- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Reporting passive loss carryover on rental property that converted to home in prior year

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reporting passive loss carryover on rental property that converted to home in prior year

passive loss carryover on form 8582

Hi, I had two rental properties. Property A had rental income and Property B had passive loss carryover on form 8582. Property B became our home current year. Where do I enter the passive loss carryover on Property B in current year tax return? In the rental income section, there were three selections: Sold or disposed of property, converted home to rental or rental to home, or rented part of your home. None of them applied as the rental to home was converted last year. And since I didn't rent Property B at all in current year, it says remove this property. I need to enter the passive loss carryover on Property B in order to offset the rental income on Property A.

Note: prior year tax return not filed NOT using Turtotax.

Thank you.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reporting passive loss carryover on rental property that converted to home in prior year

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reporting passive loss carryover on rental property that converted to home in prior year

Check the appropriate boxes in the Property Profile section.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reporting passive loss carryover on rental property that converted to home in prior year

Hi,

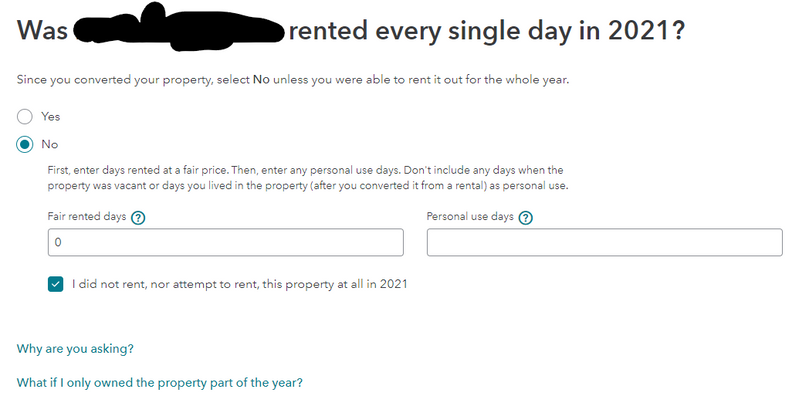

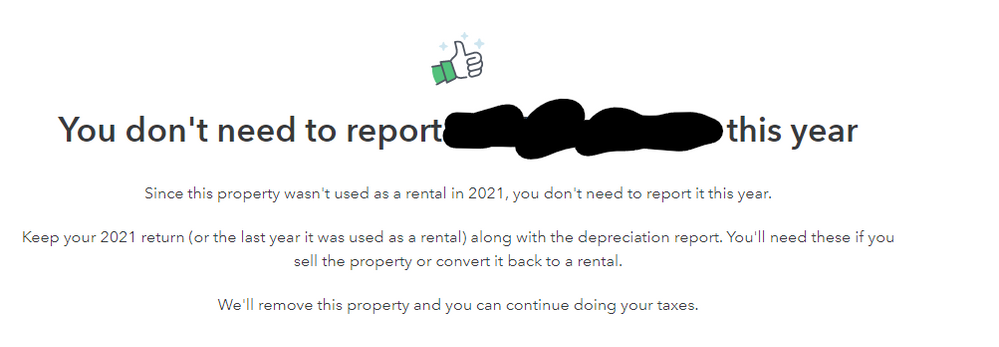

Thank you for your help. However, on the online version I use, I actually don't even see "Property Profile" where it allows me to enter Carryovers. After selecting "I converted this property from a rental to personal use in 2021", then it asks was Property rented every single day in 2021. The answer is No, and I checked "I did not rent, nor attempt to rent, this property at all in 2021". Then I clicked continue, then it says I don't need to report this property this year.

Very bizarre that it won't allow me to enter Loss Carryovers. Is it because I'm using the online version? By the way, I'm using the Self-Employed version which should also includes the rental investment functionality.

Please advise. Thank you for your help and assistance.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reporting passive loss carryover on rental property that converted to home in prior year

Ok ... if this property was converted to personal use in 2020 then you have nothing to report on the 2021 return for this property. The unallowed passive loss is now part of the information needed if you ever put the property back into rent or you sell the property.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reporting passive loss carryover on rental property that converted to home in prior year

Hi,

Is the rental loss carryover attached to a specific property or can it be used to offset income from any other rental property? As I mentioned in my original post, we have two properties, one property was converted from rental that became primary residence in 2020 (this property has loss carryover) and one income producing rental property. My understanding is that I can use the loss carryover from now the primary residence to offset income from the other rental property.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

dinesh_grad

New Member

NMyers

Level 1

Darenl

Level 3

jasonzyang

New Member

optca50

Level 3