- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Sale of a property in instalments.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of a property in instalments.

I sold a rental property and the payment received was split between 2 tax years - 2020 and 2021. When reporting the sale in Turbotax, I report the total 2 years amount where you report a real estate that was sold, and when I continue, there is a screen asking "Do you want to report this sale using the installment method?"

So, I choose Yes, and report the amount for 2021 payment.

However, On 1040 line 7 I see the entire amount instead of just the 2020 amount.

How do I resolve it?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of a property in instalments.

It depends. The calculation is much more complex on line 7 of the 1040 than the payment you received in 2020. There are many different factors involved.

I don't know if you have turbo Tax software but if you did, you can see how the gain was calculated and reported on line 7 by viewing form 6252. For sake of illustration, I am going to use a hypothetical example to show how line 7 income should look using the installment method.

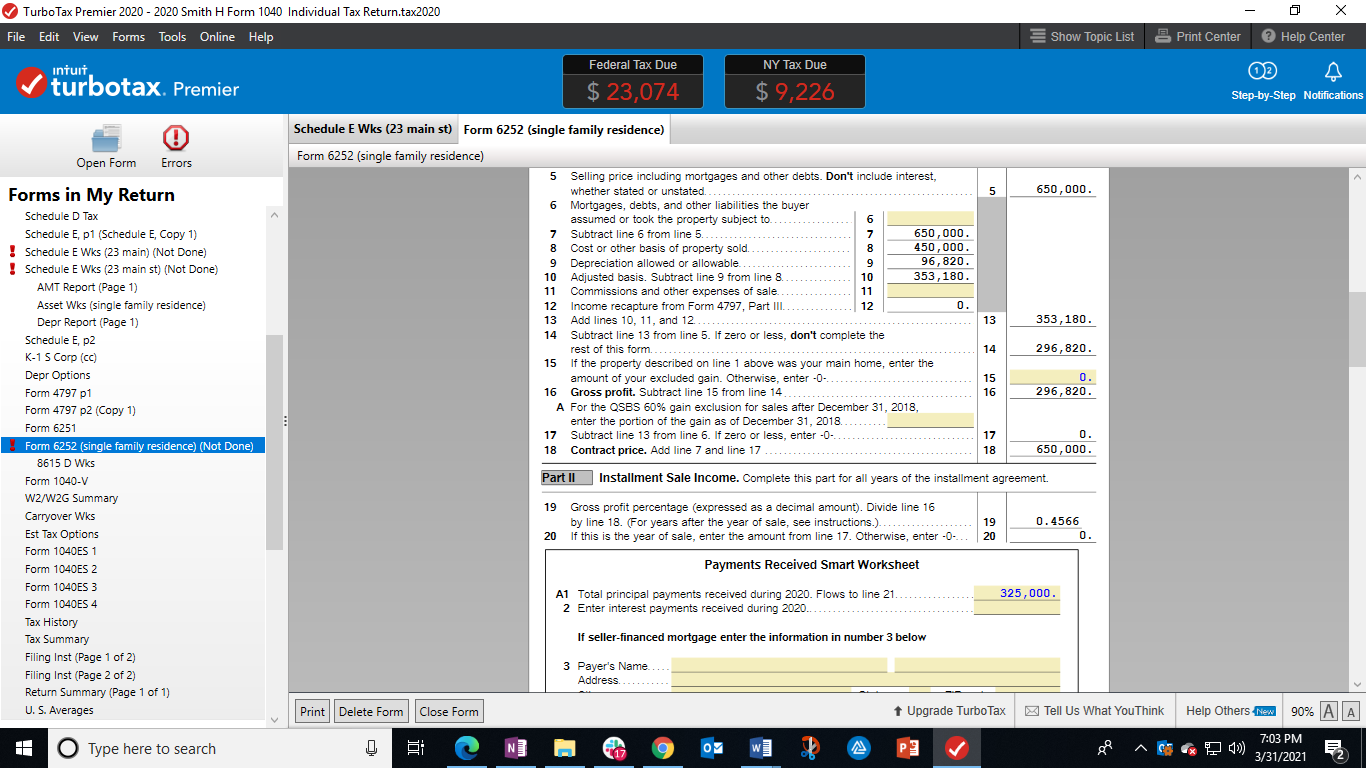

I have a rental house I bought in 2015 for $450,000. I sold in 2020 for $650,000 and reported that it was an installment sale. I reported I received $325,000 in 2020. Here is what the 6252 looks like. One of the factors is depreciation recapture, which you see in line 9 of this form. Also there is a gross profit percentage, which divides the net profit by the contract price. This is used in the calculation. This is what the screenshot looks like but don't leave because i have more to add after this screenshot. Also note the $325,000 payment I received this year.

