- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Roth conversion plus recharacterization on 8606

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Roth conversion plus recharacterization on 8606

Hi,

My wife has the following activity for her IRA- Traditional and Roth.

4/12/19- contributed 5500 to traditional deductible IRA for year 2018

01/28/20- contributed 6000 to traditional 'non'- deductible IRA for year 2019

02/03/20- Converted all of the balance to Roth IRA- reported on 1099-R received in 2020

03/01/2020- Contributed 6000 to Roth IRA directly by mistake- for year 2020

03/03/2021- Recharacterized 6000 plus gains of 1700 for the 2020 Roth contribution to Traditional IRA

03/04/2021- Converted the full 7700 recharacterized amount back to Roth

The form 8606 in Turbo tax shows me the following:

Line 1- 6000 - for year 2020 contribution

Line 2- zero- is this correct?

Line 4- blank

Line 8- blank - is this correct given that i did convert (and i answered that in the Turbo tax interview)

Line 6 - 12 - blank - are these correct?

Line 13- 6000

Line 14- 15 - blank

Line 16- 11590

Line 17- 6000

Line 18- 5590

Are the above correct? How does it take care of the recharacterization?

Should the conversion of deductible IRA to Roth IRA be reported anywhere specifically. I do see IRA distribution on Line 4 in Form 1040.

Thanks,

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Roth conversion plus recharacterization on 8606

"Did you make a contribution to traditional IRA in 2020" should this be "No". You will enter the Roth IRA contribution and during the interview select that you switched/ recharacterized the contribution.

- Open your return

- Click on "Search" on the top right and type “IRA contributions”

- Click on “Jump to IRA contributions"

- Select “Roth IRA”

- Answer “No” to “Is This a Repayment of a Retirement Distribution

- Enter the Roth contribution amount

- Answer “Yes” to the recharacterized question on the “Did You Change Your Mind?” screen and enter the contribution amount (no earnings or losses)

- TurboTax will ask for an explanation statement where it should be stated that the original $xxx.xx plus $xxx.xx earnings (or loss) were recharacterized.

- On the screen "Choose Not to Deduct IRA Contributions" answer "Yes"

"Value of all Traditional IRA as on Dec 2020"- zero is correct

Outstanding recharacterizations $6,000 is correct. Your tax amount went up because this affects the amount that is allocated as your basis for the 2020 conversion. Some of your basis is allocated to the 2020 conversion and some of the basis is allocated to future conversions/distributions (in your case it will be the 2021 conversion).

No, should not see 5590 added to your income. You stated you had $3,683 on line 18 (taxable amount) on Form 8606. This will show as taxable amount on line 4b of Form 1040 and be included in your taxable income. Next year on your 2021 tax return when you convert the balance of the traditional IRA only $4,093 will be tax free the rest will be included in your taxable income.

No, you do not need to create a 1099-R for the recharacterization. You will get a 2021 1099-R with code R and it belongs on the 2020 return. But a 1099-R with code R will do nothing to your return. Therefore, you can ignore it. You can only report a recharacterization as mentioned above.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Roth conversion plus recharacterization on 8606

No, your 8606 doesn't seem correct.

To clarify, you entered the $5,500 contribution as a nondeductible traditional IRA contribution on your 2018 tax return and $6,000 as a nondeductible traditional IRA contribution on your 2019 tax return, correct? This should have triggered the Form 8606 in those years and you have a basis of $11,500 for 2019.

Do not enter the 2020 $6,000 contribution as a traditional IRA contribution you will have to enter the recharacterization like this:

- Open TurboTax

- Click on "Search" on the top right and type “IRA contributions”

- Click on “Jump to IRA contributions"

- Select “Roth IRA”

- Answer “No” to “Is This a Repayment of a Retirement Distribution

- Enter the Roth contribution amount $6,000

- Answer “Yes” to the recharacterized question on the “Did You Change Your Mind?” screen and enter the contribution amount $6,000 (no earnings or losses)

- TurboTax will ask for an explanation statement where it should be stated that the original $xxx.xx plus $xxx.xx earnings (or loss) were recharacterized.

- On the screen "Choose Not to Deduct IRA Contributions" answer "Yes"

To enter the conversion from the 1099-R:

- Click on "Search" on the top right and type “1099-R”

- Click on “Jump to 1099-R”

- Click "Continue" and enter the information from your 1099-R

- Answer questions until you get to “What Did You Do With The Money” and choose “I moved it to another retirement account”

- Then choose “I did a combination of rolling over, converting, or cashing out money.” and enter the amount next to "Amount converted to a Roth IRA account"

- On the "Your 1099-R Entries" screen click "continue"

- Answer "yes" to "Any nondeductible Contribution to your IRA?"

