- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: My tax return has a duplicate total ordinary dividend entry which I could see in the 1040 Sch...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My tax return has a duplicate total ordinary dividend entry which I could see in the 1040 Sch B only after paying TT fees. How can I Clear & Start Over?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My tax return has a duplicate total ordinary dividend entry which I could see in the 1040 Sch B only after paying TT fees. How can I Clear & Start Over?

As long as you haven't submitted payment, deducted the TurboTax fee from your refund, or registered your product, you can erase your return and start from scratch in TurboTax Online. If you have done any of these things, you'll need to manually edit your return.

Please see this help article for more information.

To delete a Form 1099-DIV that you already entered, in TurboTax Online:

- Go to Wages and Income

- Scroll down to Investments and Savings

- Select Show More

- Click the down arrow button next to Dividends (1099-DIV)

- When you see the 1099-DIV you previously entered, there will be a trash can icon next to the Edit button. Click on the trash can to delete the item completely if the entire 1099-DIV was inadvertently entered twice, or click Edit to open the entry fields and remove any duplicated entries

- Click the button +Add Investments if you need to add a 1099-DIV and Continue

- Select a financial institution to Import, or click Enter a Different Way

- Click Dividends and Continue

- Select an Upload option or click Type it in Myself

When you click Type it in Myself, a screen appears with the entry fields you need to complete.

See this article for more information from TurboTax on reporting Forms 1099-DIV.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My tax return has a duplicate total ordinary dividend entry which I could see in the 1040 Sch B only after paying TT fees. How can I Clear & Start Over?

As long as you haven't submitted payment, deducted the TurboTax fee from your refund, or registered your product, you can erase your return and start from scratch in TurboTax Online. If you have done any of these things, you'll need to manually edit your return.

Please see this help article for more information.

To delete a Form 1099-DIV that you already entered, in TurboTax Online:

- Go to Wages and Income

- Scroll down to Investments and Savings

- Select Show More

- Click the down arrow button next to Dividends (1099-DIV)

- When you see the 1099-DIV you previously entered, there will be a trash can icon next to the Edit button. Click on the trash can to delete the item completely if the entire 1099-DIV was inadvertently entered twice, or click Edit to open the entry fields and remove any duplicated entries

- Click the button +Add Investments if you need to add a 1099-DIV and Continue

- Select a financial institution to Import, or click Enter a Different Way

- Click Dividends and Continue

- Select an Upload option or click Type it in Myself

When you click Type it in Myself, a screen appears with the entry fields you need to complete.

See this article for more information from TurboTax on reporting Forms 1099-DIV.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My tax return has a duplicate total ordinary dividend entry which I could see in the 1040 Sch B only after paying TT fees. How can I Clear & Start Over?

Thanks for your response. I deleted the 1099-DIV from that particular payer, which incidentally was correctly imported from the payer's website. After deletion, I did the tax calculation without any trace of the 1099-DIV from that payer in the interview mode, but the duplicate entry from the same payer is still there in the resulting 1040 Schedule B. Unlike the correctly imported 1099-DIV (now deleted) from the same payer, the problematic entry that can't be deleted from my account does not have any other data, e.g., Qualified Dividends, Total Capital Gain Distributions, Foreign Tax Paid, etc.; it has only one nonzero entry in Box 1a (Total Ordinary Dividends), which happens to be same as the 1a entry in the correct 1099-DIV. This can only be visible in Schedule B (and the smart worksheet for Sch B) after recalculating the return without any 1099-DIV from the same payer shown in the interview mode. There is no way to delete or edit this obviously wrong entry which will make my tax return wrong. My only crime seems to have paid the fees but without which I couldn't see the returns and hence be aware of the duplication. I spent a lot of time on this problem but am ready to Clear the data & Start Over, which TT will not allow me to do. I have been using TT for many many years and do not want to go to another provider. Please help

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My tax return has a duplicate total ordinary dividend entry which I could see in the 1040 Sch B only after paying TT fees. How can I Clear & Start Over?

You should be able to delete an incorrect 1099-Div, whether you have paid or not, or whether you have imported it or not. Since we can't see your return in this forum, let's try some basic troubleshooting.

