- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Official COVID-19 (Coronavirus) stimulus payment thread

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Official COVID-19 (Coronavirus) stimulus payment thread

I just got a notification from Turbo Card that $1200 was deposited to my card. I did my 2019 tax returns on turbotax and did the advance. But the app is still down.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Official COVID-19 (Coronavirus) stimulus payment thread

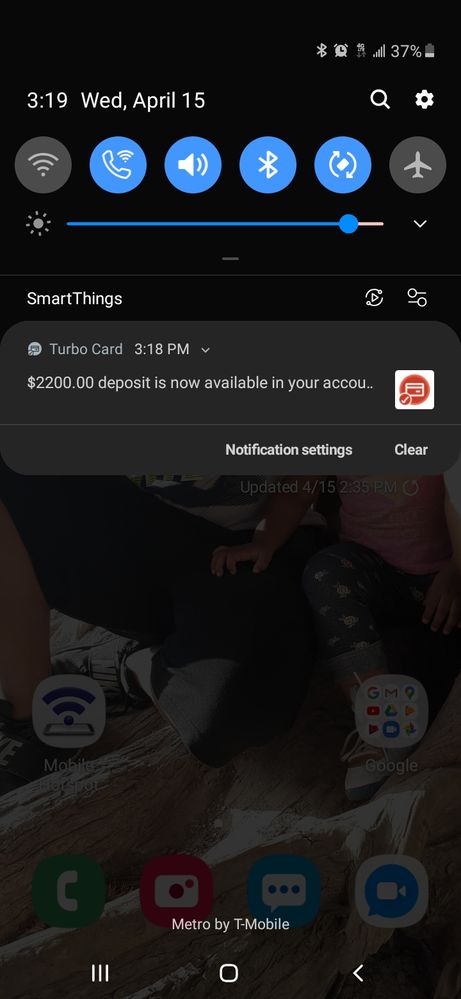

Everybody just hold tight TurboTax I guess is trying to get it together. I just got a notification that my direct deposit for my stimulus just came through on my turbo card.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Official COVID-19 (Coronavirus) stimulus payment thread

How recent did you do your 2019 Tax Returns? Mines got e-filed and received by the IRS on Apr 4th, but it hasn't been approved yet on the Tax Return Status tool. I'm worried that because my 2019 Tax Return hasn't been approved yet they haven't sent me a Stimulus Check.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Official COVID-19 (Coronavirus) stimulus payment thread

If you used turbo card for 2019 go to its get my payment you need ago and amount refunded and enter direct deposit and it update give u date stimulus check deposit date

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Official COVID-19 (Coronavirus) stimulus payment thread

I haven't heard anything from TurboTax: or my bank about a deposit, all I've gotten was information that the irs accepted 2019 return from TurboTax:what's going on?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Official COVID-19 (Coronavirus) stimulus payment thread

I filed my taxes way back on January 27th but I didn't receive my refund until March 18th. I also believe the turbo card is the reason on the delay of my refund and now with the stimulus check issues. But yeah you may have to wait until it shows that they processed or accepted your return for you to be able to track where your stimulus payment is

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Official COVID-19 (Coronavirus) stimulus payment thread

I did my tax return early. Jan 28

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Official COVID-19 (Coronavirus) stimulus payment thread

Is it to late to file with irs directly I'm really getting frustrated with this system

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Official COVID-19 (Coronavirus) stimulus payment thread

I've submitted my 2019 taxes April 15th and My taxable income dropped from 2018. Will my stimulus check be adjusted with the lower income?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Official COVID-19 (Coronavirus) stimulus payment thread

Is says if it does that it will be sent back and a paper check mailed

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Official COVID-19 (Coronavirus) stimulus payment thread

If it doesnt by when?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Official COVID-19 (Coronavirus) stimulus payment thread

I have filed 2018 through turbo tax but not 2019 yet , I want to know if IRS has my bank account info to send stimulus check?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Official COVID-19 (Coronavirus) stimulus payment thread

@Carlp48 If you filed a return in 2018, and haven't filed 2019 yet, it's probably too late. They've probably already used your 2018 return info to determine your stimulas. Go to: https://www.irs.gov/coronavirus/get-my-payment

Enter the requested info and if needed, you can update your direct deposit info to avoid the paper check issue.

If you haven't yet filed 2019, AND you also didn't file a return in 2018, it really depends on your situation.

If you have a filing requirement (i.e. you're under 65, and income is above the threshold for your filing status) but you have not filed for 2018 or 2019, then you MUST file a 2019 tax return to receive the payment. You can file on the irs.gov site.

If you are not required to file a 2018 or 2019 tax return, (depends on your age, income & filing status. e.g. the minimum for single filing status if under age 65 is $12,200. If your income is below that threshold, you generally do not need to file a federal tax return) then visit: Non-Filers: Enter Payment Info Here on the irs.gov site.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Official COVID-19 (Coronavirus) stimulus payment thread

Hey guys, interesting situation that I think might help shed some light on the situation for some of you.

Came home from work today, everyone in my house said they got their stimulus check direct deposited. They used their bank accounts for their tax returns, but I had a TT Debit Card sent to me, so I was naturally curious to see if mine came in.

Now, I hadn't actually registered my TTDC online yet - so the only way I was checking my balance was through the automated phone number. So I had to go through the process of creating an account and verifying it on the turbotax card website. For a minute, the website would not send me a verification code to activate this account, possibly due to the heavy load from people checking their stimulus payments.

Also, I should mention that I got a check from the US treasury in the mail today for an amount much lower than the stimulus payment I should be receiving. So, that caused some confusion, but after speaking to a TT rep on the phone, I'm fairly certain this check is just from the IRS from them taking out more than they needed from my federal return.

When I finally got access to my TT Debit account online, I saw that the stimulus had not dropped into my account. Going onto the IRS's new portal for the check, I was actually prompted to enter my DD info, so it seemed that for whatever reason, they did not get my direct deposit info from my tax return. I entered my information from the TT Debit card, and now the website says that it will update with my payment date once they have it.

That, along with my conversation with the TT rep, told me that they have not sent my stimulus check yet, and that for some reason, they did not use the info printed on my return that leads back to my TT Debit card. I think this is the only part that doesn't make sense to me right now, as the Direct Deposit info on my tax return matches that of my TT Debit Card. My only theory on this is that, because I had not yet activated my card online, there was some sort of problem using it for my stimulus payment.

Either way, it seems that after putting my information into the IRS's new website, the payment will be deposited onto my TT debit card. I'm not sure why some card holders have received their payments today but I have not, but like I said, I believe that has something to do with my not activating the card through the website before the payments were issued.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Official COVID-19 (Coronavirus) stimulus payment thread

@WmFerris Depends on whether you filed 2018. If you did they might've already used your 2018 info. Check: https://www.irs.gov/coronavirus/get-my-payment

If they've already used your 2018 info, you should be able to see that from the Get My Payment link.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

DA_New

Returning Member

Shannone_beall

Level 2

debr45

New Member

megareader

New Member

BanArt

Level 2