- Answer the questions about the basis ($11,500) and value

You will have on line 14 Form 8606 the $6,000 basis from the 2020 contribution and will enter your 2021 conversion with the steps above on your 2021 tax return (enter $6,000 basis in step 8).

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Roth conversion plus recharacterization on 8606

Thanks DanaB27.

To your question:

"To clarify, you entered the $5,500 contribution as a nondeductible traditional IRA contribution on your 2018 tax return and $6,000 as a nondeductible traditional IRA contribution on your 2019 tax return, correct?"

I entered 5500 as 'deductible' for 2018 and that's why there was no 8606 in 2018. And 6000 as non deductible in 2019 for which I have a 8606.

I also have a page with explanation for recharacterization created for 2020 based on Turbo tax interview. But it shows 6000 on line 1. I did answer yes to Did you change your mind.

With the above information, which part on my 2020 8606 is incorrect, if at all?

I converted the 2018 deductible and 2019 non deductible contribution to Roth in Mar 2020.

And should my 8606 show the conversion to Roth on 8606 on line 8?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Roth conversion plus recharacterization on 8606

Your 8606 should show the $6,000 basis from 2019 on line 2.

Line 3 and 5 should be $12,000.

You should have a basis in line 14 since you recharacterized the 2020 contribution as a traditional IRA contribution and made it nondeductible.

It seems as if you entered the recharacterization correctly.

Please make sure you enter the prior basis, the value of the traditional IRA on December 31, 2020 and the outstanding recharacterization amount (step 9).

- Login to your TurboTax Account

- Click on "Search" on the top right and type “1099-R”

- Click on “Jump to 1099-R”

- Click "Continue" and enter the information from your 1099-R

- Answer questions until you get to “What Did You Do With The Money” and choose “I moved it to another retirement account”

- Then choose “I did a combination of rolling over, converting, or cashing out money.” and enter the amount next to "Amount converted to a Roth IRA account"

- On the "Your 1099-R Entries" screen click "continue"

- Answer "yes" to "Any nondeductible Contribution to your IRA?"

- Answer the questions about the basis $6,000 and value on December 31, 2020 and the outstanding recharacterization

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Roth conversion plus recharacterization on 8606

Thanks DanaB27.

I did what you suggested and just to summarize my activity:

I had a 5500 'deductible' IRA contribution for 2018 and a 'non' deductible IRA contribution of 6000 for 2019, made in 2020 for 2019.

I converted the deductible and non deductible IRA to Roth in 2020 (total amount being 11590). My1099-R for 2020 shows 11590 with code 02.

I contributed 6000 to Roth by mistake for 2020 in March 2020 and then recharacterized it to Traditional IRA and then reconverted all of it (with gains) to Roth in March 2021.

At the end of 2020, I had a Roth balance of 11590 after conversion from T-IRA plus 6000 from 2020 (which i later recharacterized in Mar 2021). I had no traditional IRA balance at the end of 2020.

Since I converted my deductible IRA balance from 2018 (5590) to Roth, I believe it would be taxable and Turbo tax was calculating it before I made the change of adding the basis. I shall confirm below, what it does now. Earlier it calculated a taxable amount of 5590 (for the converted amount) and added it to my income. But not anymore.

Here is what I did:

1. Went to my form 1099-R which was uploaded through my brokerage account and just checked it again

2. What did you do with the money- i replied "I moved it to another retirement account' and did a combination of rollover, converted etc and the Amount moved to Roth = 11590

3. Put money in HSA- No

4. Withdrawal due to Covid- No

5. Hit Continue

6. Did you take any disaster distribution- no

7. Any non deductible IRA contribution - YES (this is for previous year)

8. Total basis as of Dec 31, 2019- 6000. Is this correct? As this changes my tax amount. I think this is my basis for the 2019 non deductible IRA.

9. Value of all Traditional IRAs as on 31 Dec 2020 - 0 because I had no traditional IRAs. But not sure if my 2020 contribution to Roth (by mistake) and its recharacterization has a role to play here. IS this correct?

10. Let us see if we can reduce your early withdrawal penalty

11. Explain Garima's recharacterization- I did that.

Now the 8606 shows the following:

Line 1- 6000 - is this correct if i recharacterized from Roth to T-IRA and later converted it back to Roth

Line 2- 6000 - this seems to be from the 2019 basis

Line 3- 12000

Line 4- 0

Line 5- 12000

Line 6 -12 - blank

Line 13- 11590 - this does not look correct to me. How does it calculate this?