When you type '1099-Div' in the Search area, then click in 'Jump to 1099-Div' do you see more than one entry? If not, how about deleting the entry that is there currently, and manually making a 1099-Div entry. Check your Schedule B after this.

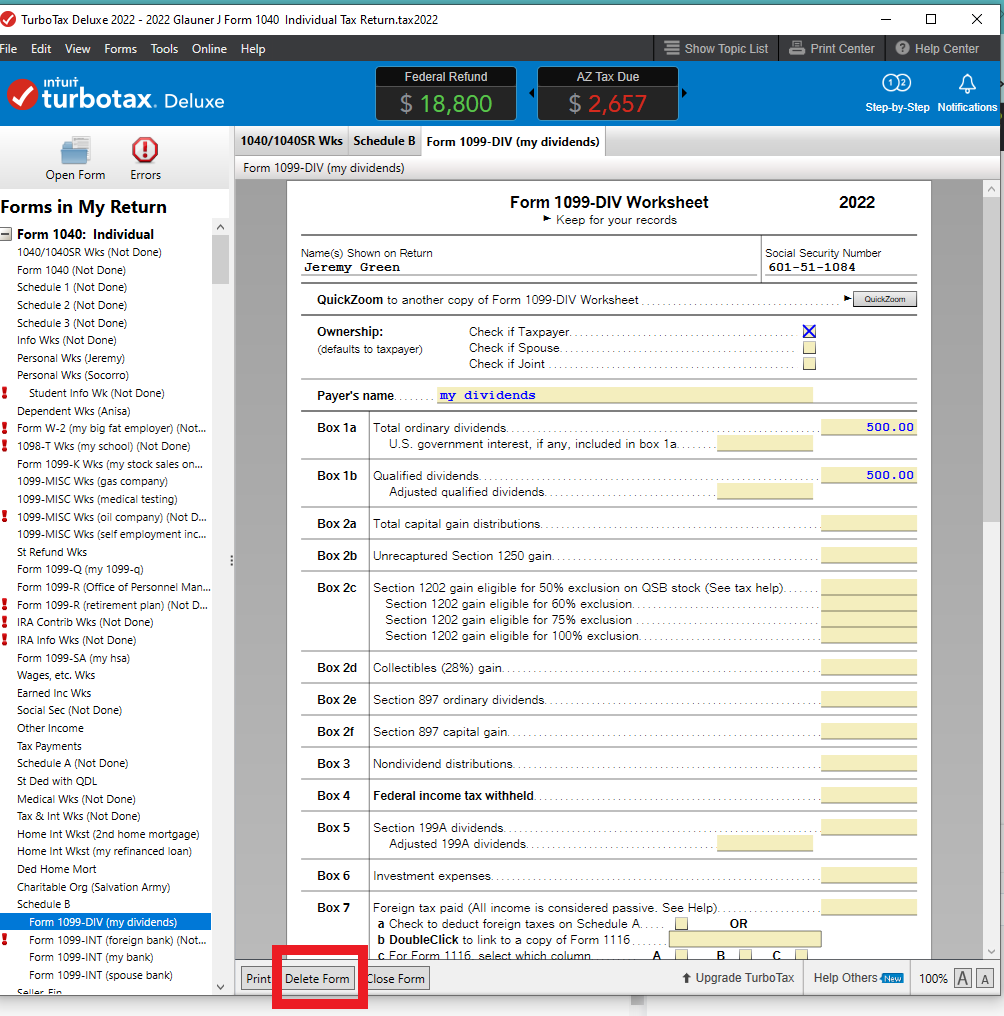

You mention that you can see the duplicate entry on Schedule B. In the Dividend Income Smart Worksheet area, you can drill down to the source (magnifying glass), which should be the Form 1099-Div Worksheet for that entry. Use the 'Delete Form' button at the bottom to delete if this is the duplicate you don't want in your return.

Sometimes deleting or editing an imported entry can cause problems, which may be what you are experiencing. Please let us know if this doesn't resolve your issue.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My tax return has a duplicate total ordinary dividend entry which I could see in the 1040 Sch B only after paying TT fees. How can I Clear & Start Over?

