- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Please help! Accidentally submitted a Non-Filer form

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please help! Accidentally submitted a Non-Filer form

This is a systematic problem. Too many people committed this error for it to go unanswered. We need a workaround so we can file our taxes and get our refunds!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please help! Accidentally submitted a Non-Filer form

If you missed all the warnings and filed a non filer return anyway then your ONLY option for 2019 will be to mail in an amended return ... TT cannot change the IRS rules on this subject ... How to File an Amended Tax Return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please help! Accidentally submitted a Non-Filer form

Thank you so much!! It worked.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please help! Accidentally submitted a Non-Filer form

What worked? Please elaborate for us.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please help! Accidentally submitted a Non-Filer form

I just Founded the solution.log in to NON FILTER website ,delete the form, Click on Start over.It should go to a different menu.go to File 2019 tax return or something like that.then you should see a 1040 form.Transfer all form and Information from your Turbo tax return,You can add any form you need.It let me to efile it.Let Us know if it worked for You!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please help! Accidentally submitted a Non-Filer form

And to be clear here .... prior to deleting and starting over, you had attempted to efile your 2019 return and it was rejected due to "duplicate ssn" .... which we all now know is because of our error(s) using the non-filer:enter payment details form which created a nil 1040.

If that's true, if you were indeed blocked from efiling a REAL 2019 because of the duplicate ssn, and you went back to the same free fillable forms site, deleted and started over with an ACTUAL 1040 and all of her bells and whistles ... and you pressed submit and that 1040 WENT ... and was not immediately stonewalled with a DUPLICATE SSN message .... da heck? That defies everything I've read to this point.

Have you received any type of confirmation that they accepted it??

I went, deleted, and am now staring into a very LEGIT looking 1040.

Please, please please update us as new info becomes available to you.

Experts: please, if you have any insight into this please chime in.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please help! Accidentally submitted a Non-Filer form

Before and after doing this go to IRS and check your refund status.Also should use 1$ for return amount .Yes it did go thru for me but no email no confirmation and status is still pending on irs website.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please help! Accidentally submitted a Non-Filer form

I am not concerned about the stimulus money any longer. Mine came earlier this week. The non filer worked great! But the mistake has cost me the option of efiling a near $5k refund return due to the system detecting a duplicate ssn when turbo try's to submit it.

Maybe itll be a nice christmas, at least. If then.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please help! Accidentally submitted a Non-Filer form

WRONG #1: "Also, you will need to file Form 1040X, rather than Form 1040. "

1) One does not file a 1040X INSTEAD of a 1040. Wrong wrong wrong. You still file a 1040... and then ADD or subsequently file, after the fact, a 1040X amendment. The 1040 reports a complete accounting, whereas a 1040X reports ONLY the information that is being AMENDED. When amending with a 1040X, you file BOTH.

2) Many people submitted their info to the IRS using the "non-filer" form, because for the first 2 weeks that the feature was available on the IRS web site, it appeared that people who had not filed a 2019 YET, could use this form to make sure their address and Direct Deposit info was correct. So many people used the feature for this purpose. They hadn't filed a 2019 return YET, and wanted to make sure the IRS had their correct info to receive their stimulus check.

It was after TWO WEEKS of poor information on the IRS web site, did they add a yellow colored "warning box" instructing people to not use this feature just to update their information.

BUT... now that you have alerted the IRS that you are a non-filer, you will not be able to submit via e-file or through TurboTaxes e-file feature, because the IRS rejects your e-file believing it to be a fraudulent SECOND FILING.... which it is not. But, the IRS system, "THINK" that it is. You'll need to send in a paper return by snail-mail.

The 1040X Amended Return form, IS OF NO USE for this purpose. The 1040X for is ONLY for "financial" modifications. There is no provision on that form to change your IRS status from "Non-filer" to "Yes-filer".

At this time, I am unaware of any mechanism for changing your status from non-filer to filer. I am sending in my paper return with a 4 sentence cover letter to alert the IRS why they are receiving a paper return from me. It should be obvious when they receive the paper return, and have no other return on file AT ALL, what the situation is and accept the paper return. Fingers crossed.