Line 14- 410

Line 15a- 0

Line 16- 11590

Line 17- 11590 - this was 6000 earlier and i think it 'was' correct because the basis for non deductible is 6k only out of the 11590 that i converted

Line 18- 0 - so it basically removed the tax on my deductible IRA conversion to Roth. This seems wrong. It does not do this in my 8606 (this case is for my wife's account. and i do not have a recharacterization)

I guess we need to figure out how to make the 'deductible' IRA contribution's conversion to be taxable and also have the right basis on 8606.

Really appreciate your patience and help.

Thanks,

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Roth conversion plus recharacterization on 8606

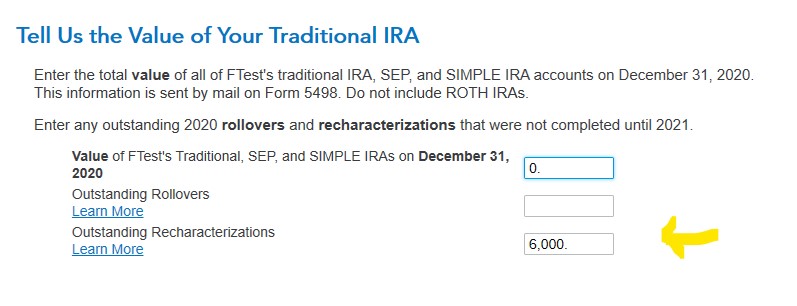

It seems that you forgot to enter the outstanding recharacterization amount from step 9:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Roth conversion plus recharacterization on 8606

Thanks for the input and your patience DanaB27.

I added 6000 for my recharacterization as outstanding and it changed the 8606 a bit and also the taxable part. However, I am not sure why my recharacterization would affect the taxable income at all. The entire deductible contribution to T-IRA should have been taxable when i converted it to Roth in 2020. And this recharacterization was for 2020 contribution so it should have no tax impact as this was a non deductible contribution anyway.

Here is what the 8606 is showing now:

Line 1-6000

Line 2- 6000

Line 5-12000

Line 6-12- blank. Line 10 has 'x' on it.

Line 13- 7907 * - not sure how it calculated this based on adding outstanding recharacterization amount.

Line 14- 4093

Line 15a- 0

Line 16-11590 - which is what i converted to Roth on 2/3/20 (for 2018 and 2019 contributions) before contribution to 2020 Roth in Mar 2020.

Line 17- 7907

Line 18- 3683

These numbers are not making sense to me. I should have a taxable amount of 5590 for the deductible IRA conversion to Roth on line 18.

Thanks again for your help. Appreciate what you do on this forum.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Roth conversion plus recharacterization on 8606

I explained this to you when you asked a few days ago.

There should be a * next to line 15 on the8606 that means the calculations were done on the "Taxable IRA Distribution Worksheet" and not the 8606. View that worksheet to see how line 13 was arrived at.

Line 13 is the non taxable part.

If you converted the entire Traditional IRA to a Roth so tat no Traditional IRA existed at the end of 2020 then line 14 should be zero and the taxable amount would be the total 1099-R box 1 minus $12,000.

Line 14 suggests that you entered a non zero 2020 year end value that would be in the above mentioned worksheet line 4.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Roth conversion plus recharacterization on 8606

Thanks macuser_22.

Just saw the Taxable IRA distribution sheet and it has the following. At the bottom of this post is what I answered to different questions on Turbo tax.

- Line 4- 6000 - in reply to the question on 'Value of all Traditional IRA as on 31 dec 2020' I replied as zero for value of traditional IRA and 6000 for outstanding recharacterizations as suggested on this post. Are these right? I only had Roth contributions at the end of 2020- 11590 from my conversion in Feb 2020 and 6000 from my new Roth contribution in 2020 done in Mar 2020 (which I recharacterized in Mar 2021 because that 2020 Roth contribution was a mistake), so a total of 17590.

- Line 6- 11590

- Line 7- 17590

- Line 8- .68221

- Line 9- 7907 - which is 11590* .68221. This does not seem correct as this should be 12000 (for my non T-IRA deductible part from 2019 and 2020)

- Line 12- 3683

"If you converted the entire Traditional IRA to a Roth so tat no Traditional IRA existed at the end of 2020 then line 14 should be zero and the taxable amount would be the total 1099-R box 1 minus $12,000."