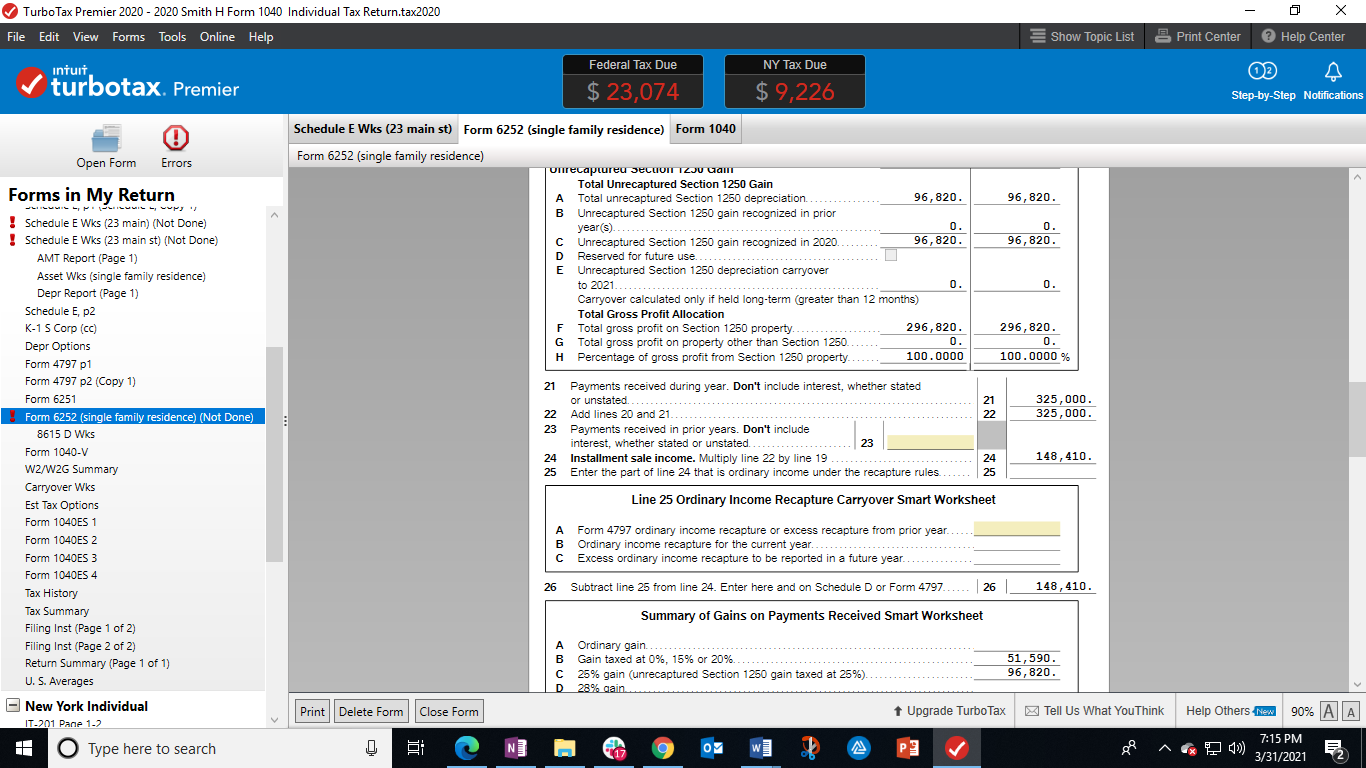

The second part of 6252 shows that if all the gains were reported in 2020, the full amount of the profit plus the depreciation would have been $296,820 as shown in the 1250 gains worksheet. But since 1/2 of the $650K was received this year, only $148,410 is claimed this year. here is the remainder of that screenshot.

Anyhow, this illustration demonstrates the complexity of the calculation. If you reported this listing the basis, when the house was sold, when you first rented it, and the proceeds. That is how Turbo Tax handles the installment sale. As I mentioned, if you are using the software, take a look at it and see if it resembles what I illustrated.

I hope this helps.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of a property in instalments.

Thanks, with your help I figured it out.

That brings up another question. When I input the foreign tax credit, TurboTax brings the total sale amount into the "Total foreign income for this category" and I suppose to key in the "Foreign qualified dividend and L.T. capital gain"

Do I key in the total or just the part of the amount realized in 2020?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of a property in instalments.

Since you are preparing for the 2020 tax return, you will enter the amount that pertains to year 2020. Next year, you will enter the amount for your 2021 portion.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

cm-jagow

New Member

user17524367965

Level 1

in [Event] Ask the Experts: Investments: Stocks, Crypto, & More

andredreed50

New Member

user17524181159

Level 1

NYtoFL

Returning Member