- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: On 2106 line 9, column b, how does TurboTax calculate that?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On 2106 line 9, column b, how does TurboTax calculate that?

On 2106 question 9, column b, how does TurboTax calculate that?

Last year, I had $1755 in line 8 column b.

Then, TurboTax calculated $1404 in line 9, column b.

I read the instructions, and I don't get how they arrived at that. I thought it should be 50% of line 8. What did I entered for it to be calculated that way?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On 2106 line 9, column b, how does TurboTax calculate that?

I called TurboTax and they weren't able to explain this either. : (

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On 2106 line 9, column b, how does TurboTax calculate that?

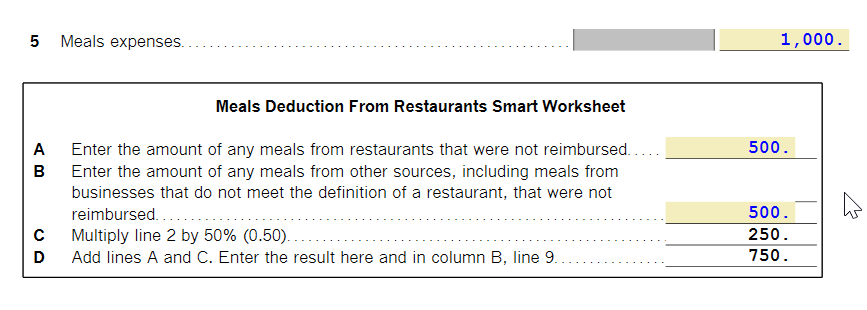

The 50% deduction for meals in 2021 did not include any meals from restaurants that were not reimbursed. Those were 100% deductions. Your 2021 line 8 line may have included a combination of 50% and 100% meals.

Generally, you can deduct only 50% of your business meal expenses, including meals incurred while away from home on business.

Meals that are not separately stated from entertainment are generally nondeductible. However, you can deduct 100% of business meals provided by a restaurant. This applies only to meals paid or incurred after December 31, 2020, and before January 1, 2023.

See Notice 2021-63.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On 2106 line 9, column b, how does TurboTax calculate that?

Thanks for joining the conversation Ernie.

Yes, I did see that in the instructions as well. However, there was no place to designate what part of my unreimbursed expenses were meals versus anything else. Did TurboTax just come up with an arbitrary percentage?

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On 2106 line 9, column b, how does TurboTax calculate that?

Meals would be a direct entry on Form 2106. You would have split restaurant and non-restaurant meals.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On 2106 line 9, column b, how does TurboTax calculate that?

I was shown documentation that California does not follow this rule. Thanks for your help.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

sonia-yu

New Member

ahkhan99

New Member

jjon12346

New Member

user17550208594

New Member

user17548719818

Level 2