How can I manually edit my return? Since I paid my fees, TT will not allow me to start over again. Even if I delete all my entries, manually entered, imported directly, or otherwise, it will not erase the offending entry. Unless I can remove that entry, I have no hope of salvaging this return.

It is a pity that TT doesn't allow the user to view or review the tax forms and Schedules, where the errors and inconsistencies show up prior to the step of paying fees. Once the user pays, the option to clear and start over is taken away. I had no reason to suspect given the lifetime guarantee that anything was wrong before taking the fatal and irreversible step of paying the fees. Please provide a solution.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My tax return has a duplicate total ordinary dividend entry which I could see in the 1040 Sch B only after paying TT fees. How can I Clear & Start Over?

"It is a pity that TT doesn't allow the user to view or review the tax forms and Schedules"

The reason for this practice is obvious - if TurboTax let you use the Online product and preview the return in toto (as a whole), people would just create a return, copy all the data, and file without paying TurboTax a penny.

At another tax preparer, I watched a customer do this exact thing...she gave the data to us, the tax preparer entered it into the system, and when the tax preparer ended up with a result, the customer - who had already entered the return on her mobile using another vendor - said, "great!" and she hit Enter to file it on her phone. And she walked out without paying us anything.

You can achieve what you want by using the CD/download product - review your return to your heart's delight before you file...this is because you pay for the software before you get it.

You might consider getting the CD/download software for next year. Note only can you see all forms all the time, but you have the ability to override many entries on the forms if need be.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My tax return has a duplicate total ordinary dividend entry which I could see in the 1040 Sch B only after paying TT fees. How can I Clear & Start Over?

I have already deleted the only visible 1099-DIV from the payer in question in the usual way, i.e., going to the Wages & Income section and clicking on the Dividends (1099-DIV) by clicking the trash icon. I also checked by clicking on "Jump to form 1099-div" to verify that no 1099-Div from that payer exists anymore. However, in the Premier version of TT online, I am unable to display/arrive at the editable forms and worksheets as you showed (or allude to) in your reply. It could also be that the editable forms and worksheets are no longer available because I already paid the fees. As I said, even without any 1099-Div from the payer in question, I still can see the sole Total Ordinary Dividends (Box 1a) from the payer in question in the "SMART WORKSHEET FOR: Schedule B: Interest and Dividend Income" in the Tax return package I downloaded in pdf format. However no

"Form 1099-DIV Worksheet" exists corresponding to that dividend entry or that payer. Please advise.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My tax return has a duplicate total ordinary dividend entry which I could see in the 1040 Sch B only after paying TT fees. How can I Clear & Start Over?

Your explanation makes sense from the TT side but not from the side of a paid returning customer, because of a bug or glitch in the process or the program.

The TT technical specialist should be able to correct any obvious data glitch that the user uncovers only after paying up and seeing the lifetime tax return guarantee monogram. At the very least, the customer after paying the fees should be allowed to exercise the nuclear option of Clear & Start Over option. That is not an unreasonable expectation.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My tax return has a duplicate total ordinary dividend entry which I could see in the 1040 Sch B only after paying TT fees. How can I Clear & Start Over?

@BillM223 Do you have any solution for this year now that I have already paid for a premier online edition? I have been using TT online for more than a decade, if not more. I prefer online over desktop for a number of reasons and am not sure I understand why I shouldn't be able to review and change entries after I have already paid, especially when TT didn't flag the error in its review before paying up.

@MarilynG1 So far your response has been the most helpful. Thank you. Hoping that you will come up with a solution for the bind I find myself in.

@MonikaK1 Thanks for your prompt response but I had already tried to Clear & Start Over without success because as I wrote in my first I made the misfortune of paying before discovering the error in the printout.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My tax return has a duplicate total ordinary dividend entry which I could see in the 1040 Sch B only after paying TT fees. How can I Clear & Start Over?

Since you have paid, but not filed, I don't know why you can't change something in the return before you file.

I can't be sure - the thread is getting long - but have you gone and deleted the form by doing this:

Get into your return Online (it doesn't matter where).

