- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Official COVID-19 (Coronavirus) stimulus payment thread

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Official COVID-19 (Coronavirus) stimulus payment thread

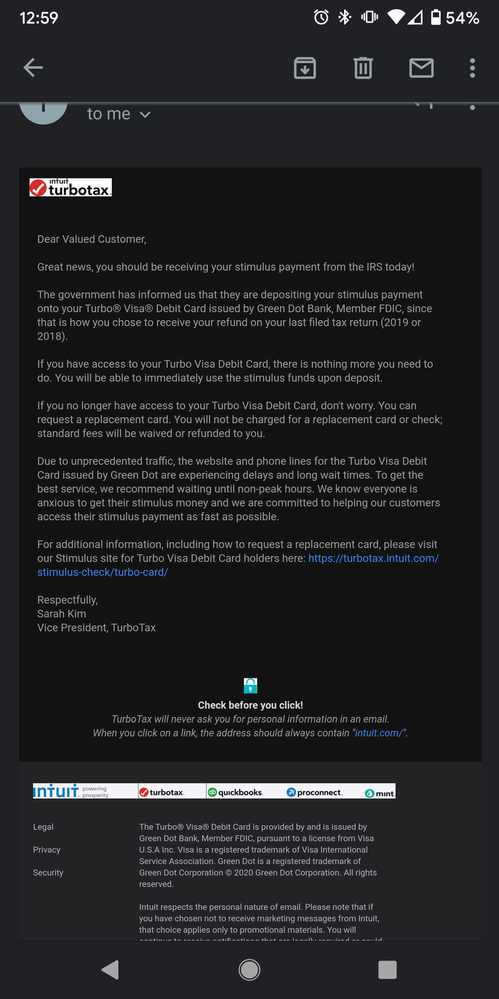

I understand the process but why did I receive this email stating I would be getting it yesterday? Isn't that information coming directly from your organization?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Official COVID-19 (Coronavirus) stimulus payment thread

I didnt recieve an email so should i put my dd info into the get my payment ? Which iv been lock out of for the past 28 hrs

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Official COVID-19 (Coronavirus) stimulus payment thread

I also received the no payment info available message on the IRS site, yet I received this email regardless. There's a whole lot of gray area in the way TT is handling this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Official COVID-19 (Coronavirus) stimulus payment thread

I understand the last part isnt ur problem turbo tax butnid appreciate and awnser for if i should or shouldnt considering i didnt recieve an email

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Official COVID-19 (Coronavirus) stimulus payment thread

If it's asking for your direct deposit information, yes, put it in.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Official COVID-19 (Coronavirus) stimulus payment thread

This is exactly what they do...lie!!!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Official COVID-19 (Coronavirus) stimulus payment thread