WRONG #2: "If you used the TurboTax site to submit your return, you will be able to use your TurboTax account that you created to work through your amended return. "

1) TurboTax CAN NOT be used to file an amended return. An amended return CAN ONLY be filed by paper via snail-mail.

WRONG #3: "If you used the TurboTax site to submit your return, you will be able to use your TurboTax account that you created to work through your amended return. "

1) Once you declare your return as "Complete" in TurboTax, TurboTax "LOCKS you out" of making any other changes to your return. You can't fix it, you can't change it, you can't even access the form questions. NOTHING.

(It MAY be possible to phone TurboTax Support and have them "re-set" your account so that you can retroactively make changes. They can do this for other scenarios but I haven't verified for this scenario. BUT... if a return has been e-filed already, you CAN NOT make any additional changes via the TurboTax software.)

2) For people who accidentally submitted on the IRS website that they are a "non-filer" when in fact they ARE trying to file a 2019 return... these people will NOT be able to e-file by ANY method, or via ANY software. The IRS will have locked them out of the e-file system, and they have no choice but to file by paper via snail mail.

3) IF ....

A) ... you are locked out of e-file by the IRS and can not e-file your return, AND

B) ... you want to print you paper return using TurboTax, AND

C) ... you have already declared in the TurboTax software that your return is "Complete"

.... you CAN NOT go back into the TurboTax program and make any changes. TurboTax does not allow this after you have declared your file complete.

(It MAY be possible to phone TurboTax Support and have them "re-set" your account so that you can retroactively make changes. They can do this for other scenarios but I haven't verified for this scenario. BUT... if a return has been e-filed already, you CAN NOT make any additional changes via the TurboTax software.)

At the time of this writing... May 1st 2020....

- the IRS website offers NO INFORMATION on how to change your non-filer status to filer status. The 1040X Amended Return form WIL NOT WORK, for this purpose.

- the IRS phone services are NOT AVAILABLE due to COVID-19 limitations.

Suggestions:

- IF you OWE money with your return, you have until the extended deadline of June 15th 2020 to file your return and pay. So, why not just wait 4-6 weeks and see if the IRS can provide more guidance between now and then... or see if the IRS phone support services go back online in the next 4-6 weeks... and ask them directly. You have until June 15th, so why not wait and see if better information comes out from the IRS.

- IF you are due a RETURN of FUNDS to you from the IRS... (as I am)... Send in your paper return via snail mail, and attach a simple 3-4 sentence cover letter which explains what should be self evident to the IRS when they receive a paper return on an account which shows non-filer status. Your (and my) return will likely need to go into some kind of "secondary review" and be delayed an additional week or two. But I'm confident it will get processed.

- BEWARE of the s**t-ton of bad answers from people in these forums. It is remarkable how many people are offering advice which is completely wrong, and don't seem to know what they are talking about... yet have great confidence about their nonsense and gibberish.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please help! Accidentally submitted a Non-Filer form

1040X will not work for this purpose.

1040X is ONLY for financial data.

There is no provision on the 1040X form to allow someone to change their "non-filer" STATUS to a "filer" STATUS.

The 1040X for can not be used for the purpose of changing a "filing status".

The IRS is not providing any guidance for this issue at the time of this post.

IF you OWE money.... why not wait and see if IRS guidance comes, or the IRS opens up their phone lines again to ask them. You have until June 15th 2020, so why not wait.

IF you are anticipating a financial RETURN from the IRS.... Send in the paper copy of your return. They will see the obvious. That you are not filing fraudulently as a second return and that you ARE a filer, (not a non-filer) as evidenced by the fact that they are now in possession of your return. Receipt of your financial return will likely take an additional few weeks to receive, but it'll be handled.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please help! Accidentally submitted a Non-Filer form

Thank you thank you thank you..... FINALLY someone in this forum who is answering this issue correctly. The person with the cat picture is giving out completely wrong information on this topic.

