- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: My deceased husband employer issued a 1099-misc form to me. It is for his patent payment. Do ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My deceased husband employer issued a 1099-misc form to me. It is for his patent payment. Do I need to report it as self employment income?

The section 3 (Other income) of 1099-Misc is used (not section 2 Royalties) by his employer. I'm not sure how I should report it.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My deceased husband employer issued a 1099-misc form to me. It is for his patent payment. Do I need to report it as self employment income?

Try deleting the Form 1099-MISC that you have already entered and re-enter it using the steps below. After you go through the first few steps, you should see a list of Form 1099-MISC where you can delete the one you have already entered. Click the trash can icon or the Delete button beside it and re-enter it. Deleting the old one should remove the links to Schedule C and allow you to simply report the income by following the steps below.

To include the 1099-MISC as a part of your tax return, follow these steps:

- On the top row of the TurboTax online screen, click on Search (or for CD/downloaded TurboTax locate the search box in the upper right corner)

- This opens a box where you can type in “1099-MISC” (be sure to enter exactly as shown here) and click the magnifying glass (or for CD/downloaded TurboTax, click Find)

- The search results will give you an option to “Jump to 1099-MISC"

- Click on the blue “Jump to 1099-MISC” link

- Answer Yes you did receive a 1099-MISC

- Fill in the details from your 1099-MISC then click Continue

- Provide a short description for the reason you received the 1099-MISC then click Continue

- On the next screen titled, “Does one of these uncommon situations apply?” choose the last option, None of these apply and then click Continue

- On the next screen asking if the 1099 involved work like your main job, answer No and click Continue

- On the next screen, check the box that you received the income in 2021 and then click Continue

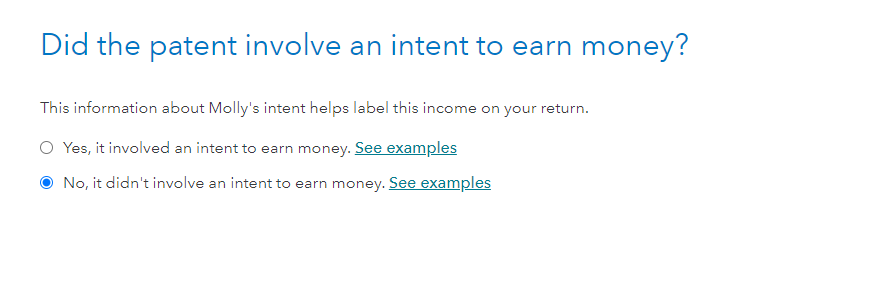

- Finally, choose “No, it didn’t involve an intent to earn money” and click Continue

- Answer the questions on the next couple of screens to finish the process

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My deceased husband employer issued a 1099-misc form to me. It is for his patent payment. Do I need to report it as self employment income?

No, a 1099-MISC Box 3 is treated as other income. This would not be considered as self-employment income. There is a new form for reporting non-employee income which is a 1099-NEC. A 1099-NEC would result in self-employment income.

To enter the 1099-MISC go to:

- Open TurboTax and select the Federal section.

- Go to Income and Expenses and Scroll down to Other Common Income

- Click on Form1099-MISC.

- Click on Start

- Go through the questions and enter the 1099-MISC

- This will show on Line 8 of the 1040.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My deceased husband employer issued a 1099-misc form to me. It is for his patent payment. Do I need to report it as self employment income?

Thank you for the replay. Turbo Tax asks me to link to Schedule C, Schedule F, Form 4835 or the Other Income Statement. I tried to enter under "Other reportable income" of "Miscellaneous Income", but the Turbo Tax says "Do no enter income reported on Form 1099-MISC". Where should I report it then?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My deceased husband employer issued a 1099-misc form to me. It is for his patent payment. Do I need to report it as self employment income?

As you walk through the steps to enter the 1099-Misc, how are you answering the questions?

When you get to the question, did this involve an intent to earn money you would need to answer no. This will enter the income on line 8.

You may want to start that section over. You can go back and click the trash can next to the 1099-Misc entries or you can click Tax Tools>>Tools>>Delete a Form>>then delete the 1099 Misc

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My deceased husband employer issued a 1099-misc form to me. It is for his patent payment. Do I need to report it as self employment income?

Thank you, but somehow I don't get the window you showed. It doesn't matter how many times I redo it, Turbotax just put me into the Schedule C. Either I give up and go with it, or I hire an accountant to redo it. Hmmm....

Thanks for your help though..

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My deceased husband employer issued a 1099-misc form to me. It is for his patent payment. Do I need to report it as self employment income?

Try deleting the Form 1099-MISC that you have already entered and re-enter it using the steps below. After you go through the first few steps, you should see a list of Form 1099-MISC where you can delete the one you have already entered. Click the trash can icon or the Delete button beside it and re-enter it. Deleting the old one should remove the links to Schedule C and allow you to simply report the income by following the steps below.

To include the 1099-MISC as a part of your tax return, follow these steps:

- On the top row of the TurboTax online screen, click on Search (or for CD/downloaded TurboTax locate the search box in the upper right corner)

- This opens a box where you can type in “1099-MISC” (be sure to enter exactly as shown here) and click the magnifying glass (or for CD/downloaded TurboTax, click Find)

- The search results will give you an option to “Jump to 1099-MISC"

- Click on the blue “Jump to 1099-MISC” link

- Answer Yes you did receive a 1099-MISC

- Fill in the details from your 1099-MISC then click Continue

- Provide a short description for the reason you received the 1099-MISC then click Continue

- On the next screen titled, “Does one of these uncommon situations apply?” choose the last option, None of these apply and then click Continue

- On the next screen asking if the 1099 involved work like your main job, answer No and click Continue

- On the next screen, check the box that you received the income in 2021 and then click Continue

- Finally, choose “No, it didn’t involve an intent to earn money” and click Continue

- Answer the questions on the next couple of screens to finish the process

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My deceased husband employer issued a 1099-misc form to me. It is for his patent payment. Do I need to report it as self employment income?

I was able to go through the questions as you navigated. Thank you so much.

However, at the step of

- On the next screen, check the box that you received the income in 2021 and then click Continue

TurboTax asks me whether I received it in previous year, so I checked the box. Then it brings me to Schedule C. If I received the patent payment previous year, is it considered as a self-business?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My deceased husband employer issued a 1099-misc form to me. It is for his patent payment. Do I need to report it as self employment income?

Put No for the previous year. You are lying to TurboTax to get it to work correctly for you, That is not the same as lying to the IRS. The whole 1099-MISC and Schedule C interaction really needs to be rewritten so it is not so confusing for you and millions like you who have a 1099-MISC that does not require a Schedule C.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My deceased husband employer issued a 1099-misc form to me. It is for his patent payment. Do I need to report it as self employment income?

Thank you SO much!

I almost sent the Tax return using section C. Good thing that I asked here again before sending it. I submitted the return using section C last year. It was the 2nd time I got the payment last year. I thought it was so strange to claim it as a business and come up with a business name & ID for the tax purpose. However, I didn't know what else I could do. No matter how many time I redid it, Turbotax came back to the same result.

This year, I'm so glad I asked here.

I hope I could be like you to help someone who is helpless like me yesterday.

Thank you very much!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My deceased husband employer issued a 1099-misc form to me. It is for his patent payment. Do I need to report it as self employment income?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jmgretired

New Member

yolbec11

New Member

Evetseel

New Member

mukeshsapra

Level 1

sakiskid

New Member