- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: "Returns including one instance of Form 568 cannot be filed electronically at this time." How...

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

"Returns including one instance of Form 568 cannot be filed electronically at this time." How come?

Hello,

After spending couple of days troubleshooting the issue with Turbotax support, I reported this issue to Office of the President at Intuit and a representative reached out to their development team to resolve this issue. I was told that the fix only efiles the federal and state forms. It does NOT efile 568 form since they currently don't have the ability to do that. Please make sure to paper mail your 568 form like you did last year. You also need to fill the waiver form online since we are not electronically filing the 568 form.

Hope this helps.

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

"Returns including one instance of Form 568 cannot be filed electronically at this time." How come?

I filed the tax returns and have the pdf summary of filed returns.

"Nowhere" does it say that I need to mail the 568 form.

Can anybody who already filed check their pdf to confirm this, please , please?

Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

"Returns including one instance of Form 568 cannot be filed electronically at this time." How come?

This is neilh1 from 4 posts ago. I filed on 3-22-2020. Review that post before you read this.

I did what garys_lucyl advised and looked on page 1 of my Electronic Filing Instructions for your 2019 California Tax Return. You can get to this if you select the Forms Icon in the top right corner, then scroll to bottom of the left pane, and select Filing Instr.

Sure enough, it says I have to request a waiver and file 568 by mail.

Thank you garys_lucyl

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

"Returns including one instance of Form 568 cannot be filed electronically at this time." How come?

Update from 03/31/2020, in case it helps anyone

- SMLLC, I was able to file Federal and CA directly via Turbotax Home and Office.

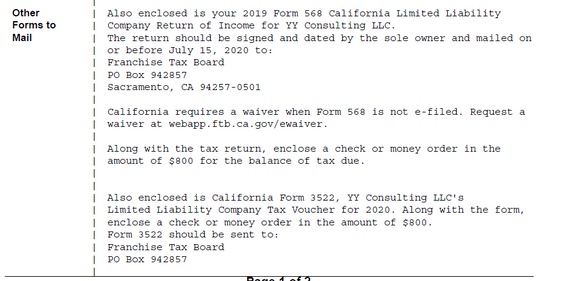

- However, on the final document that you can print out for record under "Electronic Filing Instructions for your 2019 California Tax Return", it says the following

- I talked to ftb.ca.gov, and the agent told me that

a) it is required to e-file 568 (unless you request a waiver), and

b) to e-file you need to find a qualified tax provider or software (apparently Turbotax is not one)

- I signed up CalFile as recommended on the state website , but it's only for individual (not for business), looks like there are several software that will allow you to e-file 568 which probably cost money

https://www.ftb.ca.gov/tax-pros/efile/appr[product key removed]are.html

- I just sent in the Business Entity e-file Waiver Request and see if I will get approved to be able to mail my 568.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

"Returns including one instance of Form 568 cannot be filed electronically at this time." How come?

I have just talked to TuboTax support and it turns out I have to mail physical copy of the 568 form, and also get the online waiver.