My response - I do not know how to interpret this- as i said above I had no traditional IRA as of Dec 2020 but I recharacterized my 2020 Roth IRA to T-IRA and then converted it back to Roth in Mar 2021.

"Line 14 suggests that you entered a non zero 2020 year end value that would be in the above mentioned worksheet line 4."

My response - As per above I am not sure what I should put as year end value. I entered 0 for the T-IRA value and 6000 as outstanding recharacterizations.

Here is what I did on the questionnaire :

Here is what I did:

1. Went to my form 1099-R which was uploaded through my brokerage account and just checked it again

2. What did you do with the money- i replied "I moved it to another retirement account' and did a combination of rollover, converted etc and the Amount moved to Roth = 11590

3. Put money in HSA- No

4. Withdrawal due to Covid- No

5. Hit Continue

6. Did you take any disaster distribution- no

7. Any non deductible IRA contribution - YES (this is for previous year)

8. Total basis as of Dec 31, 2019- 6000. Is this correct? As this changes my tax amount. I think this is my basis for the 2019 non deductible IRA.

9. Value of all Traditional IRAs as on 31 Dec 2020 - 0 because I had no traditional IRAs. But not sure if my 2020 contribution to Roth (by mistake) and its recharacterization has a role to play here. IS this correct?

10. Let us see if we can reduce your early withdrawal penalty

11. Explain Garima's recharacterization- I did that.

Eventually I think and I may be wrong, that all of my deductible IRA conversion to Roth in Feb 2020 should be taxable, so the taxable amount should just be 5590. I do not know what impact the recharacterization would have on Part 1 of 8606. And what should it show in Line 1, 2 and 13.

Thanks for all your guidance and patience.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Roth conversion plus recharacterization on 8606

It seems as if you entered everything correctly.

Yes, the total basis of December 31, 2019 is $6,000.

Yes, you entered $0 for the traditional IRA value and 6000 as outstanding recharacterizations correctly.

No, $7,907 for line 9 for the IRA distribution worksheet is correct. For each distribution/conversion an amount is allocated towards your basis. You didn't convert the recharacterized amount until 2021 therefore some of the basis is allocated to that amount.

When you file your 2021 tax return to report the conversion you will have the rest of basis $4,093 allocated to that conversion ($4,093 + $7,907 = $12,000 total basis used) assuming the traditional IRA balance will be $0.

Please be aware that the recharacterized amount has to be considered that is why you had to enter it as outstanding amount. If you didn't make the mistake that amount would have been in the traditional IRA account and you would have had a balance left in the account that you converted in 2021.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Roth conversion plus recharacterization on 8606

Hi,

I am still struggling with this. See my previous post for details.

At the end of Dec 2020, I had no T-IRAs but had a Roth which I recharacterized in Mar 2021. So what should i enter to the question on:

"Did you make a contribution to traditional IRA in 2020"- should this be Yes or No (i made a roth contribution by mistake and recharacterized)

"value of all Traditional IRA as on Dec 2020"- I entered zero. is this right?

Outstanding recharacterizations- I entered -6000 and my tax amount went up. Not sure why it would for my 2020 Roth contribution which was recharacterized in Mar2021.

But when I entered the distribution from my 1099-R, which has a total of 11590 (mix of deductible and non deductible IRA conversion) , it said I owe no tax. That does not sound correct since I had a 5590 conversion of deductible IRA (out of 11590). Should I not see 5590 added to my income?

Instead i see that it calculates the non taxable part differently and says that it is 7907 non taxable. How can it reduce tax on the deductible IRA contribution to Roth?

And do i need to create a form 1099-R for 2020 for the recharacterization?

Thanks for your help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Roth conversion plus recharacterization on 8606

Thanks DanaB27.

From your response, "When you file your 2021 tax return to report the conversion you will have the rest of basis $4,093 allocated to that conversion ($4,093 + $7,907 = $12,000 total basis used) assuming the traditional IRA balance will be $0." I understand that because i contributed to a Roth in 2020 and recharacterized it to T-IRA and it was not converted to a Roth until 2021, it is still a non deductible Traditional IRA and has a basis of 4093 for next year. So next year even though i converted this 6000 from 2020 to Roth, my basis would be 4093 only and therefore i would have to pay more tax in 2021 on this non deductible IRA conversion to Roth. So effectively my tax on conversion of 5590 deductible IRA in 2020 is spread over two years even though I converted all of it in 2020. IS that correct? Just want to make sure that I am not underpaying the tax for the full conversion of my deductible IRA.

