- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Phase out for overtime deduction

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Phase out for overtime deduction

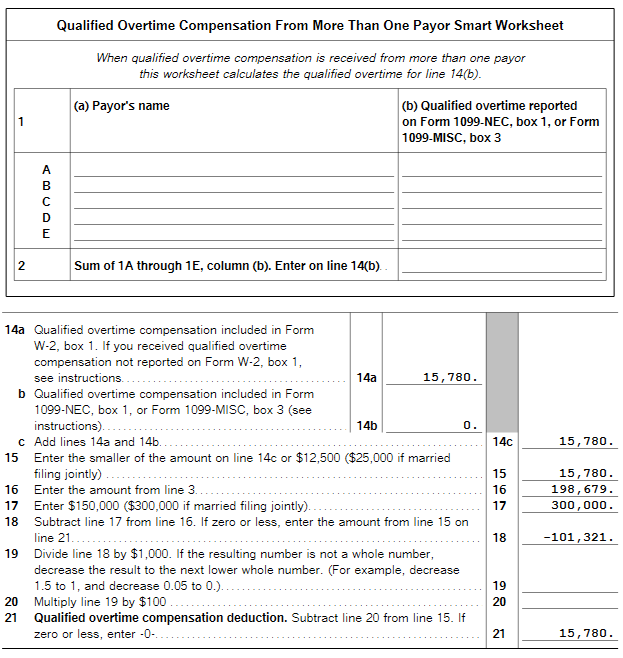

I am filing MFJ and my spouse received OT pay in 2025. Our AGI is only slightly over the $300,000 amount which is when the deduction starts to phase out. TurboTax calculated the OT deduction correctly based on her end-of-year paystub, but it then reports that the maximum deductible amount for us is $0 due to the phaseout. By my calculation, the maximum deductible amount should be something less than IRS $25,000 MFJ maximum but not zero since our AGI falls in the phaseout range. Any help explaining why Turbotax is not letting claim any amount for this deduction?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Phase out for overtime deduction

One possibility is on the screen that says Were you an exempt employee at (name of employer) you answered I was an exempt employee by mistake. You will see that screen after you indicate that you have overtime earnings after you enter your W-2 form.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Phase out for overtime deduction

Hello - I am having the same issue, however I am filing as Head of Household. My modest overtime *should* be fully deductible since my MAGI is around $200,000 and complete phase out is not until MAGI of $275,000. But Turbo Tax deluxe is saying my deductible OT is $0 due to phase out limits, which appears incorrect to me. How do I fix this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Phase out for overtime deduction

Check the calculations on Schedule 1-A for your Overtime Deduction calculation. If you think it's incorrect, step through the interview section again to check your entries/selections.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Phase out for overtime deduction

Thank you for your response, @MarilynG1

I looked for this in the "Forms" section Schedule 1-A is not there at all, oddly.

Does Turbo Tax leave it out completely if it thinks I do not qualify? There seems to be an error behind the scenes in calculation, TurboTax @intuit

If MAGI is $200,000 my overtime should still qualify (and deduction should not be $0 as indicated). And, Schedule 1-A should appear in the forms.

How do I fix this?

I will look at Schedule 1-A on the IRS website and do a manual calculation using the PDF

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

LB200

Returning Member

keminianjr

New Member

mcafeevincent

New Member

Fuzzyman0069

New Member

MLBLKLCL

New Member