ATTENTION READERS:

THIS reply from CatinaT1 is the CORRECT answer to this issue. Beware. Most of the other answers on this topic are completely wrong. DO NOT file a 1040X for this scenario. That form doesn't apply to this scenario. That form has no provisions for this scenario. The 1040X is not a solution. Do what Catina says. She is right.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please help! Accidentally submitted a Non-Filer form

It will be mailed via US Postal snail-mail. (most likely)

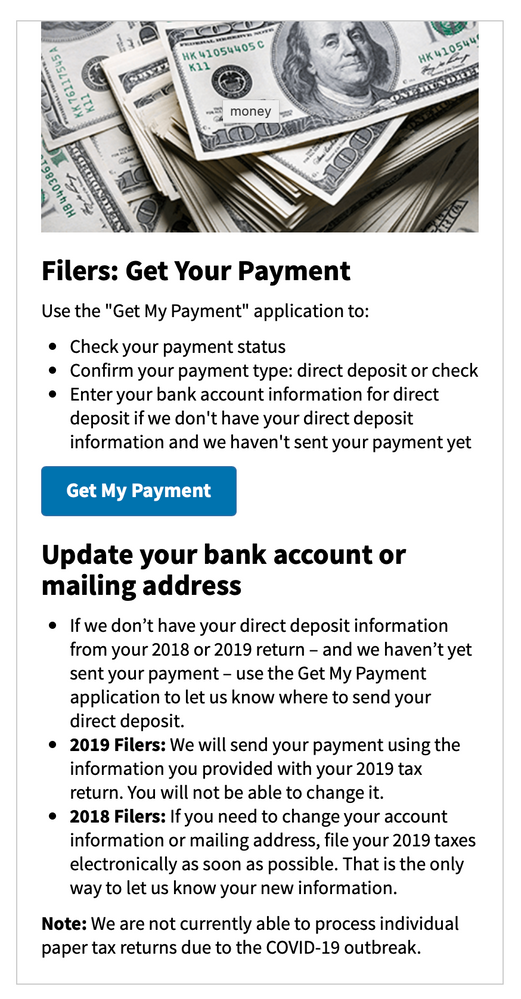

1) Originally, the IRS and the Administration, said REPEATEDLY, that if you had filed in 2018 OR 2019, you would receive a Direct Deposit to whatever account they had on file.

WRONG: it seems now that if you filed a 2018, but not yet filed a 2019, your stimulus payment is being MAILED.... no Direct Deposit. I can't verify that this was true for 100% of people, but it appears true for may, including me.

2) Treasury Secretary Mnuchin said in a live press conference that there would be a provision for people to "verify" their address or DD info. This is why so many people used the "non-filer reporting tool" on the IRS web site, mistakenly.

When it first rolled out, this feature looked like the promise that we could verify our DD info through this feature. There was no clarification for "non-filer EVER" vs "non-filer YET". The clarification and the subsequent yellow colored warning box on the IRS site, to not do this, didn't appear for TWO WEEKS, after the feature rolled out. So, many of us made the mistake.

WRONG: There STILL is no toll for verifying Direct Deposit info or verifying address info as promised by the Administration. Promised, but still doesn't exist 4 weeks later.

3) The IRS portal for checking the status of stimulus payments is

https://sa.www4.irs.gov/irfof-wmsp/status

CRAP: For WEEKS... this has been a relatively useless resource for millions of people because it would report "Status Unknown" for millions of people. Also, the web site is programmed to lock you out for 24 hours after an inquire. You can only check once every 24 hours. This was intentional so not to overload the servers with too many simultaneous inquires.

For an entire MONTH this site reported that my status was "Unknown".

But... 3 days ago on April 27th 2020, my status changed to "Your payment will be mailed on May 1st."

Keep checking back. They are slowly adding people to the database and updating status.