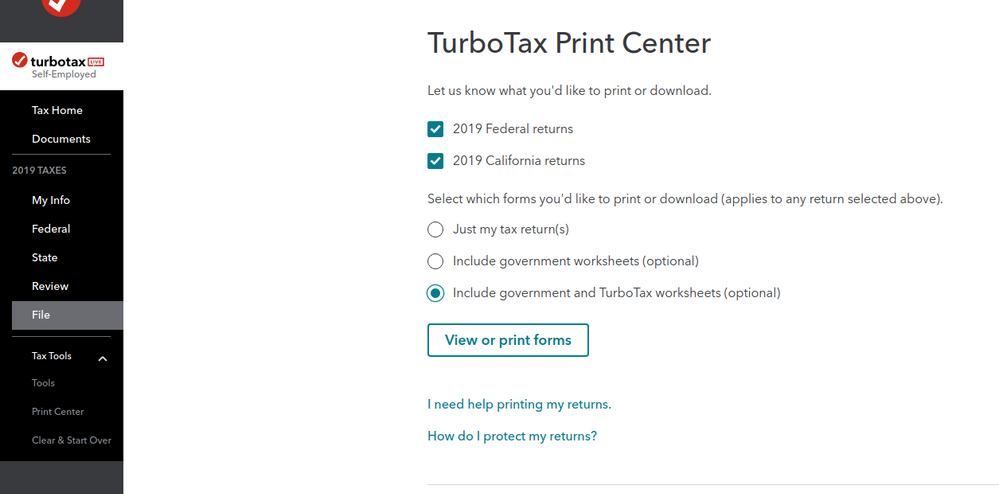

The confusing part had been that the tax return "printout" PDF didn't include instructions (as I hadn't clicked on the right buttons.) So, went in again (by the trick of "Add State"), then went to the Tools / Print Center and printed the PDF with instructions this time. And indeed, there are instructions for mailing in the form 568.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

"Returns including one instance of Form 568 cannot be filed electronically at this time." How come?

@Dino_ @sstax @Pixelsage @neilh1

and others.

I am unable to see this information in my return. (I have already filed it).

Are you folks referring to getting the print out "before" filing the return and you received instructions?

I have no way to do what Dino suggested..

I am getting the tax returns and it does not mention the instructions everyone is talking about.

Please educate, thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

"Returns including one instance of Form 568 cannot be filed electronically at this time." How come?

@mrakeshm , you can get back to the documents by clicking on the "Add State" button. You don't actually need to add a state return but that's an action that gets you back in.

Hope that helps.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

"Returns including one instance of Form 568 cannot be filed electronically at this time." How come?

Hi! Were you able to enter the business code into the field on Form 568, Line J, Principal business activity code (Do not leave blank)? It doesn't allow me to type anything. Please advice. Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

"Returns including one instance of Form 568 cannot be filed electronically at this time." How come?

I can't type in the business code either. Although since the form has to be printed and filed, I guess I can just fill it in by hand after I print it out. Unless someone know show to get it to fill in?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

"Returns including one instance of Form 568 cannot be filed electronically at this time." How come?

CA Franchise Tax Board's list of supported e-filing software does not include TurboTax: https://www.ftb.ca.gov/tax-pros/efile/appr[product key removed]are.html . But what is a good alternative?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

"Returns including one instance of Form 568 cannot be filed electronically at this time." How come?

Thank you for posting this (I know I'm replying months later). The 2019 version of Turbotax did not do what every prior year of the program has done, which is to have an entire section dedicated to the filling, printing, and filing of 568 and 3522 for CA SMLLCs during the interview process. I'm glad I already knew those needed to be filed because I would otherwise not have seen that "other forms to mail" on page 186 our of 253 pages worth of my tax return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

"Returns including one instance of Form 568 cannot be filed electronically at this time." How come?

Will we be able to use TurboTax to efile California Form 568 for tax year 2020?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

"Returns including one instance of Form 568 cannot be filed electronically at this time." How come?

No, you can't e-file California Form 568 in TurboTax for tax year 2020.

Please see the California Franchise Tax Board's Forms you can e-file for individuals page and TurboTax's State forms availability table for TurboTax individual (personal) tax products page for more information.

LLCs classified as a aartnership file Form 568, Limited Liability Company Return of Income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

"Returns including one instance of Form 568 cannot be filed electronically at this time." How come?

Why TurboTax tells me to wait for Form 568, p1-2 to be ready if I'm failing schedule C as a sole proprietorship and not LLC for 2020?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

"Returns including one instance of Form 568 cannot be filed electronically at this time." How come?

You will need to review your input in the state section of the program to ensure you have not selected that the business is a single member LLC.

- Select State in the black panel on the left hand side of your screen when logged into TurboTax.

- This will take you to a screen titled Let's get your state taxes done right. Click continue on this screen.

- You will see the following screen titled Status of your state returns. Select Edit to the right of California.

Proceed through the screens until you see the state asking questions about your business. When you see the screen titled Business Summary, be sure to select Edit so you can correct the input here.

The following screen will ask you if your business is owned by a single member LLC?. Be sure to select No to remove the LLC classification on your state tax return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

bradymarlayna

New Member

stilou3071

New Member

alexjeannebarrett

New Member

user17705050931

New Member

kggirl21

New Member