On the left, click on Tax Tools.

Then click on Tools.

Then in the center, click on Delete A Form.

Then in the Form list, click to delete any and all 1099-DIV forms.

Then re-enter the correct 1099-DIV.

Perhaps some data has become "stuck" and won't delete when you delete it in the input.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My tax return has a duplicate total ordinary dividend entry which I could see in the 1040 Sch B only after paying TT fees. How can I Clear & Start Over?

@BillM223 I have successfully deleted the 1099-Div from the payer in question, but that didn't remove the ordinary total dividends from the payer in question, which still appears in Schedule B Part II and in the smart worksheet for Schedule B (of the printed tax return) even in the absence of a 1099-Div worksheet from the payer in question. How is this possible only a TT software expert can guess.

Please assume as you suggest in your post that the "data has become "stuck" and won't delete when I delete it in the input". Any solution for manually purging the bad piece of data?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My tax return has a duplicate total ordinary dividend entry which I could see in the 1040 Sch B only after paying TT fees. How can I Clear & Start Over?

Data can indeed become 'stuck' in TurboTax Online.

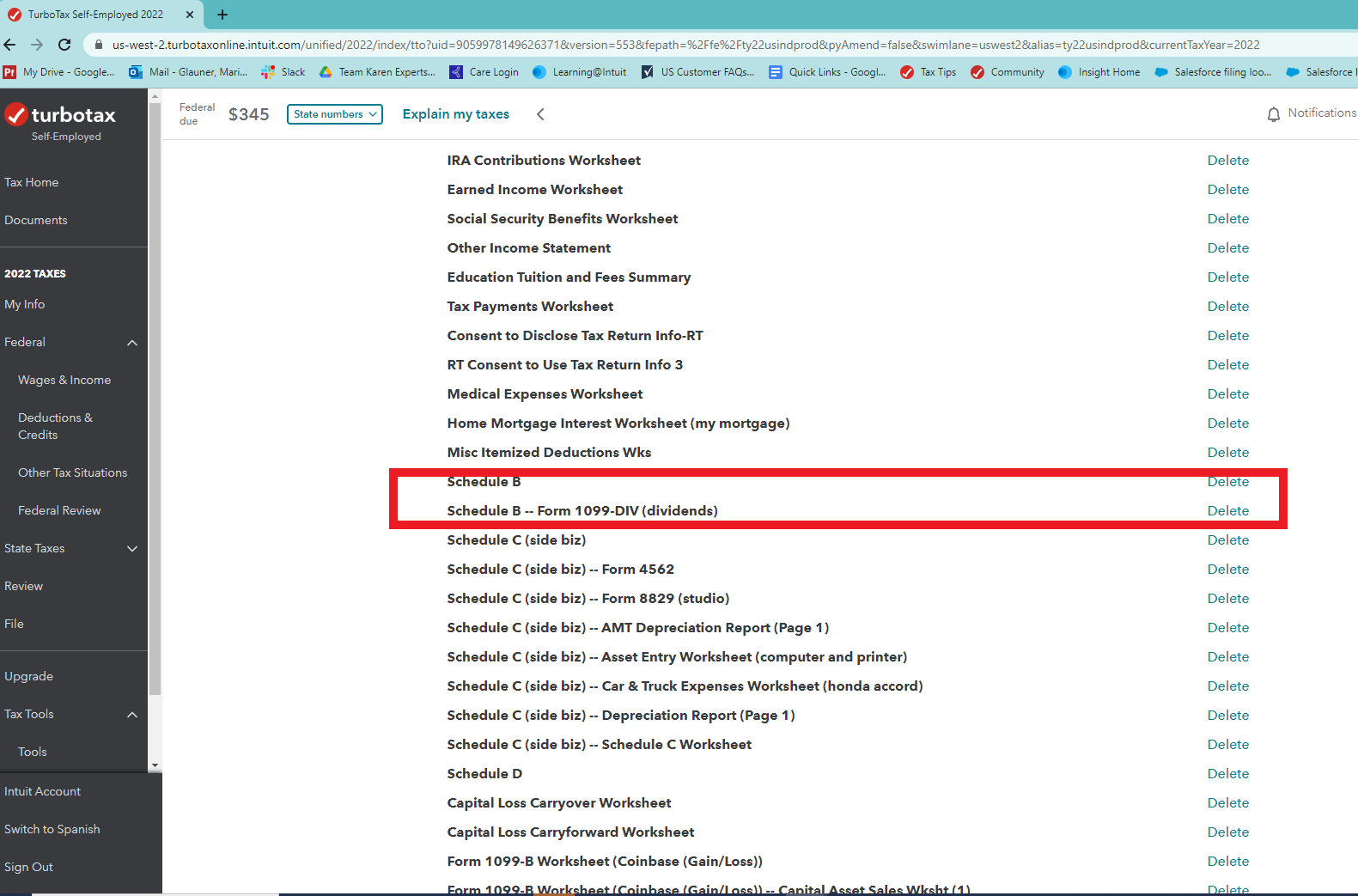

At Tax Tools > Tools, 'Delete a Form', delete any 1099-Div and Schedule B (screenshot).

Close TurboTax, clear your Cache and Cookies, and re-open TurboTax.

Back at Tax Tools > Tools, 'Delete a Form' check that there are no 1099-Div or Schedule B forms showing.

Manually enter the correct 1099-Div info in that section.

If this doesn't resolve the error, you may need to Contact Tech Support, where they can actually get into your computer/return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My tax return has a duplicate total ordinary dividend entry which I could see in the 1040 Sch B only after paying TT fees. How can I Clear & Start Over?

@MarilynG1 Thanks for your suggestions, which I am in the process of implementing.

1. I have three 1099-Divs from three different payers. Do you want me to delete Schedule B and all three 1099-Divs or just from the payer in question?

2. After deletion do you want me to manually enter all three 1099-Divs or just the one from the payer in question that was duplicated? In other words, can I retreive the other two non-problematic 1099-Divs the smart way