And form this I understand that the timing of the conversion to Roth does not matter. It is all the contributions made in the entire year and then a pro-rata is done?

Thanks again,

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Roth conversion plus recharacterization on 8606

"Did you make a contribution to traditional IRA in 2020" should this be "No". You will enter the Roth IRA contribution and during the interview select that you switched/ recharacterized the contribution.

- Open your return

- Click on "Search" on the top right and type “IRA contributions”

- Click on “Jump to IRA contributions"

- Select “Roth IRA”

- Answer “No” to “Is This a Repayment of a Retirement Distribution

- Enter the Roth contribution amount

- Answer “Yes” to the recharacterized question on the “Did You Change Your Mind?” screen and enter the contribution amount (no earnings or losses)

- TurboTax will ask for an explanation statement where it should be stated that the original $xxx.xx plus $xxx.xx earnings (or loss) were recharacterized.

- On the screen "Choose Not to Deduct IRA Contributions" answer "Yes"

"Value of all Traditional IRA as on Dec 2020"- zero is correct

Outstanding recharacterizations $6,000 is correct. Your tax amount went up because this affects the amount that is allocated as your basis for the 2020 conversion. Some of your basis is allocated to the 2020 conversion and some of the basis is allocated to future conversions/distributions (in your case it will be the 2021 conversion).

No, should not see 5590 added to your income. You stated you had $3,683 on line 18 (taxable amount) on Form 8606. This will show as taxable amount on line 4b of Form 1040 and be included in your taxable income. Next year on your 2021 tax return when you convert the balance of the traditional IRA only $4,093 will be tax free the rest will be included in your taxable income.

No, you do not need to create a 1099-R for the recharacterization. You will get a 2021 1099-R with code R and it belongs on the 2020 return. But a 1099-R with code R will do nothing to your return. Therefore, you can ignore it. You can only report a recharacterization as mentioned above.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Roth conversion plus recharacterization on 8606

Thanks DanaB27 and mac_user22.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Roth conversion plus recharacterization on 8606

Hi DanaB27,

I am sorry I am going back to my last year's situation as it has implications for my 2021 return too. And thanks for your help in resolving it last year.

Here is a summary of the case:

I have the following activity for my wife's IRA- Traditional and Roth.

4/12/19- contributed 5500 to traditional deductible IRA for year 2018

01/28/20- contributed 6000 to traditional 'non'- deductible IRA for year 2019

02/03/20- Converted all of the balance to Roth IRA- reported on 1099-R received in 2020

03/01/2020- Contributed 6000 to Roth IRA directly by mistake- for year 2020

03/03/2021- Recharacterized 6000 plus gains of 1757 (total 7757)for the 2020 Roth contribution to Traditional IRA in 2021 before tax date

03/04/2021- Converted the full recharacterized amount back to Roth- total of 7481

03/15/2021- Contributed 6k to non deductible traditional IRA for 2021

03/16/2021- Converted 6k from traditional IRA to Roth for 2021

Balance in traditional IRA at the end of 2020- 0

Her 2020 IRA statement had 11590 as distribution (including 90 of income) and all of it taxable.

2021 traditional IRA statement has a total of 13481 as distribution and taxable. This has 7481 of the amount that i reconverted to Roth on 03/04/2021. But not sure why the total is 13481; which 6k is it adding to the total given that I did not make a contribution to Traditional IRA directly in 2020.

Her 2020 return, with your help, had the following details on 8606:

Line 1- 6000

Line 2- 6000

Line 3- 12000

Line 4-0

Line 5-12000

Line 6-12- 0

Line 13-7907 (using a factor of 0.68)

Line 14- Basis in Trad IRA for 2020 and earlier- 4093

Line 15- 0

Line 16-11590

Line 17- 7907

Line 18- Taxable portion- 3683

So now I have to take care of three things in the 2021 return:

1. The conversion of the above amount with remaining basis of 4093- how do i enter that?

2. Conversion from Roth to IRA and back (for the mistake i made by contributing to Roth directly for 2020 but converting in 2021)

3. Contribution to non deductible IRA for 2021 and then converting it to Roth

How do I enter all this in Turbo Tax Premier to get the right calculations?

Thanks so much,

RG

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

michelleb193

Level 1

dpreas2017

Level 3

user17670490862

Level 1

JeffJaeger2007

Returning Member

LMTaxBreaker

Level 2