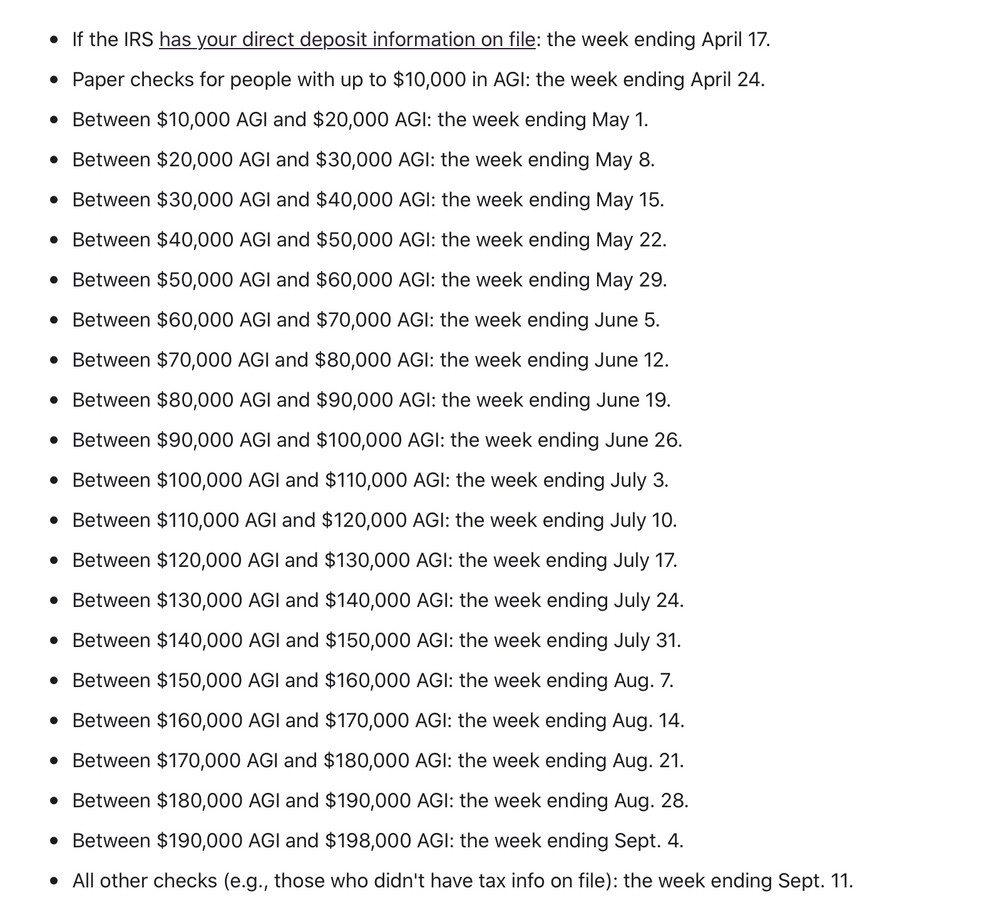

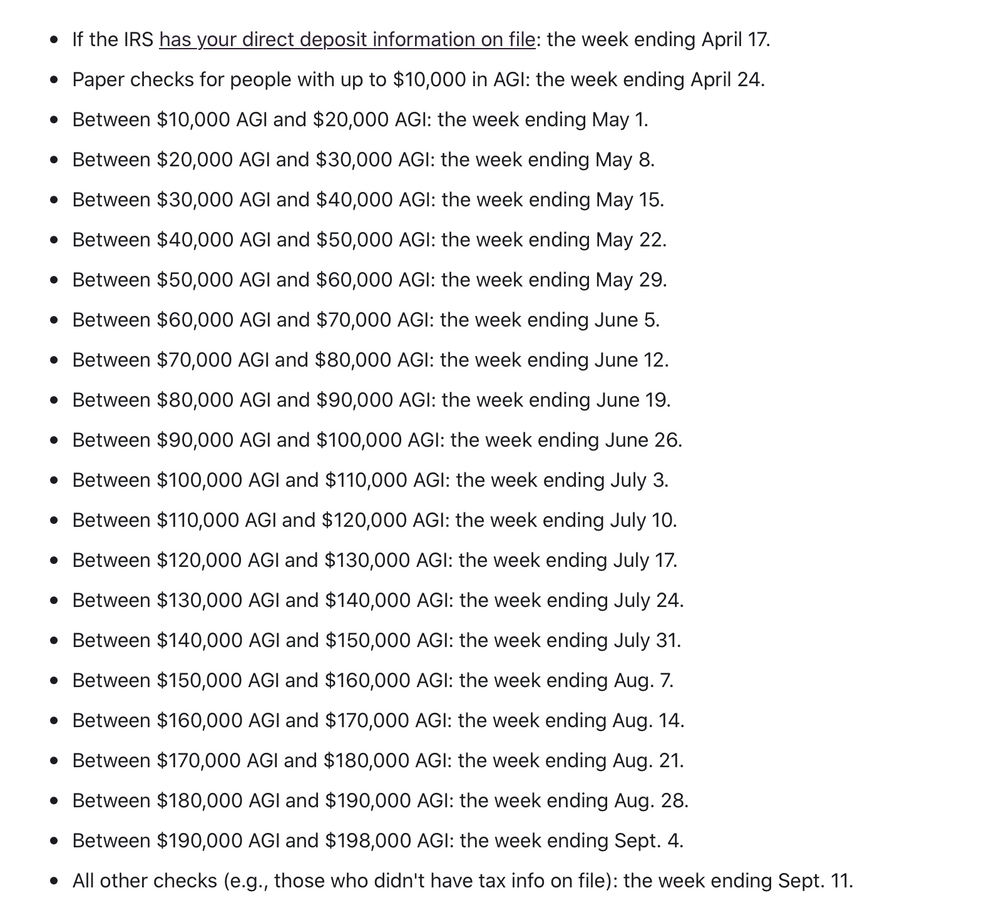

This is a link which shows the official published timeline for when people will receive their Stimulus Check. Scroll down about half way to see the bulleted list of Adjusted Gross Incomes and Dates.

https://www.fool.com/investing/2020/04/21/heres-precisely-when-youll-get-your-stimulus-check.aspx

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please help! Accidentally submitted a Non-Filer form

Catina, you know what your are talking about. I wanted to share these resources with you in case they help you provide more good info.

Originally, the IRS and Administration said that if you filed a 2018 OR a 2019 return, you would receive your Stimulus payment via the information on file, AND that there would be a mechanism by which people could "verify" that the IRS had your correct DD info or address.

This turned out to never have happen. There is no such mechanism for verifying DD or addresses.

The ONLY mechanism for making sure that the IRS has your correct DD or address is to FILE a 2019 return.

Without a 2019 return, the IRS will be MAILING your check according to the schedule shown below.

https://www.fool.com/investing/2020/04/21/heres-precisely-when-youll-get-your-stimulus-check.aspx

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please help! Accidentally submitted a Non-Filer form

Critter... you need to STOP ANSWERING THIS ISSUE.

Your answers are WRONG!

You have posted DOZENS of replies which are COMPLETELY WRONG!

I have responded to your wrong replies and wrong information in specific bulleted examples in a previous post.

But for the sake of THIS post.... NO NO NO... you DO NOT file an Amended Return to change your status from "non-filer" to filer".... in order to correct the mistake that many people made by doing this on the IRS web site.

NO NO NO... you are WRONG. The 1040X Amendment Form is ONLY for amending financial information, not for changing filing status information.

The correct thing people need to do is to file their completed 1040 and attach a 3-4 sentence cover letter explaining that THIS is their 1040 and that they made a mistake using the "non-filer" feature on the IRS web site.

THAT IS ALL.

- NO 1040X

- NO Amendment

- NO redoing their return in TurboTax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Please help! Accidentally submitted a Non-Filer form

Thank you very much @glennboulder

do you know what’s going to happen to my stimulus payment so since I couldn’t efile my 2019 return, I have to use my 2018 return for the AGI information on the “get my payment status” portal on the IRS website and we made much higher on 2018 compared to our 2019 because my wife stopped working. Is there a way to have a tax credit when we file our 2020 tax return next year? If that makes sense. Thank you!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jimenezdiego513

New Member

adriyana-allen2000

New Member

229hawk

New Member

229hawk

New Member

user17684639366

New Member