- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Received 1099-k from PayPal of $712 (this money is refund for the items I bought and returned...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received 1099-k from PayPal of $712 (this money is refund for the items I bought and returned personally)

What's the best way to report this kind of 1099-K from PayPal? I don't want to pay taxes on it.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received 1099-k from PayPal of $712 (this money is refund for the items I bought and returned personally)

If the 1099-K is only reporting refunds for items you returned, then don't report it on your tax return.

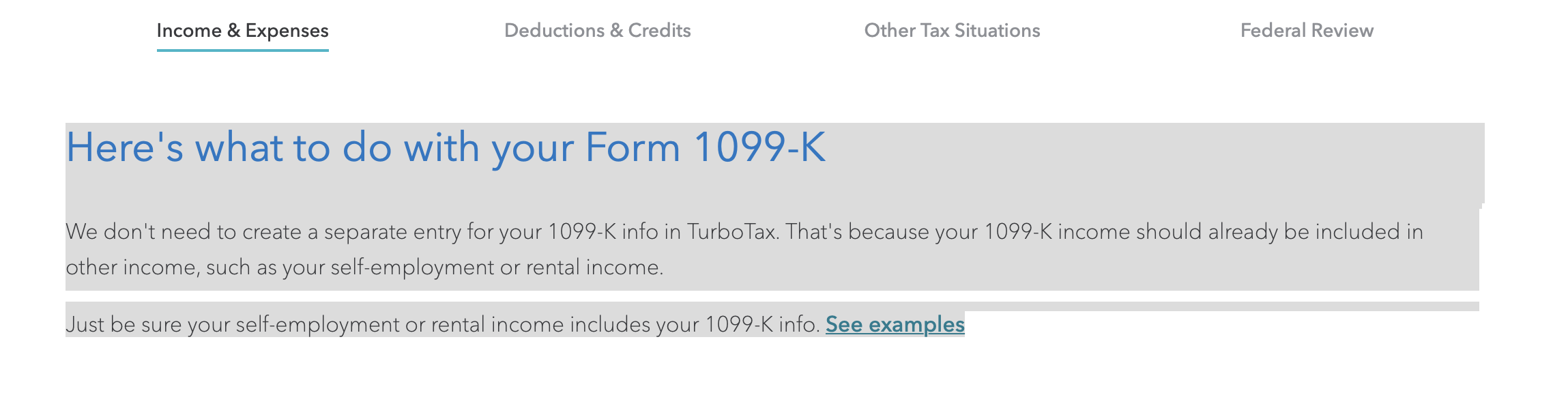

The IRS doesn't "match" 1099-Ks to your tax return - at least not yet. Unlike 1099-MISCs and 1099-NECs, they aren't expecting to see a separate "1099-K" entry in your tax return. In fact, there isn't a dedicated place in TurboTax to enter a Form 1099-K (see screenshot, below)

If the amounts reported on a 1099-K are unrelated to business activities (e.g. credit card receipts, online sales for profit, rental income such as AirBnB), you do not need to report them. Keep the 1099-K with your other 2020 tax documents, along with any documentation that it was only issued to report refunds for returned purchases.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

dave-mcmahon

New Member

Reynan2124

New Member

bees_knees254

New Member

Newby1116

Returning Member

galintheboonies

New Member