- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: option to enter w-2's on home & business software?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

option to enter w-2's on home & business software?

Hello,

I am trying to get my 2018 taxes finished up and sent in. I purchased the turbotax Home & Business software, but there are only options to enter 1099 misc and other types of income, nothing for w-2's.

Can I enter in my w-2 info in the 1099 MISC section, or is there a better solution? Or do I need to get refunded and go a different route to get these done?

Please respond as soon as possible.

Thank you so much!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

option to enter w-2's on home & business software?

No. In the Home & Business version there are 2 tabs at the top....Business and Personal. After you go through the Business area it will take you through the Personal section to enter W2 and other 1099 like for interest & dividends. Or you can jump around and enter things out of order.

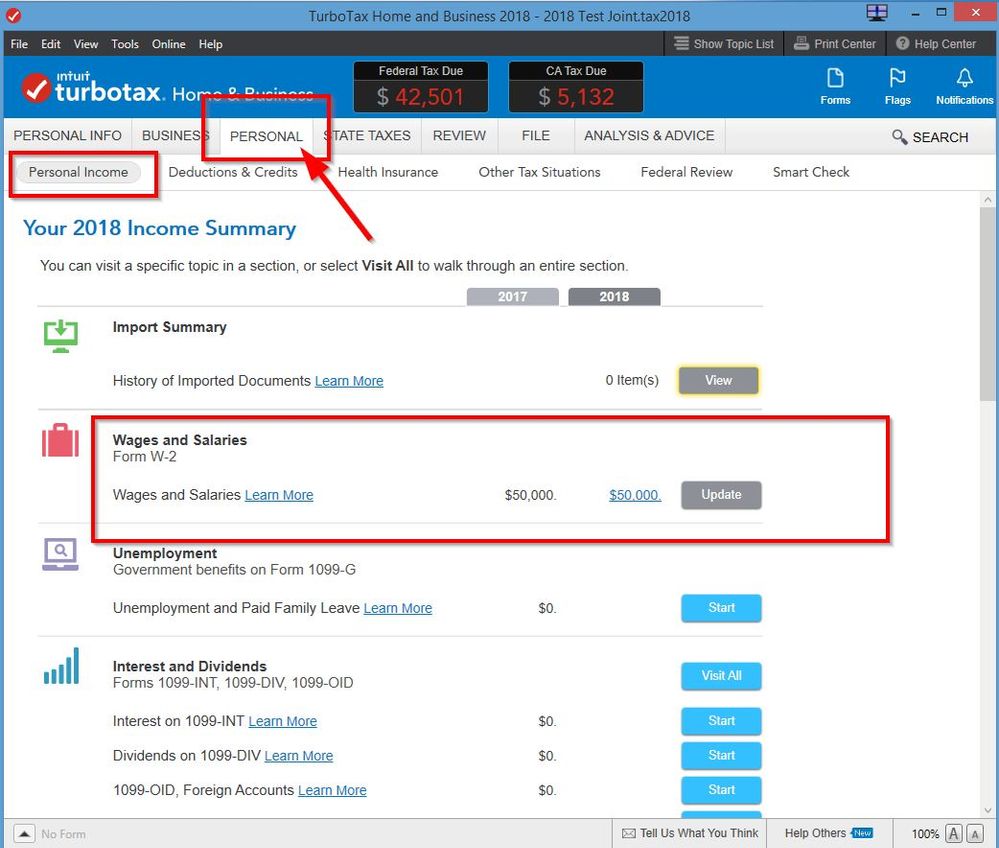

To enter W2 In the Desktop Home & Business program go to

Personal

Personal Income

Wages & Income

To the right of Wages and Salaries, click the Start or Update

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

option to enter w-2's on home & business software?

Oh and by the way the Home & Business program first gives you 2 choices to prepare either 1099Misc & W2 for your employees or to do your own personal 1040 return. Sometimes people get stuck in the wrong one and can't start the other kind of return.

Do you need to give out any 1099Misc or W2 to people you paid?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

option to enter w-2's on home & business software?

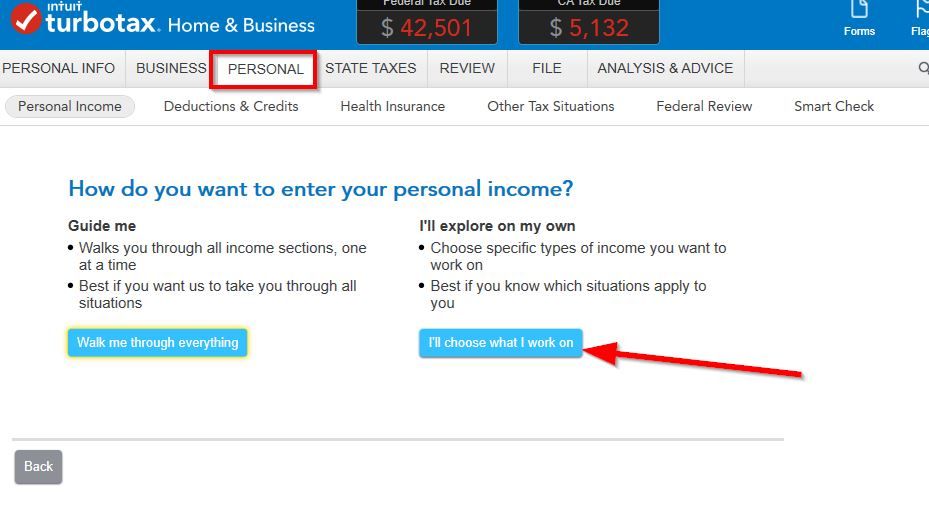

Here's a couple screen shots of Windows 2018 Home & Business. When you click on Personal at the top (not Personal Info) and hit Continue you should get this first screen to pick how to enter your info....Walk though Everything or Choose what to work on. If you pick I'll choose what to work on then you will get the second screen shot showing where to enter W2 income.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

asrogers

New Member

abarmot

Level 1

Pmh-co-unltd

New Member

smiklakhani

Level 2

davel-parr

New Member