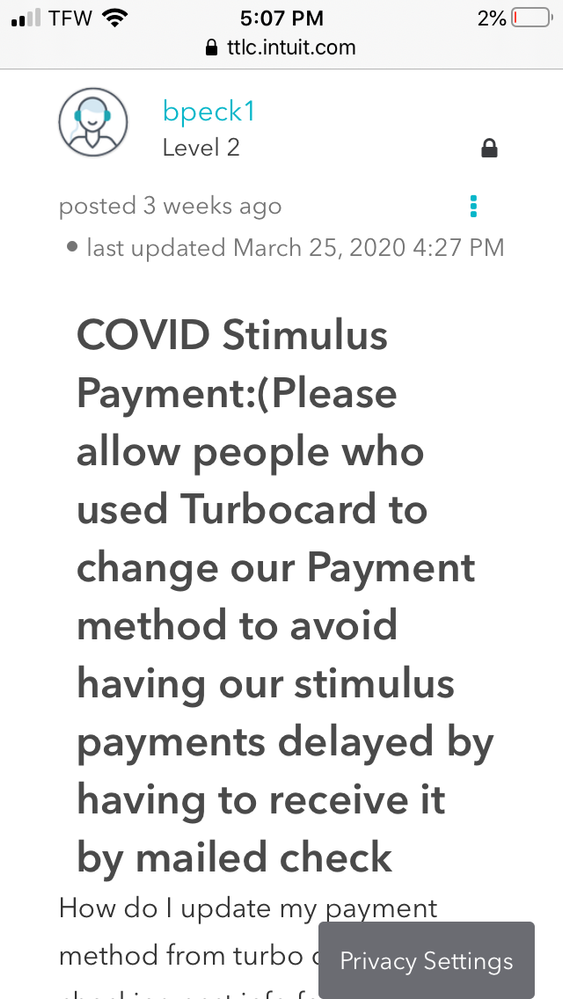

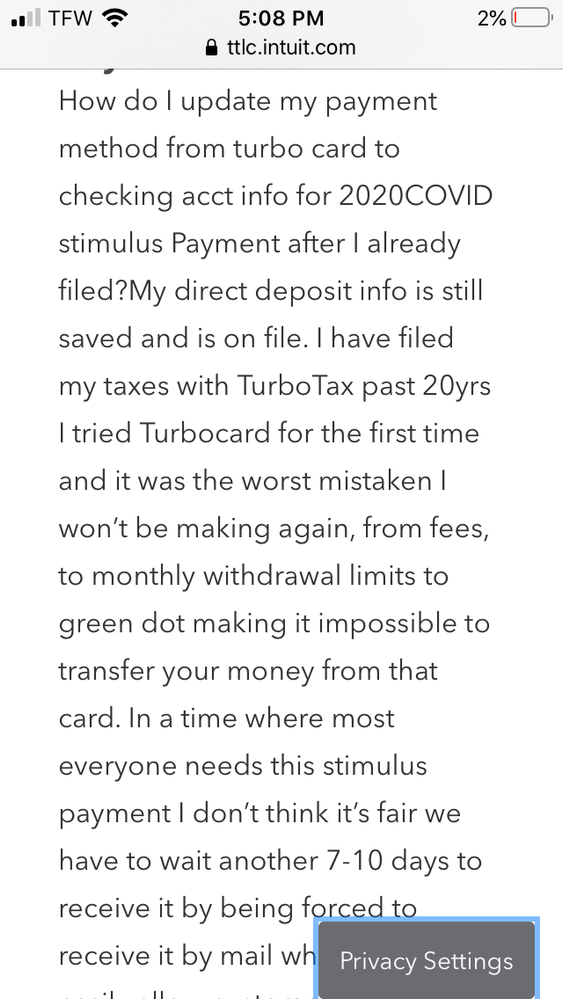

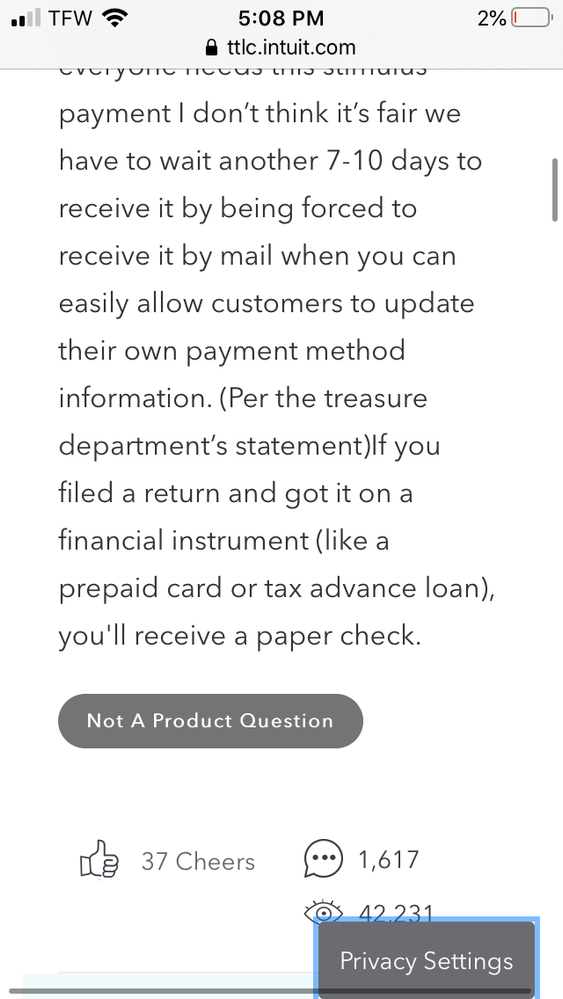

Here is the sad thing.....The reps I want to say it’s a RS issue and it’s just a waiting game that’s the only response they will give but yet a customer tried to get this issue resolved weeks ago..... If they would’ve taken time to read her question and try to solve it we wouldn’t be in this position.... if a member had it figured out and could foresee the problem it looks like the tax experts at TT would have been able to figure it out also.....All I know is the TurboTax has lost lots of customers over this I have seen the replies and I could have prevented this from even happening from the start. So win their answer has been they couldn’t foresee that this would happen I will post the question below if it lets me , I’m sure you have all seen it, but she specifically outlined every bit of this problem but apparently the employees was not willing to do anything about it!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Official COVID-19 (Coronavirus) stimulus payment thread

