on line 7 is the actual amount of loss but you are not able to claim the full amount, a limitation will be applied on line 21. In addition, you will have a carryover with another form.

You don't want to change line 7 that the program calculated.

You want to look down to line 21 for the actual limitation and you want to see the worksheet Cap Ls Carryfwd is in your forms with the remainder of the money.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

DavidRaz

New Member

rtoler

Returning Member

user17549282037

New Member

botin_bo

New Member

ripepi

New Member