- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: My return is continually freezing on check this entry when attempting to submit. I used robin...

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My return is continually freezing on check this entry when attempting to submit. I used robinhood to upload the forms so idk why I would have to check anything

I wound up just printing it an mailing it. GFY turbo tax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My return is continually freezing on check this entry when attempting to submit. I used robinhood to upload the forms so idk why I would have to check anything

https://media1.tenor.com/images/b51320c2350b55452d54569f56fe6ed2/tenor.gif?itemid=15123134

Actual solution for Intuit: Hire better devs who don't try to break the client-side device with bad code.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My return is continually freezing on check this entry when attempting to submit. I used robinhood to upload the forms so idk why I would have to check anything

They also fkd over Coinbase customers

How is it almost all of the imports that they advertise don't work?

It's a scam company, contact Girard Sharp LLP and Norman E. Siegel of Stueve Siegel Hanson LLP and see if they want to win another class action suit against TT.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My return is continually freezing on check this entry when attempting to submit. I used robinhood to upload the forms so idk why I would have to check anything

Same here, endless loop on "check this entry"

no matter what I input, it will come back with the same thing,

we pay turbotax for nothing, this is not acceptable

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My return is continually freezing on check this entry when attempting to submit. I used robinhood to upload the forms so idk why I would have to check anything

agree, I will do TAX manually, TurboTax sucks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My return is continually freezing on check this entry when attempting to submit. I used robinhood to upload the forms so idk why I would have to check anything

Please use the link below and fill out the form. Why is my 1099-B missing its acquired date?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My return is continually freezing on check this entry when attempting to submit. I used robinhood to upload the forms so idk why I would have to check anything

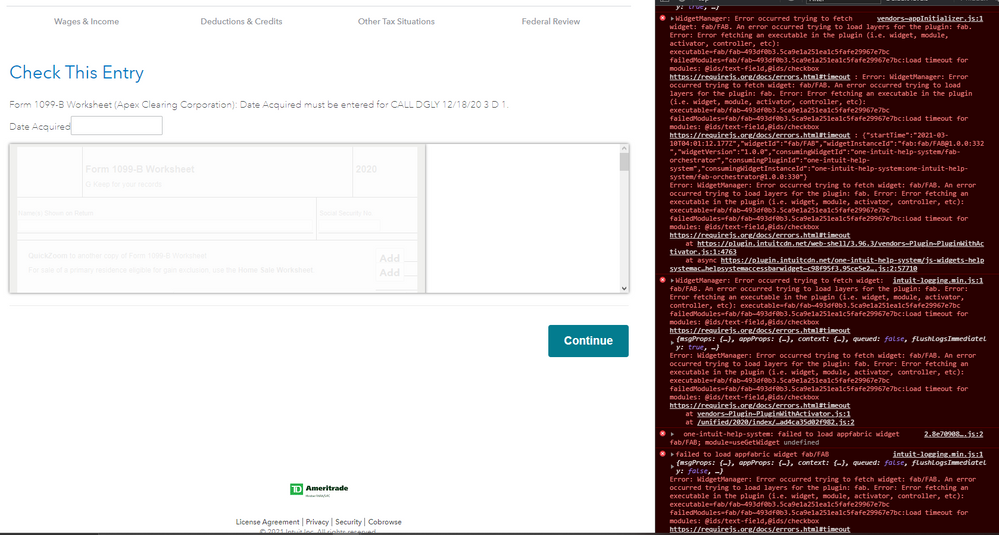

As I think you know (or would know, if you had tried your own "solution" even once), that does NOT solve it. The date acquired is always there. On the final check screen the buggy and clearly untested TurboTax Online claims it's not there. That is when it erases it. AFTER trying to go and file the return, then yes, the date is gone, that was there just minutes ago, no matter how many times one logged out and logged back in to ensure that it's saved and correct. One can go back and enter the date, yes. VARIOUS or actual date, doesn't matter. TT will always REMOVE the date that is entered at the final check, at the time it comes up with this ridiculous message and blocks one from filing.

