- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Medicaid Waiver Payments W2 box 1 $0, box 3 and 5 $9,000, box 16 $0. How do include to Califo...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Medicaid Waiver Payments W2 box 1 $0, box 3 and 5 $9,000, box 16 $0. How do include to California income to get the earned income credit in 2022?

Hello.

I have this Medicaid Waiver Payments from IHSS and I live with the recipient. I like to know if I receive a W2 with box 1 $0, box 3 and 5 $9,000, and box 16 $0, how do you "INCLUDE" this $9,000 amount to California income to get the earned income credit? I answer the federal tax questions asking me to enter the Medicaid Waiver Payments not on W2. That amount is $9,000 because is not on my W2 box 1 and 16. After I done with the Federal and transfer to California, there is no way I can include this $9,000 to get the EIC. What is wrong? My W2 box 1 and 16 are $0. Should I replace this W2 box 1 and 16 $0 to $9,000? If I do this, the W2 is not match with the IRS. Can someone help?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Medicaid Waiver Payments W2 box 1 $0, box 3 and 5 $9,000, box 16 $0. How do include to California income to get the earned income credit in 2022?

The Tax Court in Feigh, (2019) 152 TC No. 15 ruled that Medicaid Waiver payments, even though excluded from income, are still earned income for purposes of claiming refundable tax credits like the additional child tax credit and the earned income tax credit.

Certain Medicaid waiver payments you received for caring for someone living in your home with you may be nontaxable. If these payments were reported to you in box 1 of Form(s) W-2, include the amount on Form 1040 or 1040-SR, line 1. Also, include on line 1 any Medicaid waiver payments you received that you choose to include in earned income for purposes of claiming a credit or other tax benefit, even if you did not receive a Form W-2 reporting these payments. On line 8 of the tax return, subtract the nontaxable amount of the payments from any income on line 8 and enter the result.

Please see the steps detailed in this thread to report IHSS income solely for the purpose of obtaining Earned Income Credit including for California.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Medicaid Waiver Payments W2 box 1 $0, box 3 and 5 $9,000, box 16 $0. How do include to California income to get the earned income credit in 2022?

Since Box 1 is zero, entering the W-2 will not get you EIC, however, you still need to enter the W-2.

Then follow the steps below.

Steps

Enter it again as Other Reportable Income under the Miscellaneous Income section. Take the following steps:

- Sign in to TurboTax Online, click Continue your return, then pick up where I left off (if you are using TurboTax CD/ Download, then just open your return on your computer);

- Click on Federal Taxes at the top of the screen;

- At the bottom of Your Income box pick the option in blue to help me add other income, then jump to full list;

- Scroll down the page to the last section titled: Less common Income and click show more;

- Select start or update next to the last topic titled Miscellaneous Income, 1099-A, 1099-C;

- Scroll down to the last option titled Other reportable income and select start or edit;

- When it asks, "Any other reportable income?" say yes then you will make two entries:

- Your first entry description would be W-2 EIN # (enter EIN number from W-2) Medicaid Waiver Payments, and enter your wages as a positive number.

- Next you click "Add Another Miscellaneous Income Item," and enter this description: IRS Notice 2014-7 excludable income and enter your wages as a Negative (-) number.

This both shows and explains removing the zero in W-2 income and places a zero on Line 21 of your Form 1040.

If your W-2 has federal or state taxes withheld, you can enter these amounts in the Deductions & Credits section under Other Income Taxes as Withholding not already entered on W-2.

For more information, refer to IRS Notice 2014–7, 20144 I.R.B. 445 and the IRS FAQs.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Medicaid Waiver Payments W2 box 1 $0, box 3 and 5 $9,000, box 16 $0. How do include to California income to get the earned income credit in 2022?

MonikaK1

Your information I already know for tax returns 2021 or earlier. I hope people stop giving out old examples. This is "2022" and the tax questions asking me to enter is not the same. In 2022, there is 1a and 1d on 1040. Your example is only 1 on 1040. It's not the same if you actually read the 2022 1040 instruction. When I am done with 2022 form 1040 and transfer to California, I can't get the earned income credit. I don't know how in 2022 tax return. I hate they separate the 1 to 1a and 1d on 2022 form 1040.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Medicaid Waiver Payments W2 box 1 $0, box 3 and 5 $9,000, box 16 $0. How do include to California income to get the earned income credit in 2022?

I want to make sure I understand correctly - you received a W2, but entered it as if you didn't receive a W2?

If you received a W2, I would delete the entry you have for this and enter it as a W2.

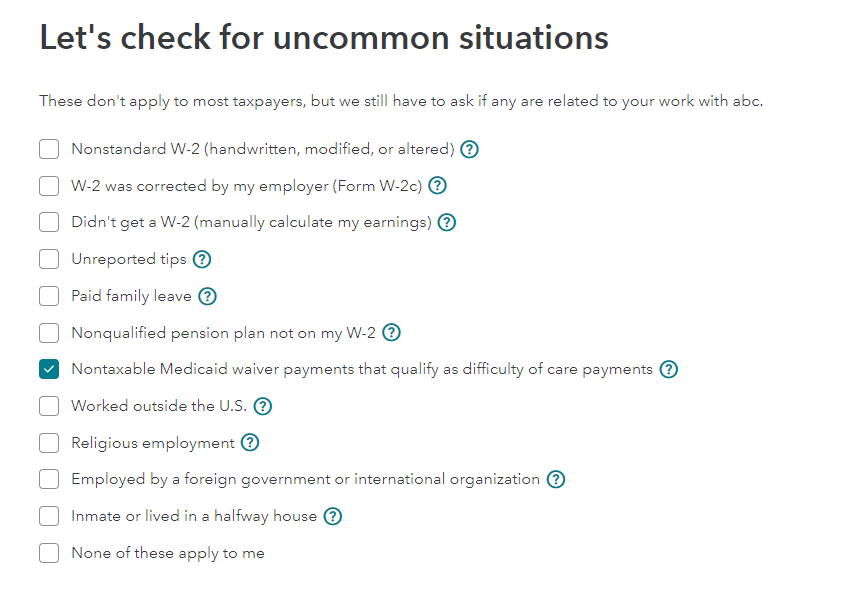

You will enter the W2 just as it it, not adding anything. After you finish the W2 entry you will get to a screen asking about uncommon situations that looks like this:

Make sure you check the box for nontaxable Medicaid waiver payments.

