- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: missing form: form1040; Individual Sch K-1 Wks-Ests and Trusts

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

missing form: form1040; Individual Sch K-1 Wks-Ests and Trusts

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

missing form: form1040; Individual Sch K-1 Wks-Ests and Trusts

Schedule K-1 is used to report a beneficiary's share of the estate’s or trust’s income, credits, deductions, etc., on their Form 1040, U.S. Individual Income Tax Return.

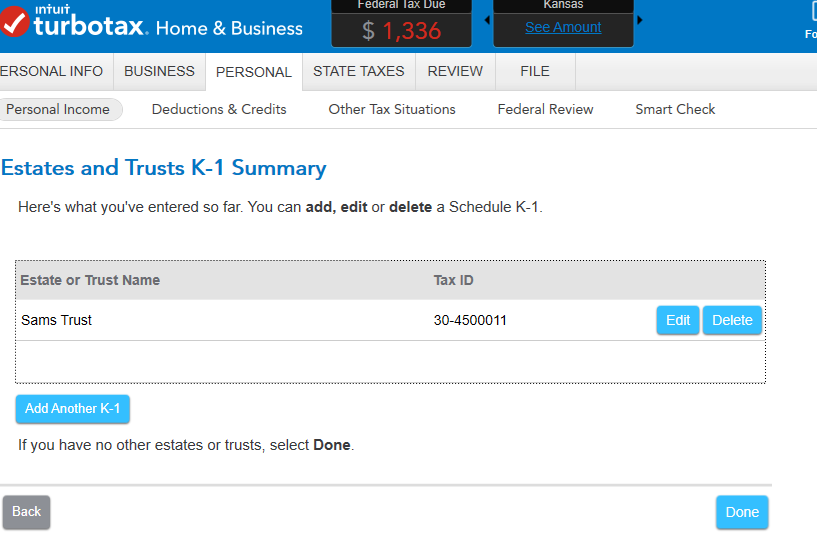

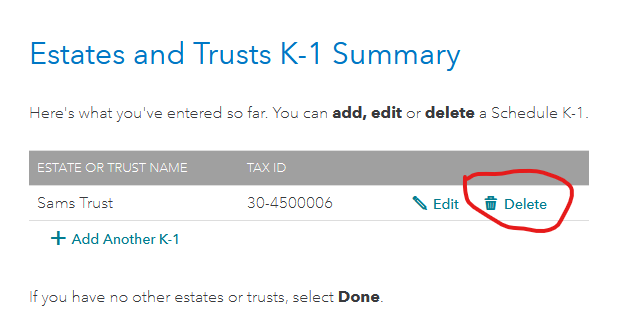

- If you don't have a K-1 for 2020 but a K-1 transferred from your 2019 income tax return, see How do I delete a K-1?

- If you received your K-1 and need to enter it, see Where do I enter a K-1 that I received?

The personal TurboTax products that support K-1's are:

- Online: TurboTax Premier, TurboTax Live Premier, TurboTax Self-Employed , TurboTax Live Self-Employed.

- CD\Download Deluxe, Premier, Home & Business .

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

missing form: form1040; Individual Sch K-1 Wks-Ests and Trusts

Why is the form1040; Individual Sch K-1 Wks-Ests and Trusts not allowing me to efile my taxes???

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

missing form: form1040; Individual Sch K-1 Wks-Ests and Trusts

You missed the point HelenC12. I have entered the information from my Sch K-1 Wks-Ests and Trusts, but Turbo Tax desktop says the form has not been approved for release at this time. Something doesn't sound right. This is holding me up from E-filing even though all the data has been entered. Is this a bug? When will this be fixed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

missing form: form1040; Individual Sch K-1 Wks-Ests and Trusts

The following link will allow you to check form availability for both state and federal filings: When will my forms be ready?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

missing form: form1040; Individual Sch K-1 Wks-Ests and Trusts

I went thru your help stuff and got nothing. The forms list for TurboTax personal returns says the K-1s are available, but when I do the update I STILL can't get the K-1. How can I get the K-1 to actually download into my Deluxe program?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

missing form: form1040; Individual Sch K-1 Wks-Ests and Trusts

I'm having the same issue, and the only thing I have on the K-1 is $4 of interest! That's preventing me from filing. It looks like the form will be available on 2/25. If not, I may just delete the trust and add the interest on schedule B. Not sure if your issue is more complicated, but the IRS form was completed in December. It doesn't make sense that TT hasn't gotten it done yet.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

missing form: form1040; Individual Sch K-1 Wks-Ests and Trusts

LOL, I have two K-1s for a grand total of $2.00 interest. Hopefully we can file by Friday. What I don't understand is if it is a worksheet, and not the actual form, why would that hold up the filing?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

missing form: form1040; Individual Sch K-1 Wks-Ests and Trusts

The K-1s for partnerships and S-Corps are available. However, the K-1 for an estate/trust is not yet ready. It should be available later this week.

For current information on forms availability please click on the applicable link below:

TurboTax Online automatically updates the website when the forms become available.

In TurboTax CD/Download, you will be prompted to download any updates available when you open the program. You can also update the program while you have it open by following these steps:

- Click on the Online link in the black bar at the top of the page.

- Click on Check for Updates.

- TurboTax will download and install any updates available. If there aren't any updates, you will receive the message "Your software is up to date."

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

missing form: form1040; Individual Sch K-1 Wks-Ests and Trusts

Thanks, It says Sch K-1 should be available tomorrow 2/25. I sure hope so since it is holding up submissions and refunds

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

missing form: form1040; Individual Sch K-1 Wks-Ests and Trusts

It's still not available. I guess when they say 2/25 they mean midnight? When will the form be ready?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

missing form: form1040; Individual Sch K-1 Wks-Ests and Trusts

I just checked and it's still not ready....this is extremely frustrating. It's not even a form, it's a worksheet that doesn't need to be filed. I received the K1 and the IRS had it completed months ago so what' the hold up!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

missing form: form1040; Individual Sch K-1 Wks-Ests and Trusts

Looks like TurboTax doesn't support State efile if you have to report income or expenses from a K1, but it does support Fed eFile according to their website. I'm in the same boat. Guess its' back to printing a large number of pages and mailing it to the state of California. Note: My son got the same K1 from the same trust and he can state efile because he is not reporting income or claiming any deductions. If you have a small deduction and a few dollars, maybe you don't take the deduction and efile instead. Hope this helps.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

missing form: form1040; Individual Sch K-1 Wks-Ests and Trusts

The form 1041 K1 is available in both the online product and the desktop product. The form 1041 K1 is used to report the beneficiary's share of Trust distributable net income. The income report to the beneficiary retains the same character as the income in the Trust. If the the trust has terminated, you can delete the K1 by clicking on delete.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

matto1

Level 2

jeremy-v12

New Member

Shamuj02

Level 1

trust812

Level 4

pnberkowtaxes201

New Member