It's highly disrespectful to your customers to provide such bogus "solutions" that you yourself know do not solve anything (but sure, make Intuit look less bad, as it is logical and makes sense) and just will waste your customers hours upon hours of more time trying to do, given the fact that TT is programmed to ERASE the date acquired at the final step, no matter if it's downloaded or entered manually, no matter if it's an actual date or VARIOUS.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My return is continually freezing on check this entry when attempting to submit. I used robinhood to upload the forms so idk why I would have to check anything

This is the 4th that I enter countless "DATE" and still... reloading... I am losing my patient ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My return is continually freezing on check this entry when attempting to submit. I used robinhood to upload the forms so idk why I would have to check anything

@iamveryorz, don't bother trying to do that. It doesn't work. The "final check" page before you can file ERASES the acquired date for each entry. You can go back, add it, but once you try to file it'll get erased again. That's the way Intuit programmed TurboTax. They clearly didn't have anyone QA test it, ever. Doesn't matter what browser or operating system you use, or even if you use a mobile device. Same thing. It's their untested code their server side. Intuit simply released a product that's not even ready for alpha version of most basic functionality testing.. and now they are trying to give you plausible sounding workarounds, that they themselves obviously know do not work. Don't fall for their BS.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My return is continually freezing on check this entry when attempting to submit. I used robinhood to upload the forms so idk why I would have to check anything

The issue has been submitted and is currently under investigation. We are currently working to resolve this issue. If you would like to receive an update for the progress, click on the following link to get notified:

Any asset you hold for one year or less at the time of sale is considered “short term” by the IRS. Capital assets that you hold for more than one year and then sell are classified as long-term on Schedule D and Form 8949.

The net gain or loss from you Form 1099-B will show on line 4 of Schedule 1 and line 7 of Form 1040. For more information, click here: 1099-B

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My return is continually freezing on check this entry when attempting to submit. I used robinhood to upload the forms so idk why I would have to check anything

thank youuuuu this was a pain in the a** to do, finally filed my taxes thanks to your method

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My return is continually freezing on check this entry when attempting to submit. I used robinhood to upload the forms so idk why I would have to check anything

I think Turbo tax reps are the smartest folks on planet. Well their solutions are something which none of us could have thought about.

1. I had no idea how to clear cache

2. and yes, I didn't know if turbo tax can be opening in multiple browsers or on multiple machines..wowwww

3. Best one - Use your friends laptop and other networks...wowwww...i didn't know my network hated TT and that's why they blocked it from working for that one special 1099.

4. And they love it when i have to repeat myself over and over again. I mean they of course love my voice, that's why they are doing it. Right??

RIP TT

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My return is continually freezing on check this entry when attempting to submit. I used robinhood to upload the forms so idk why I would have to check anything

they act as a machine response, and I will not use TT, and I will tell all of my friends about this

TT and TT's support team, do not want to help, they only want your payment.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My return is continually freezing on check this entry when attempting to submit. I used robinhood to upload the forms so idk why I would have to check anything

If import does not go smooth, I will suggest to manually enter info. For import, there are a limit on how many transactions TurboTax can handle. See blue links below. If there are too many transactions for import, program will crash or freeze.

To manually enter info, here are the steps:

In TurboTax online,

- Sign into your account, select Pick up where you left off

- At the right upper corner, in the search box, type in 1099b and Enter

- Select Jump to 1099b

- Follow prompts

- On-screen, "Let's import your tax info, select I'll type it myself

- Follow prompts to continue

For more information, click here:

how many stock transactions TT can handle

After you enter the info, program will generate either a long term or short term capital gain or loss depends on how long the stocks are being held. The amount will be reported on line 7 of your Form 1040 along with a Schedule D and Form 8949. For more info from Robinhood, click here: https://robinhood.com/us/en/support/articles/how-to-upload-your-1099-to-turbotax/

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My return is continually freezing on check this entry when attempting to submit. I used robinhood to upload the forms so idk why I would have to check anything

In case you think I'm bluffing:

Fix it ASAP.

These attorneys already beat you once.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

cheycheyb12

New Member

lauraknight744

New Member

cvharold787

New Member

ibtiki

Returning Member

afld

New Member