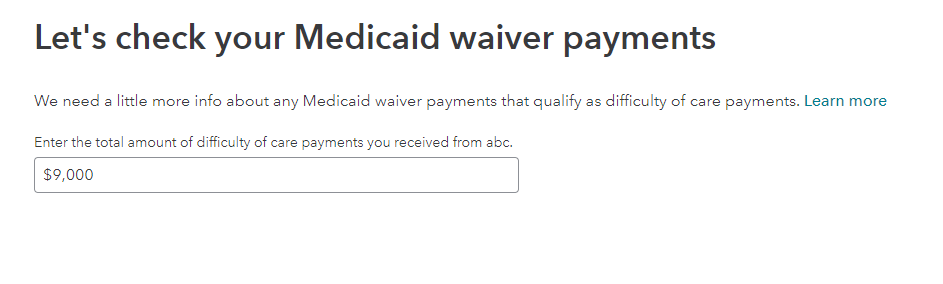

The next screen will ask how much you received for Medicaid waiver payments. You will enter the amount here.

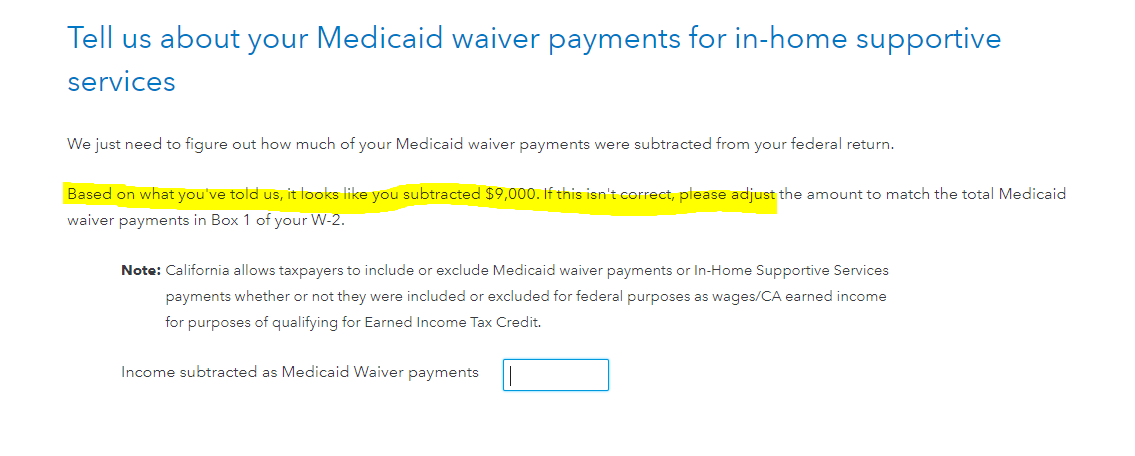

When you get to your California return you will see this screen (eventually):

Let us know if this doesn't take care of your issue.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Medicaid Waiver Payments W2 box 1 $0, box 3 and 5 $9,000, box 16 $0. How do include to California income to get the earned income credit in 2022?

CatinaT1

Ok, I already followed your example and tried to get the California earned income tax credit using Turbo Tax and other tax software. I guess California is only allow to include and exclude all the Medicaid Waiver Payments but cannot get the earned income credit even I want to include all MWP not on W2 box 1 and box 16. I guess I only can get earned income tax credit from Federal only. I already tried Turbo Tax and other tax software and the number is the same $0 for California. Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Medicaid Waiver Payments W2 box 1 $0, box 3 and 5 $9,000, box 16 $0. How do include to California income to get the earned income credit in 2022?

No, you should be able to claim EITC in California too. I am looking into this further.

California return

Some or all of this income may be included or excluded in your federal adjusted gross income, which you report on your California return.

If you receive In-Home Supportive Services or Medicaid waiver income for the care of an individual you live with, you will exclude this from your federal AGI.

New: IHSS income may now be excluded from gross income (excluded from taxation) and still be included as earned income for purposes of determining the California Earned Income Tax Credit.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Medicaid Waiver Payments W2 box 1 $0, box 3 and 5 $9,000, box 16 $0. How do include to California income to get the earned income credit in 2022?

CatinaT1

If you figure out how to get the California Earned Income Tax Credit, please post here. You can use my W2 information to play around if you can get the EIC from California.

Medicaid Waiver Payments $9,000 not on W2.

My W2 shows:

Box 1 = blank or $0

Box 3 and 5 = $9,000

Box 16 = blank or $0

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Medicaid Waiver Payments W2 box 1 $0, box 3 and 5 $9,000, box 16 $0. How do include to California income to get the earned income credit in 2022?

We reported this to be investigated. I could not get the EITC to calculate in California in the Desktop or Online Version. We will just have to wait to see what happens with the investigation.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17539892623

Returning Member

garys_lucyl

Level 2

MarkH421

New Member

Dan S9

Level 1

w_dye

New Member