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Official COVID-19 (Coronavirus) stimulus payment thread

Hello. I just found out in a Washington Post article that I am going to have to wait to get my stimulus check because I filed my taxes electronically via TurboTax. I have always received my tax return via Direct Deposit, and the IRS doesn't have my direct deposit information. What do I need to do to get my stimulus payment? Let me know. Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Official COVID-19 (Coronavirus) stimulus payment thread

@Hurctrack wrote:

Hello. I just found out in a Washington Post article that I am going to have to wait to get my stimulus check because I filed my taxes electronically via TurboTax. I have always received my tax return via Direct Deposit, and the IRS doesn't have my direct deposit information. What do I need to do to get my stimulus payment? Let me know. Thank you.

https://www.irs.gov/coronavirus/economic-impact-payment-information-center

People who filed a tax return for 2019 or 2018

No additional action is needed by taxpayers who:

- have already filed their tax returns this year for 2019. The IRS will use this information to calculate the payment amount.

- haven’t filed yet for 2019 but filed a 2018 federal tax return. For these taxpayers the IRS will use their information from 2018 tax filings to make the Economic Impact Payment calculations.

People who aren't typically required to file a tax return

Social Security and Railroad Retirement recipients who are not typically required to file a tax return need to take no action. The IRS will use the information on the Form SSA-1099 and Form RRB-1099 to generate Economic Impact Payments of $1,200 to these individuals even if they did not file tax returns in 2018 or 2019. Recipients will receive these payments as a direct deposit or by paper check, just as they would normally receive their benefits. Social Security Disability Insurance (SSDI) recipients are also part of this group who don't need to take action.

For Social Security, Railroad retirees and SSDI who have qualifying children, they can take an additional step to receive $500 per qualifying child.

There are other individuals such as low-income workers and certain veterans and individuals with disabilities who aren’t required to file a tax return, but they are still eligible for the Economic Impact Payments. Taxpayers can check the IRS.gov tool - Do I Need to File a Tax Return? - to see if they have a filing requirement.

If you don’t have to file, use the "Non-Filers: Enter Payment Info Here" application to provide simple information so you can get your payment.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Official COVID-19 (Coronavirus) stimulus payment thread

OK so how come the Washington Post says that if you filed your taxes via TurboTaxes, and if you set up to receive your return via DirectDeposit that the IRS doesn't have the DirectDeposit info to put the stimulus payment into your bank account???

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Official COVID-19 (Coronavirus) stimulus payment thread

I'm receiving the same messages on the tracker site as well as a message that my information isn't available for 2020 on the the amount owed section of my account on the IRS site. Every place I see it says people who used direct debit, I paid TurboTax I didn't have it deducted. I have already received my tax return. What I'm reading is correct because I paid out of pocket the IRS should have had my direct deposit info, is this correct? It sounded like all the direct deposits should have went at the same time if they had all the info. I know the checks are going out by income level but there is no similar statement about direct deposits. My AGI was slightly over 80 so I'm wondering if that's the issue. If I paid out of pocket and received my return they should have what they need right? Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Official COVID-19 (Coronavirus) stimulus payment thread

Turbo filed there own acct to skim there fees from....never gave them correct turbo card info afterwards.....go on get my payment tool n enter you card dd info

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Official COVID-19 (Coronavirus) stimulus payment thread

OK. I have filed my taxes via TurboTax each year since 2008, and I have always had it set up for direct deposit. Then, how come I haven't received my stimulus payment, and why am I getting a message online saying:

Payment Status Not Available

According to information that we have on file, we cannot determine your eligibility for a payment at this time.

For more information on the eligibility rules, see our Frequently Asked Questions page.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Official COVID-19 (Coronavirus) stimulus payment thread

How long after we enter our direct deposit info on irs website do we receive our payment ??

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

DA_New

Returning Member

Shannone_beall

Level 2

debr45

New Member

megareader

New Member

BanArt

Level 2