3. Lastly, I did call the TT technical support before I sought help from this forum. My experience was very disappointing. The specialist was poorly trained and claimed she did not have access to the offending piece of data even though I shared the screen with her. She blamed the error on the data retrieved from the payer, which is one of the largest brokerage firms and from whom I have been retrieving tax form data into TT online for over a decade. You have been most helpful.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My tax return has a duplicate total ordinary dividend entry which I could see in the 1040 Sch B only after paying TT fees. How can I Clear & Start Over?

@MarilynG1 Thanks for diligently staying on my problem. Your last set of instructions saved my day.

I followed all your suggestions to a T, except that after deleting (i) Schedule B and all associated 1099-Div and 1099-Int forms using Tax Tools > Tools, 'Delete a Form' and (ii) clearing the cache and cookies from my browser, I took a chance and re-retrieved the 1099-Div and 1099-Int forms from various payers, instead of entering them manually, as you advised. Your suggested way of deleting Schedule B, et. al., and/or subsequent cleans up of the browser did remove the previously stuck total ordinary dividend from TT's internally generated worksheets. Smart re-retrieval of tax forms from the payer(s) did not cause any error. As a result of successful removal of hard-to-remove the total ordinary dividend data in question, my taxable income and tax liability were reduced by around $4k and over $1k reduced.

Glad I didn't trust the lifetime accuracy warranty of Turbo Tax and checked the forms and schedules in the pdf format before submitting my return. I couldn't have, however, done it without the solution you provide.

I had called the Technical Support line before initiating this thread but my experience with Tech Support was very frustrating and a total waste of time. The specialist lacked knowledge/ training and exhibited poor attitude and communication skills. She tried to blame the payer in question for sending bad data as the root cause of the problem when the payer in question is one of the largest brokerage firms in the US and I have been importing data from them to Turbo Tax ever since the facility to do so became available.

I hope Turbo Tax hires competent staff for Tech Support and strengthen the software to prevent such errors and make it easier to spot and correct such errors. Three cheers to Turbo Tax for making quality experts like you available to dispense advice on this forum.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

joni-chintala

New Member

Pankajkr

Level 1

kv6290rjv

New Member

frostily0495

Level 3

dhawalfs1

New Member