- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: My CA state return was rejected because I didn't put in health insurance info, but I am someo...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My CA state return was rejected because I didn't put in health insurance info, but I am someone's dependent so TurboTax said I didn't have to, and leaves me no option to.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My CA state return was rejected because I didn't put in health insurance info, but I am someone's dependent so TurboTax said I didn't have to, and leaves me no option to.

You will need to go through your state interview section again and make your corrections there.

- Select State in the black panel on the left hand side of your screen when logged into TurboTax.

- This will take you to a screen titled Let's get your state taxes done right. Click continue on this screen.

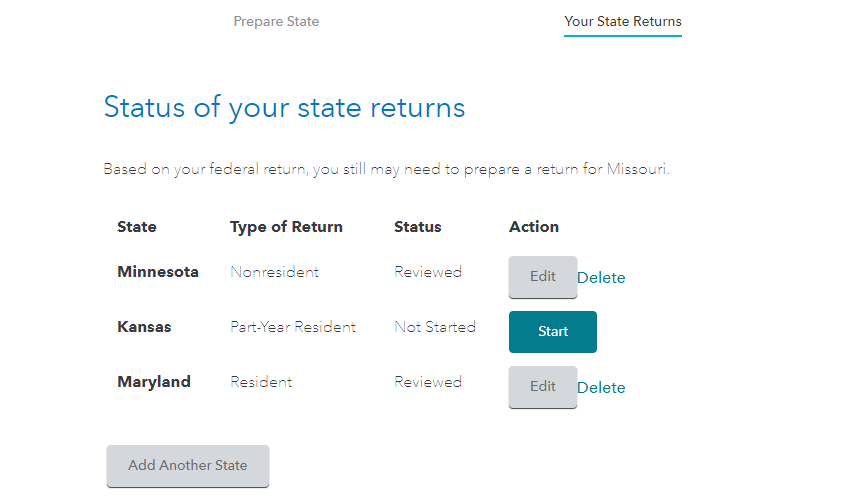

- You will see the following screen titled Status of your state returns. Select Edit to the right of California.

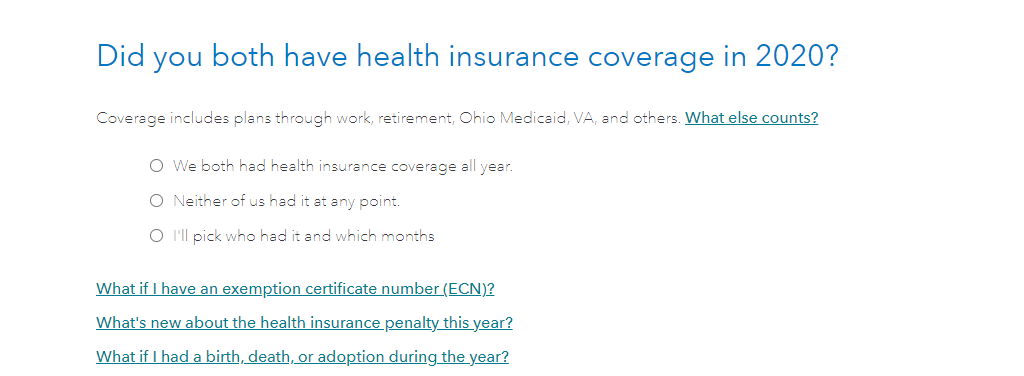

Continue through the California screens until you see Did you have health insurance coverage in 2020?

Your answers in this section will prepare the correct form for the California health coverage reporting requirement.

Please comment if you are still having issues so we can resolve your issue.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My CA state return was rejected because I didn't put in health insurance info, but I am someone's dependent so TurboTax said I didn't have to, and leaves me no option to.

I also have the same issue. It snot giving us those options you have on that picture because we are DEPENDENTS. It only gives us the option to continue.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My CA state return was rejected because I didn't put in health insurance info, but I am someone's dependent so TurboTax said I didn't have to, and leaves me no option to.

This fix is not working for dependents and that page reads " Since someone can claim you on their 2020 taxes, you don't have to complete Health Insurance." Intuit states on the description of error that there is an issue with this product and there will be release to fix the issue on 2/26/2020. Nothing has changed so far.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My CA state return was rejected because I didn't put in health insurance info, but I am someone's dependent so TurboTax said I didn't have to, and leaves me no option to.

I recommend going through the state interview section again if you are using the online version. There have been updates that have been implemented that have addressed this.

If you are using the desktop version, you may need to update your software.

You can do this by select the Online menu at the top.

Then select Check for Updates.

Please comment if you are still receiving the same error message.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My CA state return was rejected because I didn't put in health insurance info, but I am someone's dependent so TurboTax said I didn't have to, and leaves me no option to.

Still not able to mark box 91 which would show that I have health insurance. When I get to this page I receive the message "Since someone can claim you on their 2020 taxes, you don't have to complete Health Insurance"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My CA state return was rejected because I didn't put in health insurance info, but I am someone's dependent so TurboTax said I didn't have to, and leaves me no option to.

If you are still unable to e-file, you may need to print and mail your return to California. For additional assistance, you can also reach out to TurboTax Customer Support: What is the TurboTax phone number?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

My CA state return was rejected because I didn't put in health insurance info, but I am someone's dependent so TurboTax said I didn't have to, and leaves me no option to.

It would be helpful to have a TurboTax ".tax2020" file that is experiencing this issue.

You can send us a “diagnostic” file that has your “numbers” but not your personal information. If you would like to do this, here are the instructions:

Go to the black panel on the left side of your program and select Tax Tools.

- Then select Tools below Tax Tools.

- A window will pop up which says Tools Center.

- On this screen, select Share my file with Agent.

- You will see a message explaining what the diagnostic copy is. Click okay through this screen and then you will get a Token number.

- Reply to this thread with your Token number. This will allow us to open a copy of your return without seeing any personal information.

We will then be able to see exactly what you are seeing and we can determine what exactly is going on in your return and provide you with a resolution.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Vivieneab

New Member

keenerbp

New Member

csilerm

New Member

djpmarconi

Level 1

kac42

Level 1